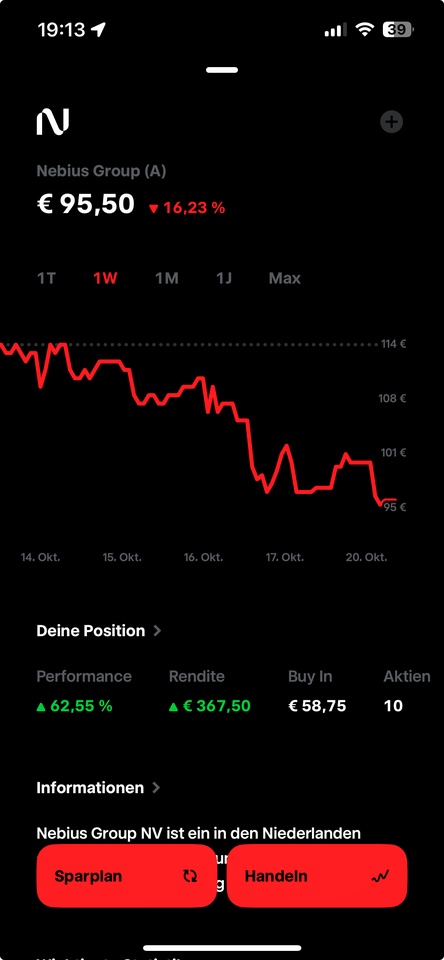

Unfortunately, I only bought 10 shares at the time. Now the share has come down a lot in the last few days and I am considering buying more, but I don't want to dilute the purchase price excessively.

At the moment it is 58.75 euros. I have calculated that if I were to buy just 2 shares, I would already end up with an equity of around €65. That's actually already too much. If the overall market had corrected, I probably wouldn't have thought about it, but I see a higher purchase price as a higher risk.

What do you say: buy or leave the position as it is? (small)