To be fair, for most people here, the return succession risk will not yet play a major role. I assume that 99% of all users here (including me) are still in the accumulation phase. But since we will all be moving towards the "unsaving phase" at some point, you should at least have heard about it once!

👉🏻 So what is this ominous risk of return succession?

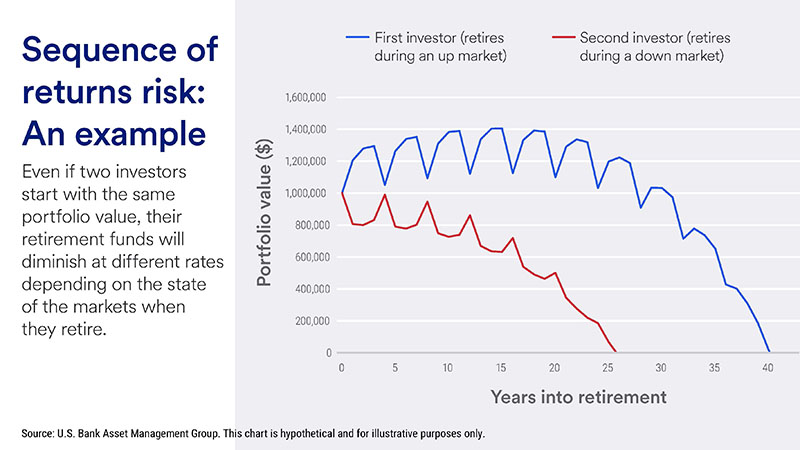

Basically, it describes the risk that an unfavorable sequence of monthly or annual returns can lead to worse investment results than expected. Withdrawal plans (withdrawal phase) involve the risk that the capital is used up more quickly than planned, while savings plans (accumulation phase) involve the risk that the final capital is lower than expected.

In short, a stock market crash at the beginning of a savings phase sometimes has a more dramatic effect than towards the end of a savings phase, because in order to be able to pay out the planned fixed amount, more units have to be sold than planned... and these are missing during the recovery. Conversely, a stock market crash at the beginning of a savings phase naturally has a less dramatic effect on the final capital than at the end of a savings phase.

👉🏻 Is it possible to prevent the risk of a return succession?

A resounding no. To a certain extent, it is simply luck or bad luck. You can't predict when a crash will occur. But you can at least plan for different scenarios!

It is particularly important to think in scenarios for the withdrawal phase, because if the capital is used up before the planned end, that is a disaster. At the age of 70+, it will no longer be easy to find a new job to fill the gap.

So it only helps to calculate a withdrawal plan with a sufficient buffer and to reduce the absolute withdrawal amount in the event of a crash.

A crash at the end of a savings phase is unpleasant, but if in doubt (if you're in good health) you can add another year or two of work to sit out the crash...

Are you worried about that? I have to be honest and admit that I personally hadn't thought about it until recently... but I should probably do it sometime! 😅

$CSPX (+0,01%)

$CSNDX (-0,33%)

$BTC (+0,49%)