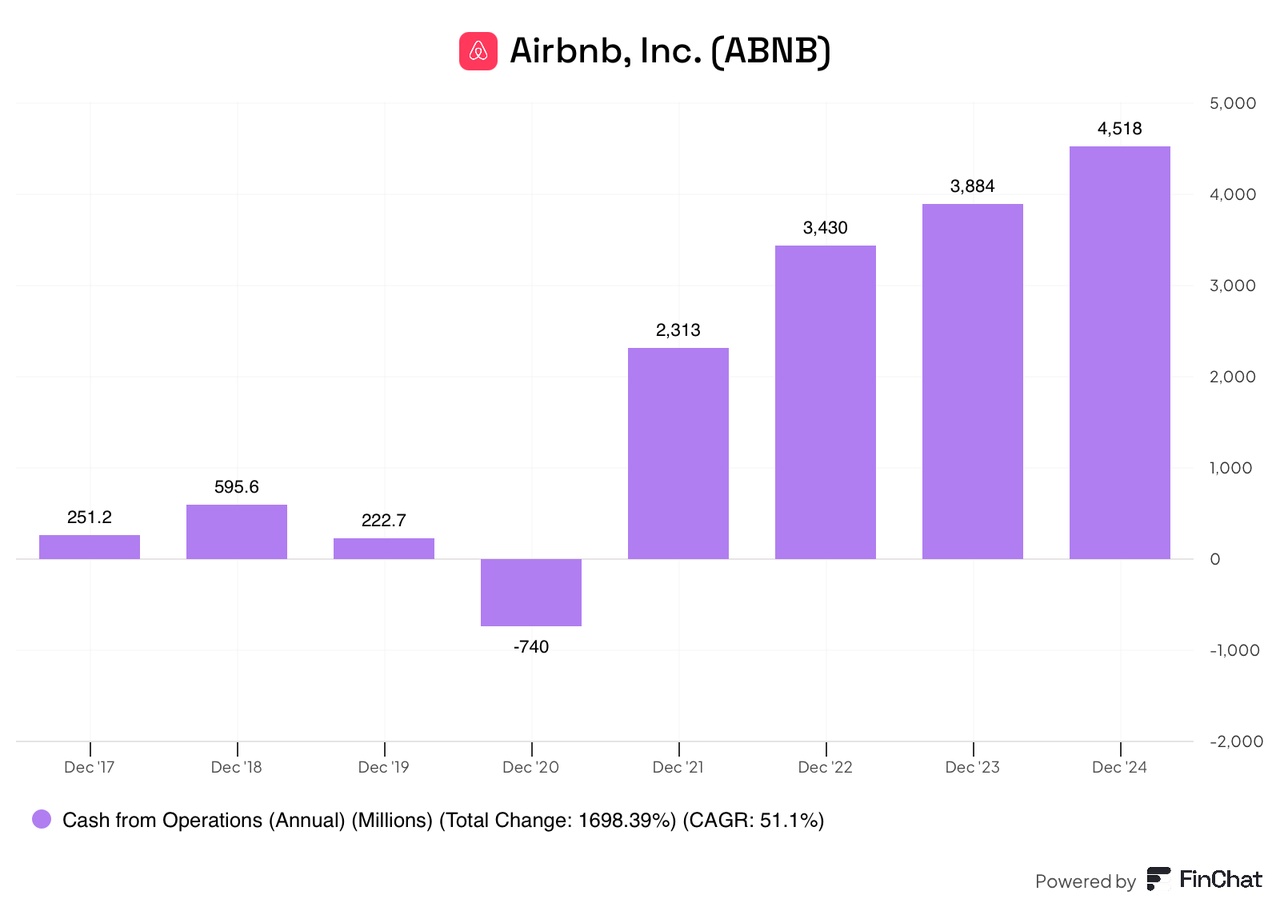

Airbnb $ABNB (-5,04%) is now quietly and secretly generating 4.5 billion US dollars in operating cash flow per year - and the trend rising.

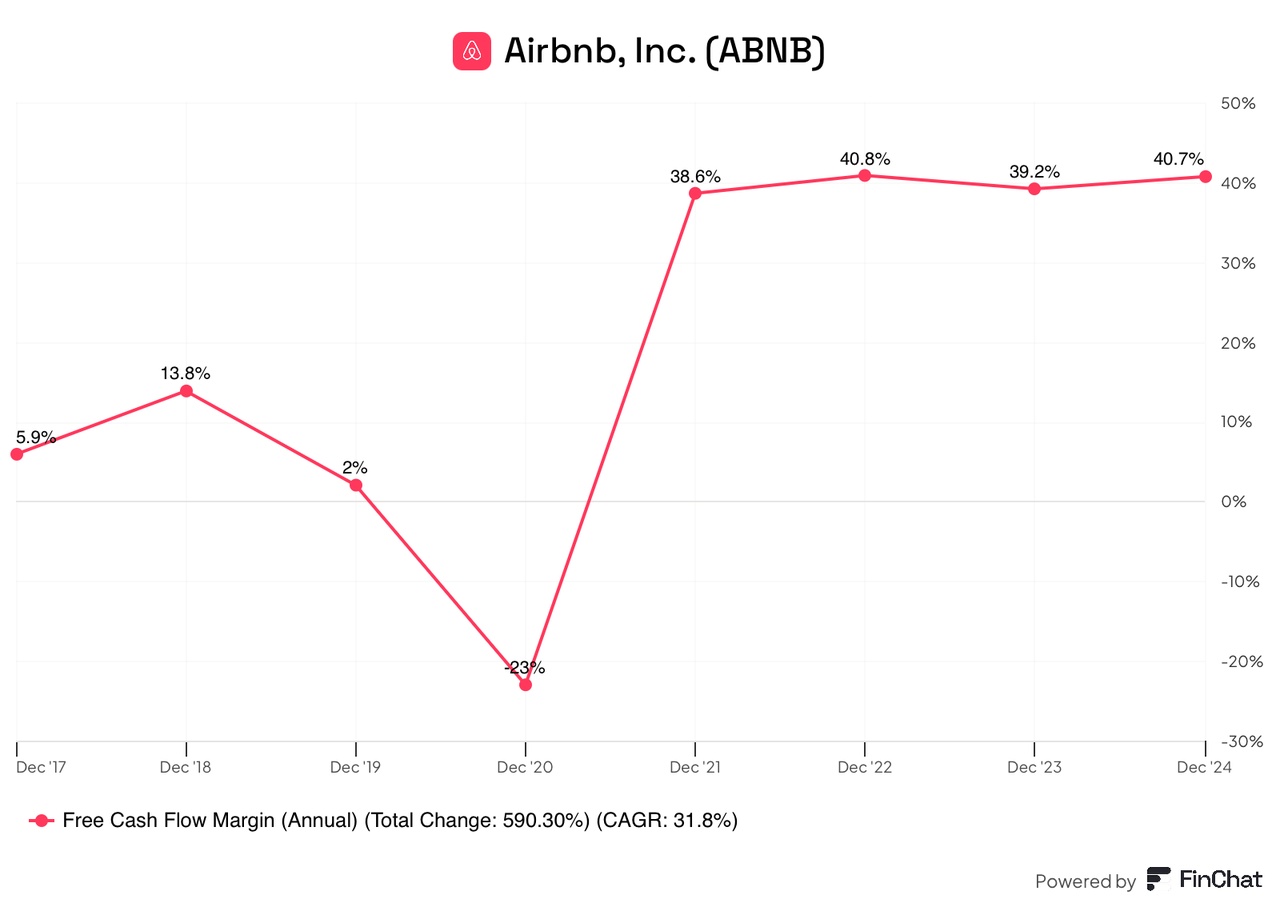

The free cash flow margin has also passed the 40% mark exceeded. This feat accomplish only a few companiese.g. Visa $V (-3,35%) / Mastercard $MA (-2,45%) , MSCI $MSCI (-2,28%) and Nvidia $NVDA (-3,83%) .

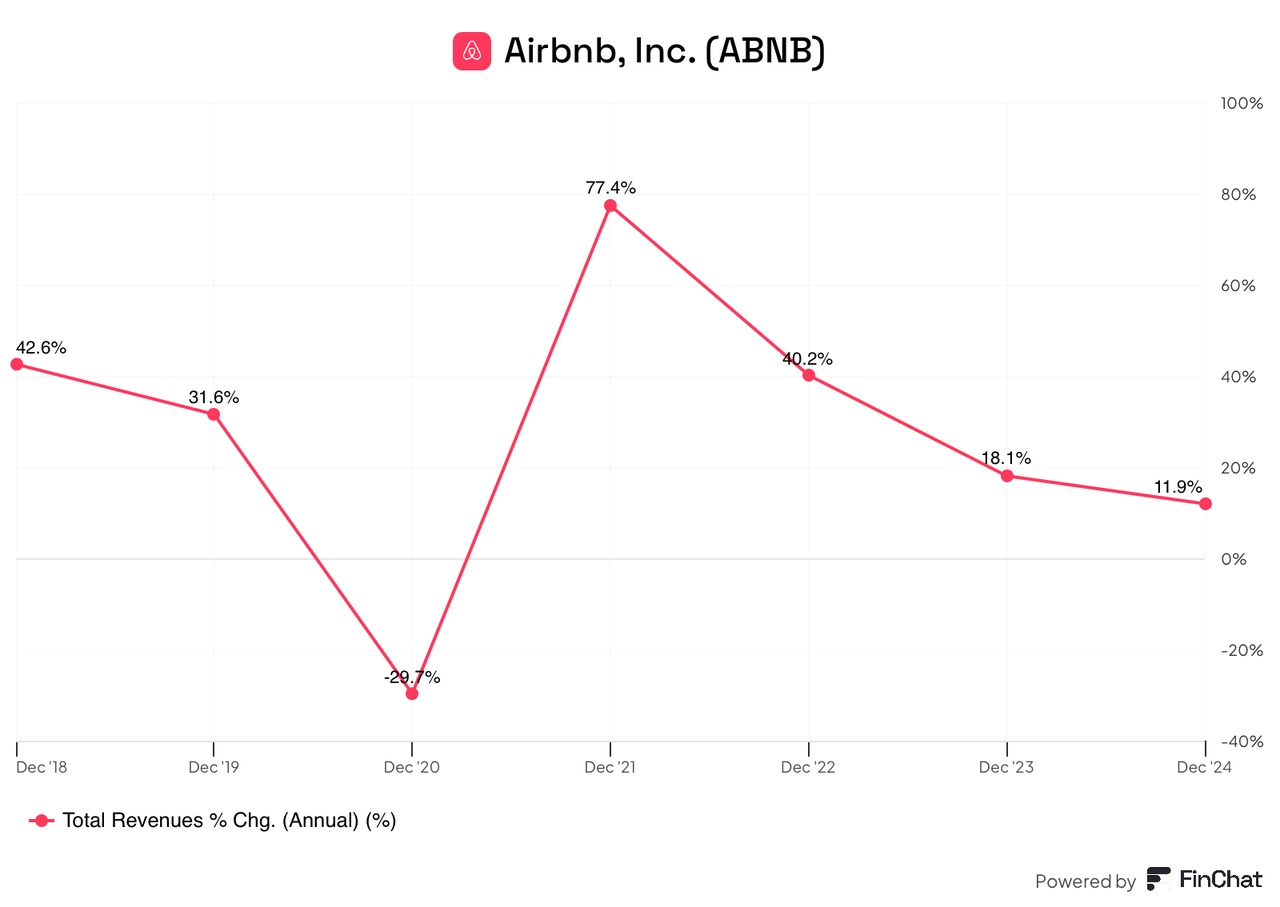

The sales growth in the core business is slowing down, but is still at 12% per year - despite unspeakable and often false headlines in the media about regulation and competition.

The management plans to increase sales growth again accelerate: off we go from May with the large-scale launch of "Experiences" and other services for guests and hosts.

"Starting in 2025, each year we will launch 1-3 new businesses that could eventually generate over a billion dollars in revenue per year (starting with travel and then moving away from the core); they are not gonna be capital intensive and they all gonna be similar margin to the current business because we are probably going to have a similar take rate." (CEO in October 2024).

The following are conceivable in the long term

- Experiences / activities (when traveling or in the home town)

- Advertising on the platform

- Concierge services

- Flights / rentals (cars, boats)

- Loyalty program (monthly subscription for frequent travelers with comprehensive benefits, discounts, exclusive accommodation, premium customer service, access to gyms, transport, food deliveries)

- Community / Social+ (networking with other local travelers, e.g. for restaurant or concert visits)

- Services for hosts (networking with craftsmen, designers, cleaning staff)

- ... and much more

Airbnb is valued with a forward PE of 24.2 (FY26) and a forward P/OCF of 15.3 (FY26) both of which are below the long-term averages.

Airbnb is rarely priced close to or below the €100 mark. $ABNB (-5,04%) is rarely available.

Do you already have Airbnb $ABNB (-5,04%) already in your portfolio?