Hi everyone,

I'm hoping to get some help with a tax issue I've encountered with dividends from my $ASML (+0,01%) shares (ISIN: NL0010273215).

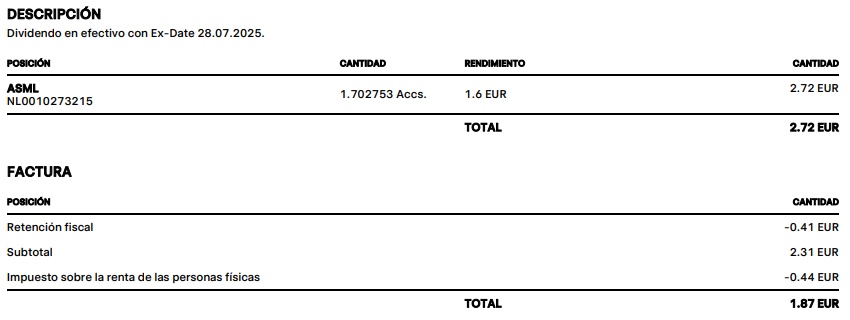

I received a dividend payment, but it seems like I've been hit with double taxation. As you can see in the attached image, there are two separate deductions: "Retención fiscal" (Tax withholding) and "Impuesto sobre la renta de las personas físicas" (Personal income tax).

This is the breakdown:

- Gross Dividend: 2.72 EUR

- Tax Withholding: -0.41 EUR

- Subtotal: 2.31 EUR

- Personal Income Tax: -0.44 EUR

- Net Total: 1.87 EUR

ASML is a Dutch company, and I'm a resident of Spain. I understand that there's typically a withholding tax from the source country (the Netherlands in this case), and then I need to declare the income in my country of residence. However, I thought that tax treaties were in place to prevent this kind of double taxation.

My question is:

- Why am I being charged twice for the same dividend income?

- Is this a standard practice, or is there a way to reclaim one of these taxes?

- Has anyone else experienced this with ASML dividends, or with dividends from other international companies?

This is happening firstly since I recently move my IBAN to Spain in Trade Republic, previously with German IBAN this was not happening.

Any insight or advice would be greatly appreciated. Thanks in advance!