This morning I see a lot of praise for the Figma IPO in various media ($FIG (+1,74%) ) - a plus of +200 % on the first day of trading on Wall Street.

For me, however, this is an obvious sign of mispricing. mispricingand here's why:

- The company raised far less capital than it could have.

- Instead, the increase in value was siphoned off by hedge funds and institutional investors who were allocated early at a lower price (which is often the case - but there should be some balance).

- Retail investors paid a (high) premium at the start of trading and bought at inflated prices, while early investors were already cashing in.

In my opinion, what is missing from the reporting and discussion is the role of the accompanying banks (underwriters). By setting a low price:

- Can the banks easily place all the shares - with minimal risk,

- Their investors receive an attractive offer,

- And the IPO is considered a "success".

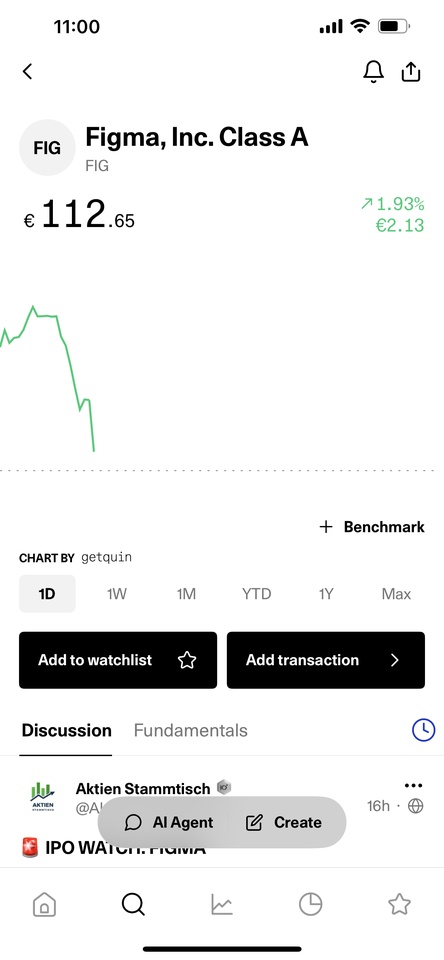

The result is already visible: the share price is now declining significantly.