The post by Michael @Michael-official has motivated me to point out an ETF with a sector rotation strategy.

There have already been comments here that see this ETF as a kind of hedge for your own portfolio.

The ETF in question is the Ossiam Shiller Barclays CAPE US Sector Value ETF: $216361 (+0,2%) [€] resp. $CAPU (+0,61%) [$

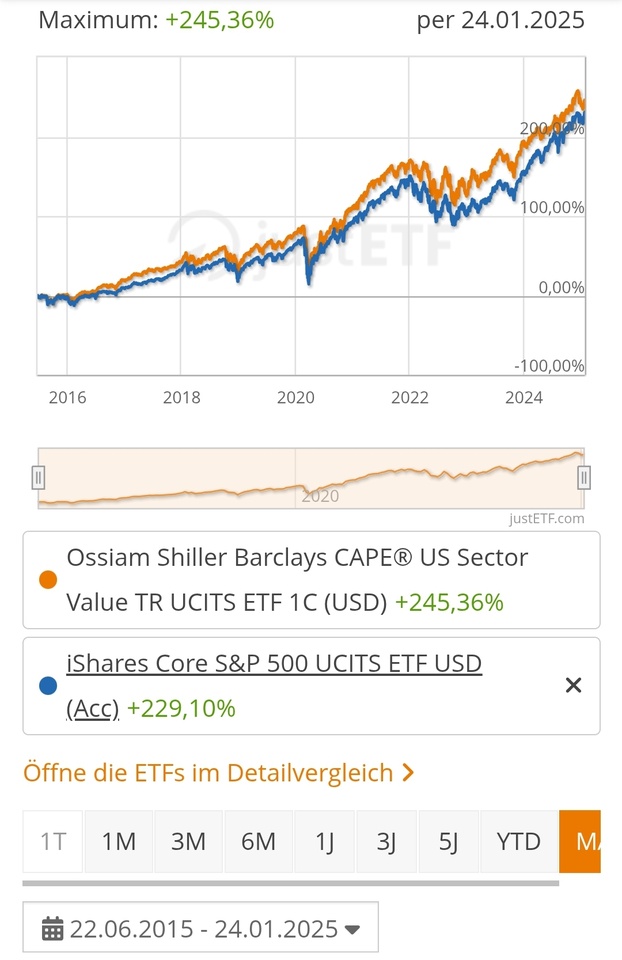

This ETF also has the rare ability to outperform the S&P 500 on the basis of the last 10 years.

I know from past comments that I am not the only one who likes the concept of the sector rotation strategy and invests in it. In my pinned post there is also a link to an article explaining the concept.

What do the others think? Interesting? Investable?...or theoretical nonsense?

Best regards

🥪