Global markets are moving in rhythm with politics again. The recent Trump–Xi meeting in South Korea aimed at easing tariff tensions could be the start of calmer waters after months of volatility. Those tariffs triggered some of the worst crypto drawdowns this year, like the Oct. 10 crash that saw $BTC (+1,77%) tumble from $121K to below $103K.

The Fed’s recent 25 bps rate cut to 3.75–4.00% added another layer, showing how monetary and trade policies now ripple through digital markets faster than ever.

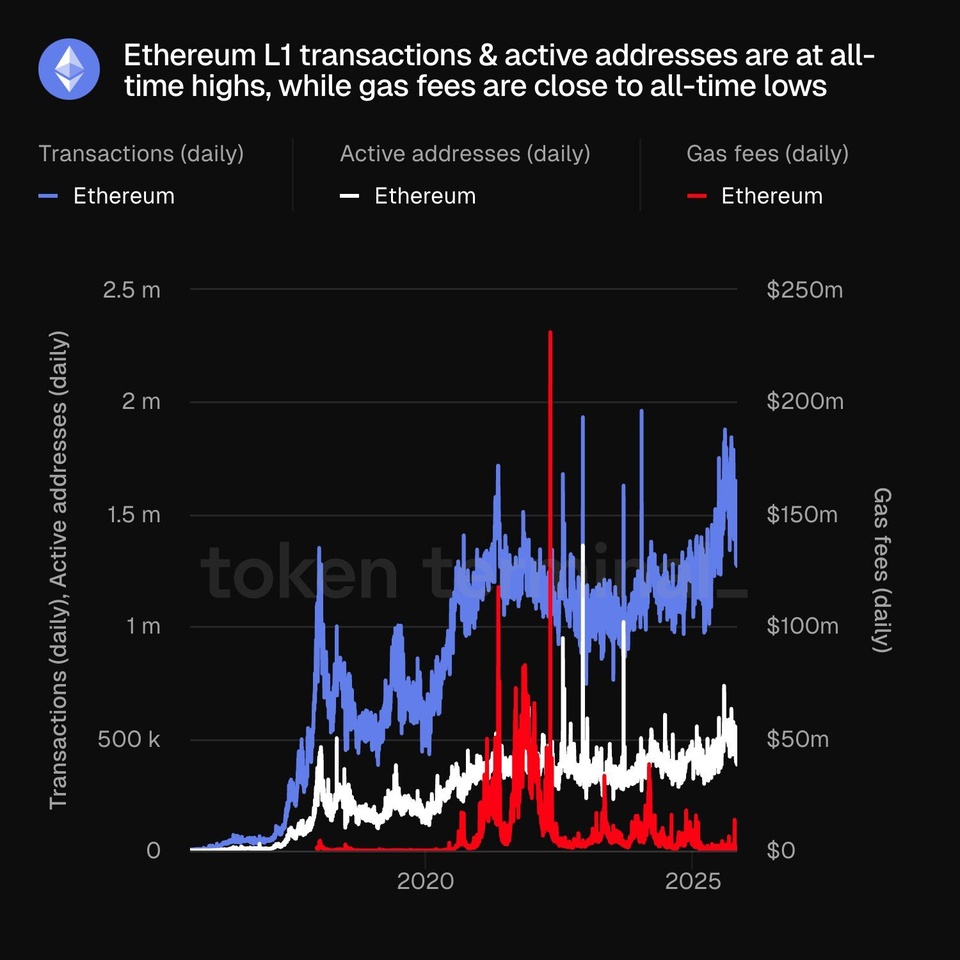

Yet, amid the noise, $ETH (+1,62%) continues to demonstrate quiet resilience. Record-high transactions, all-time active addresses, and low gas fees, signs of organic growth beneath the surface.

Meanwhile, innovation hasn’t slowed. $EAT (-0,56%) by 375ai is redefining the link between AI and DePIN, bringing real-world utility to blockchain infrastructure. I caught the move early on #bingx, closing a 52.92% gain on my EATUSDT Short (20×), proof that preparation often matters more than prediction.

From Washington to Seoul to the blockchain frontier, one thing remains clear, policy, psychology, and innovation are converging.

The question is: are we merely reacting to the market, or quietly reading the signals before they unfold?