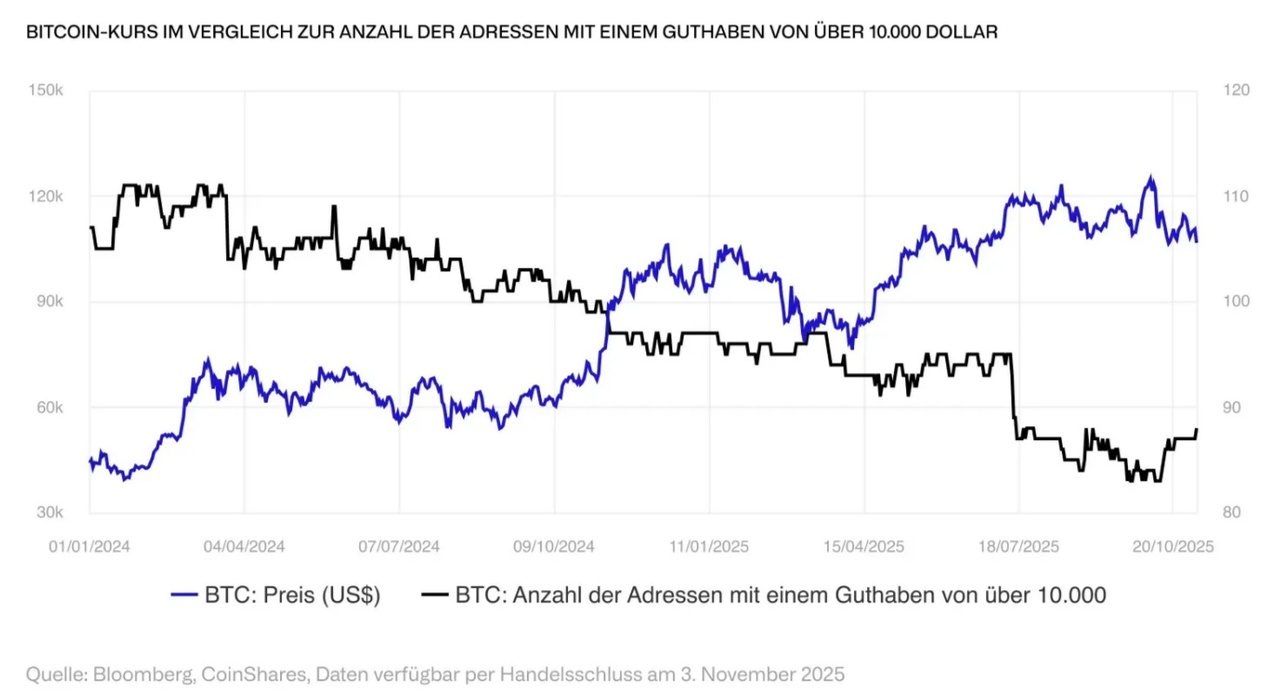

This week's on-chain data shows a growing divergence between large investors in #bitcoin and #ethereum. For Bitcoin, the number of addresses with more than 10,000 #btc continues to decline - an indication that some of the largest market participants continue to sell holdings. Over 100 wallets with more than 1,000 BTC have also reduced their positions since July, indicating continued profit-taking after this year's price rally. Ethereum, on the other hand, paints a different picture. Since June, the number of wallets with more than 10,000 #eth has risen from around 877 to around 1,250. This indicates that accumulation by large holders has increased in the background - even while the Bitcoin whales are retreating. This development suggests a shift in conviction within the market rather than a broad exit from digital assets. With interest rate expectations for December now slightly less dovish than before, markets appear to be readjusting rather than pulling back. Phases like this often serve as position restarts. Historically, a slowdown in selling by large investors and subsequent resumption of accumulation often coincides with a more stable bottom in major crypto assets.