$TMDX (-1,43%) - Company presentation - Part 1:

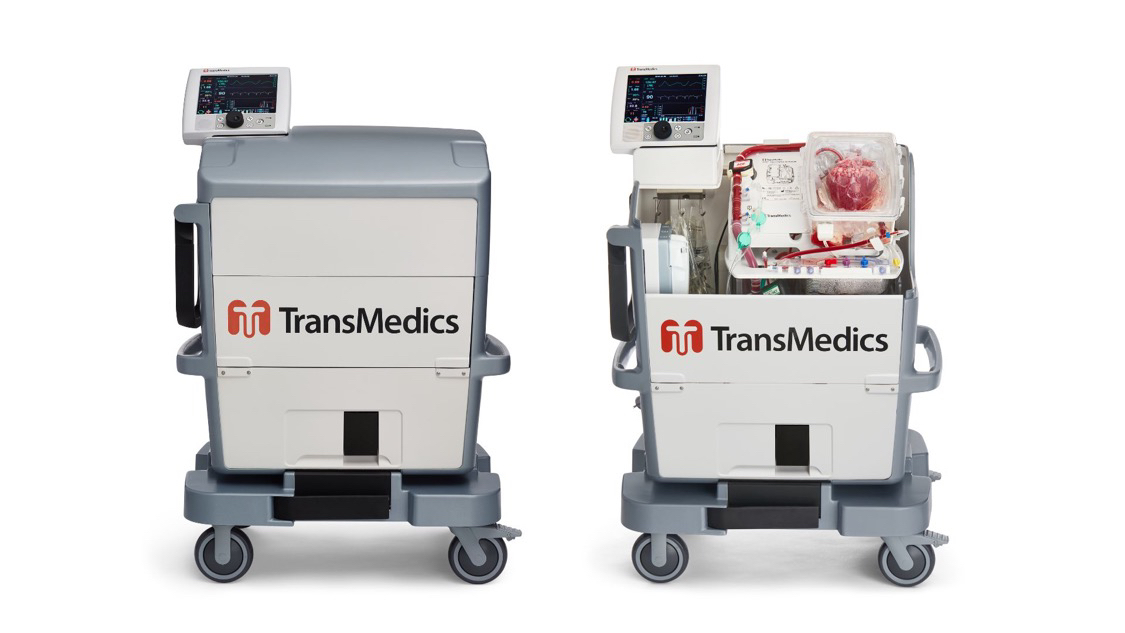

TransMedics Group, Inc. is a medical device company transforming organ transplant therapy for patients with end-stage lung, heart and liver failure.

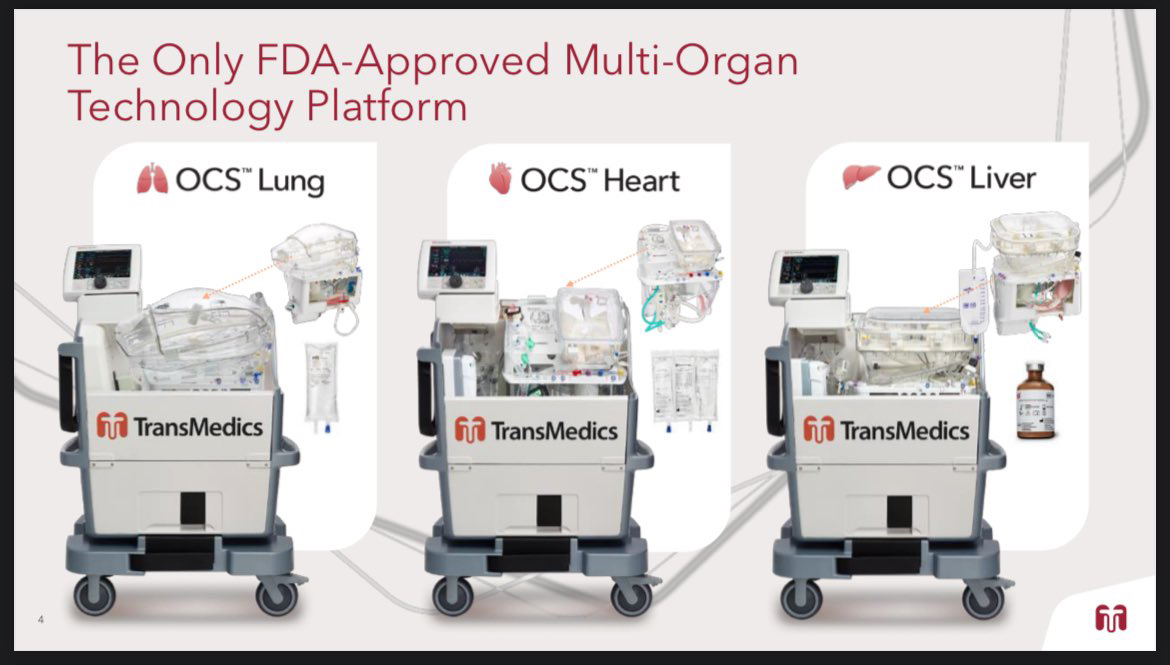

The company specializes in portable extracorporeal thermal perfusion and the evaluation of donor organs for transplantation. Its Organ Care System (OCS) is a portable organ perfusion, optimization and monitoring system that uses its customized technology to replicate near-physiological conditions for donor organs outside the human body.

In addition, the company has developed the National OCS Program (NOP), a turnkey solution for outsourced organ harvesting, OCS organ management and logistics services for transplant programs in the United States. Logistics services include air transportation, ground transportation and other coordination activities. NOP provides trained organ procurement surgeons, clinical specialists and transplant coordinators to provide an end-to-end clinical solution utilizing OCS technology.

Now a little more in detail:

OCS = Organ Care System

$TMDX (-1,43%) currently has OCS consoles for the heart, liver and lungs.

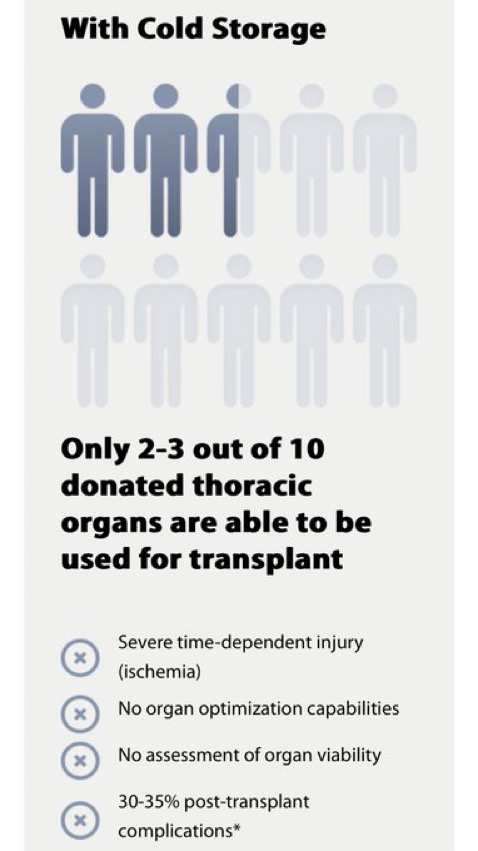

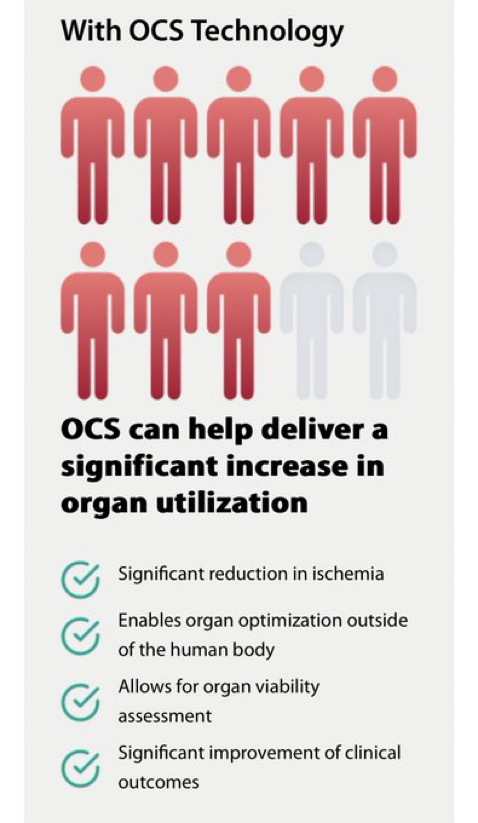

The cool thing about $TMDX (-1,43%) 's OCS is that normally 2-3 out of 10 organs stored in the cold room are successfully transplanted.

8 out of 10 OCS organs or disposable sets (as they are called) are transplanted without complications.

The trick lies in the ability of the $TMDX (-1,43%) OCS console to maintain organ functionality through the constant circulation of warm blood (perfusion).

The OCS consoles are the only FDA-approved portable multi-organ perfusion device on the market.

The installation of these innovative cutting-edge consoles in the 70 leading transplant centers in the USA is probably equivalent to a monopoly position.

Blood flow to the organs and constant monitoring of their functionality reduces ischemic injury and post-transplant complications.

$TMDX (-1,43%) also has its own fleet of 18 airplanes to help get organs to where they are needed.

If an organization needs to outsource the pick-up or drop-off of organs, it can use an aircraft from the NOP network. $TMDX (-1,43%) - aircraft from the NOP network.

NOP = National OCS Program

The NOP's nationwide hub network takes care of the transportation of organs from the donor to the recipient around the clock

The NOP network has now contributed to over 4,000 transplants

This is the only air and ground network that is 100% dedicated to the transportation of organs.

- Business model:

Selling organs and organ care system (OCS) consoles to organ transplantation and procurement centers and organizations, as well as selling to distributors who sell their products to centers and organizations abroad.

Service:

They also sell organ procurement and organ management services to all of these organizations through NOP

All customer contracts include multiple performance obligations covering all products and services they provide (organs, OCS, NOP services).

Financials:

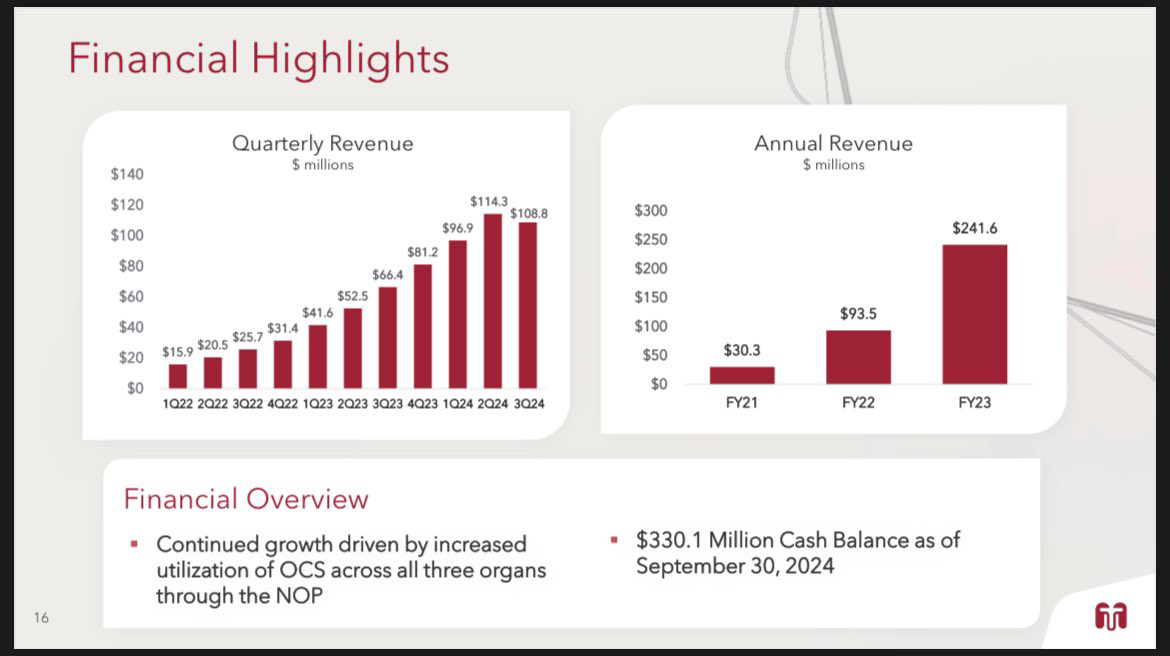

- Annual revenue:

2021: $30.3M

2022: $93.5M

2023: $241.6M

2024: $434.1M est +79% YoY

2025: $548.1M est +26%YoY

- EPS - a strong increase is expected:

2023: -$0.77

2024: USD 1.07 estimated

2025: estimated USD 1.65

$TMDX (-1,43%) is managed by the founder - which should be an advantage.

Since 1998, the CEO has built this company into the country's leading transplant network.

CEO- Waleed Hassanein

$TMDX (-1,43%) is still a small cap and

basically has everything it takes to become a future monopoly.

- Best product of its kind

- Building a complex logistics network before anyone else does

- Only FDA approved product of its kind

$TMDX (-1,43%) Continues to invest heavily in the future

They addressed profit margins and stated that they continue to invest in hiring pilots, aircraft, maintenance centers - to take care of their own aircraft, etc.

All these investments will $TMDX (-1,43%) probably turn the company from a small-cap to a mid-cap in the next few years.

The weakness in earnings in recent earnings is probably not fundamentally due to the weakness of the company.

The quarter-on-quarter decline in sales was due to general weakness and maintenance measures in the industry as well as investments that affect margins and apparently surprised many analysts.

There is actually nothing wrong with the business.

Finally, I would like to say that I am not yet invested, but after the recent fall in the share price, a long-term entry should be very interesting and I am considering an initial entry.

Are any of you already invested? ✌️