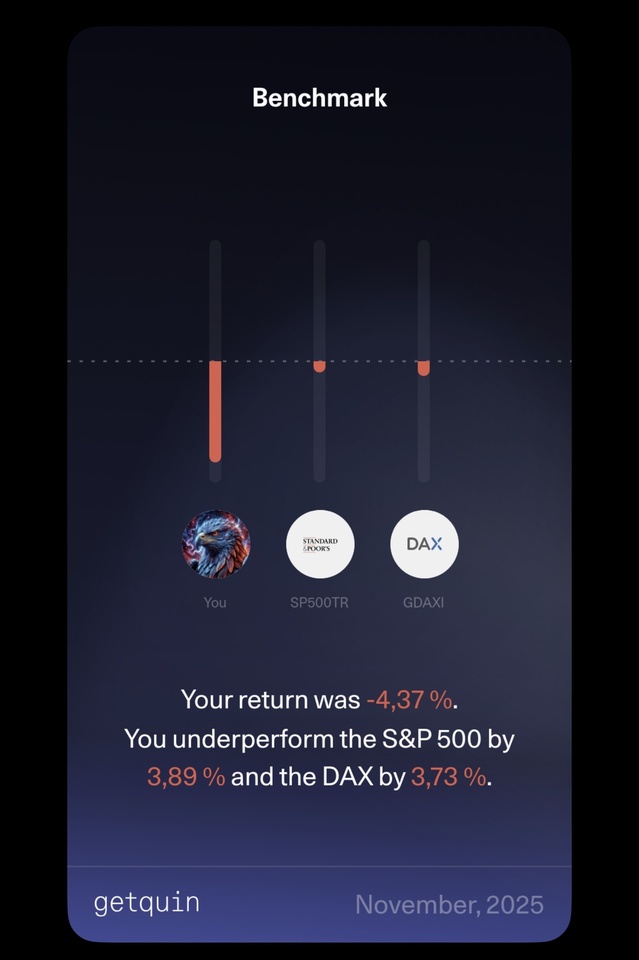

Bitcoin has caused a significant correction in the portfolio, which is nothing unusual given the high weighting.

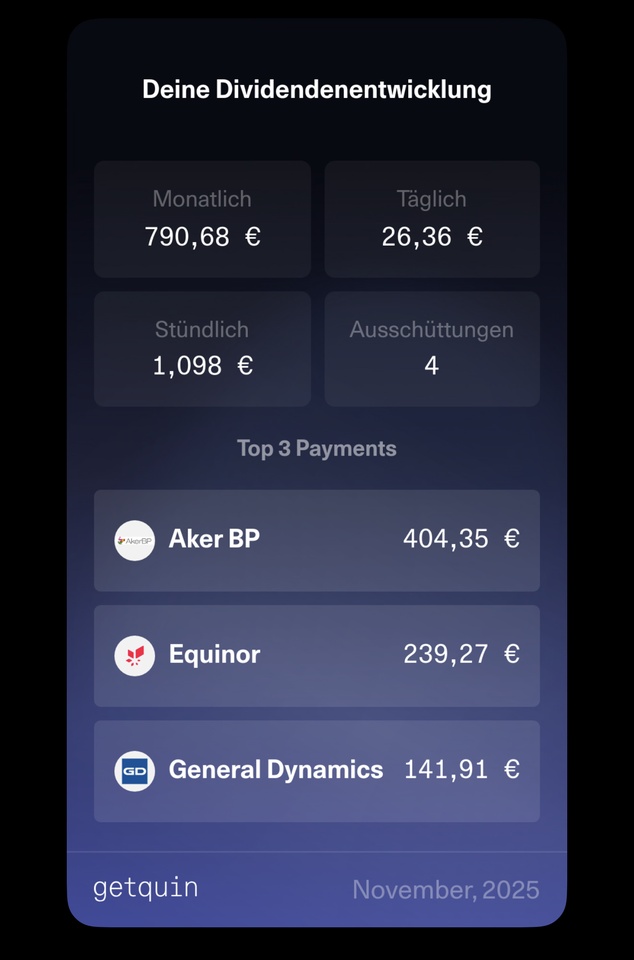

In November, there were more purchases in the energy sector ($EQNR (-0,49%)

$AKRBP (-1,04%)

$CNQ (+0,56%) )

With $RHM (-0,17%) I also took advantage of the sell-off and now hold 15 shares.

In addition to Bitcoin, my overall allocation is still overweight in the AI, defense and energy (oil/gas) sectors.

Cash is at ~16%, with a downward trend.

That's it already!

Have a relaxed Tuesday evening 🍻