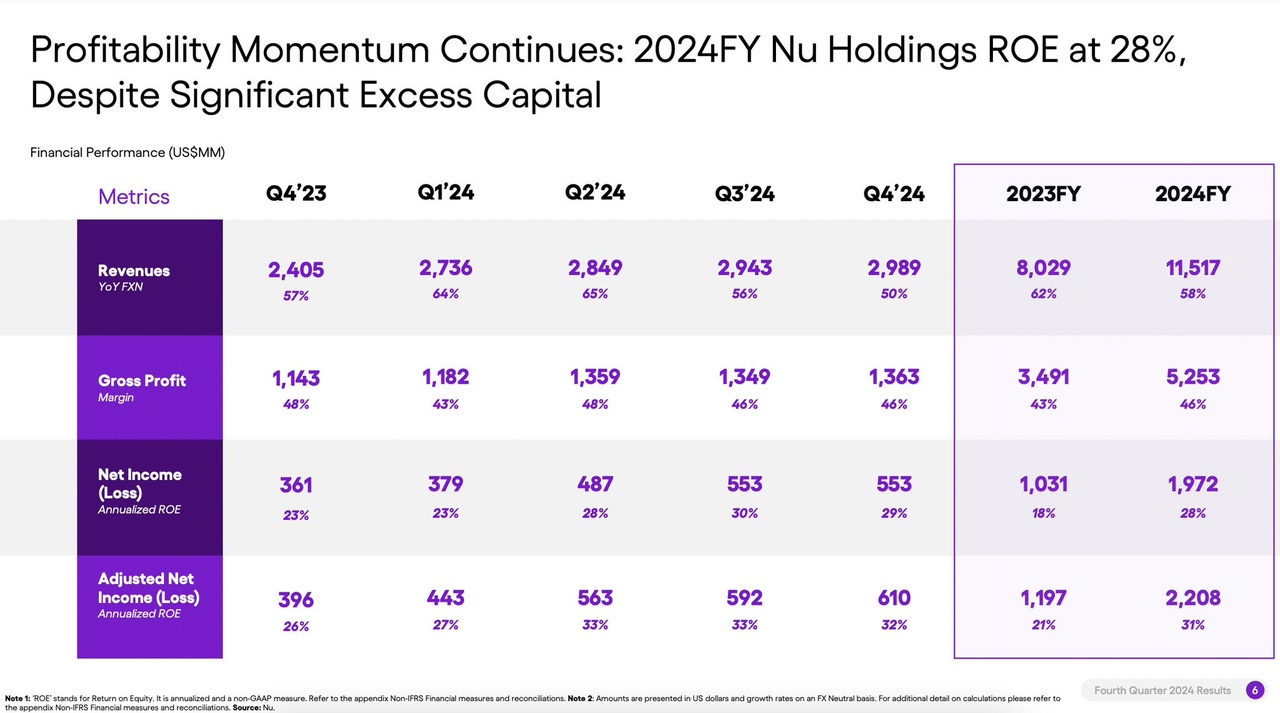

- Revenue: $2.99B (Est. $3.43B) ❌; UP +58% YoY (FXN)

- Net Income: $552.6M (Est. $596.7M) ❌; UP +85% YoY

- Gross Profit: $1.36B (Est. $1.60B) ❌; UP +44% YoY

- Gross profit margin: 45.6% (Est. 46.7%) ❌

Operating Metrics:

- Total Customers: 114.2M; UP +22% YoY

- Customer Additions (Q4): 4.5M

- Monthly ARPAC: $10.7; UP +23% YoY (FXN)

- Monthly Activity Rate: 83.1%

- Cost to Serve Per Active Customer: $0.80

Asset Quality:

- 15-90 Day NPL Ratio: 4.1% (DOWN 30 bps QoQ)

- 90+ Day NPL Ratio: 7.0% (DOWN 20 bps QoQ)

Liquidity & Lending Highlights:

- Interest-Earning Portfolio: $11.2B; UP +75% YoY (FXN)

- Lending Portfolio: $6.1B; UP +22% QoQ (FXN)

- Credit Card Portfolio: $14.6B; UP +28% YoY (FXN)

- Total Deposits: $28.9B; UP +55% YoY (FXN)

Net Interest Income (NII):

- NII: $1.7B; UP +57% YoY

- Net Interest Margin (NIM): 17.7% (DOWN 70 bps QoQ)

- Risk-Adjusted NIM: 9.5% (DOWN 60 bps QoQ)

International Expansion:

- Mexico: Reached 10M customers (+91% YoY), deposits UP +438% YoY to $4.5B

- Colombia: 2.5M customers, driven by Cuenta Nu product

Brazil Operations:

- Secured Lending Portfolio: $1.4B; UP +615% YoY

- High-Income Segment: 700K customers (+132% YoY)

- Ultravioleta Purchase Volume: $1.8B; UP +106% YoY

New Product Launches:

- NuTravel: Travel booking with multi-currency accounts

- NuCel: MVNO mobile service launched with Claro

Comment from CEO David Vélez:

- "2024 was a year of transformation for Nu. We nearly doubled our net profit, grew our customer base to over 114 million and significantly deepened our engagement. Our focus on sustainable growth and product diversification continues to strengthen our leadership position in digital banking in Latin America."