Hi community, I need your opinion:

Yesterday I came across the share of the CFD broker XTB. I had the company already in mind, because it is currently very strongly represented also in terms of advertising (among others with @Flo_Pharell , @DividendenHai).

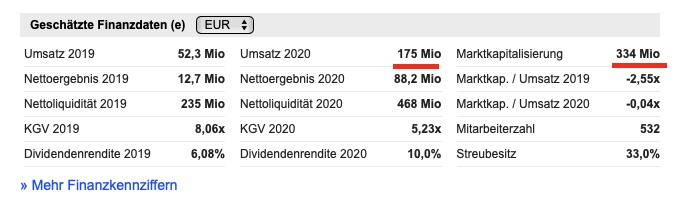

The share seems drastically undervalued compared to other financial companies, or am I missing something?

Currently, XTB is valued at only 2x turnover. For comparison: With listed brokers like e.g. $FTK (+1,52%) the multiple is about 10 (for new brokers, of course, immensely higher).

For CFD brokers, the multiples are somewhat lower (somewhere between 4-7, see e.g. IG Group), but a turnover multiple of 2 still seems extremely low to me.

What do you think?