Hello my dears, I would like to add to Andreas' great article.

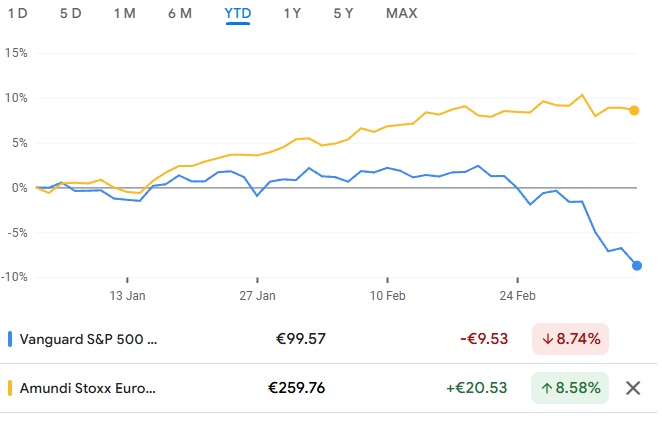

It is the tech and growth stocks that have dragged the S&P down so much.

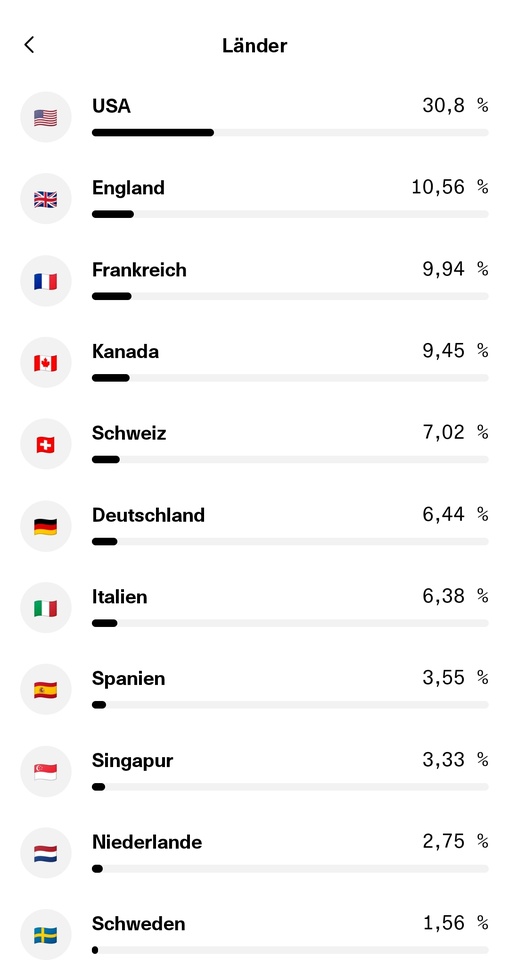

You can clearly see from the dividend ETF that it has generated a similar performance YTD to the Euro Stoxx. Despite 30% USA share.

Nevertheless, my assessment would be that the tide can turn again quickly.

And we will see tech and growth stocks back in the lead at the end of the year.

What is your assessment here, are you shifting into dividend stocks and European stocks?