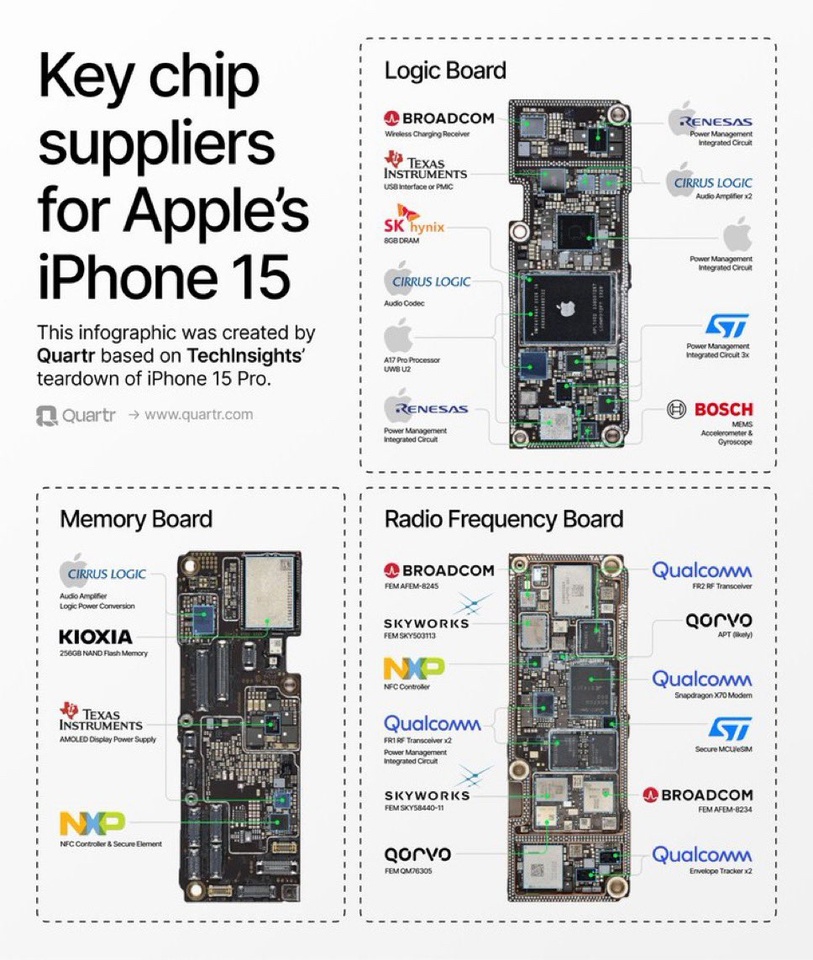

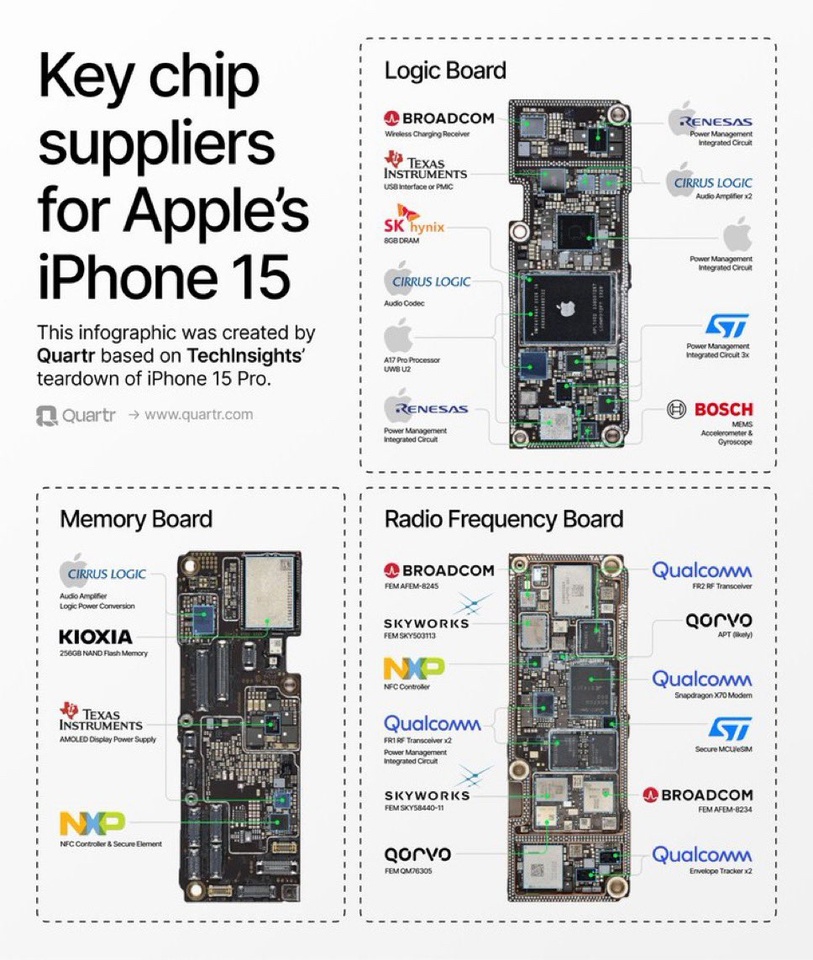

Here are the most important chip suppliers for Apple's $AAPL (-0,11%)

iPhone 15 Pro.

An exciting overview with many well-known names. Bosch and $HY9H (+5,44%) are also represented.

Here are the most important chip suppliers for Apple's $AAPL (-0,11%)

iPhone 15 Pro.

An exciting overview with many well-known names. Bosch and $HY9H (+5,44%) are also represented.