$CRWD (+0,57%)

$FTNT (+0,78%)

$PANW (+2,06%)

$S (+1,98%)

$ZS (-0,54%)

$MSFT (+1,62%)

$GOOGL (-0,44%)

$CSCO (-0,12%) .....

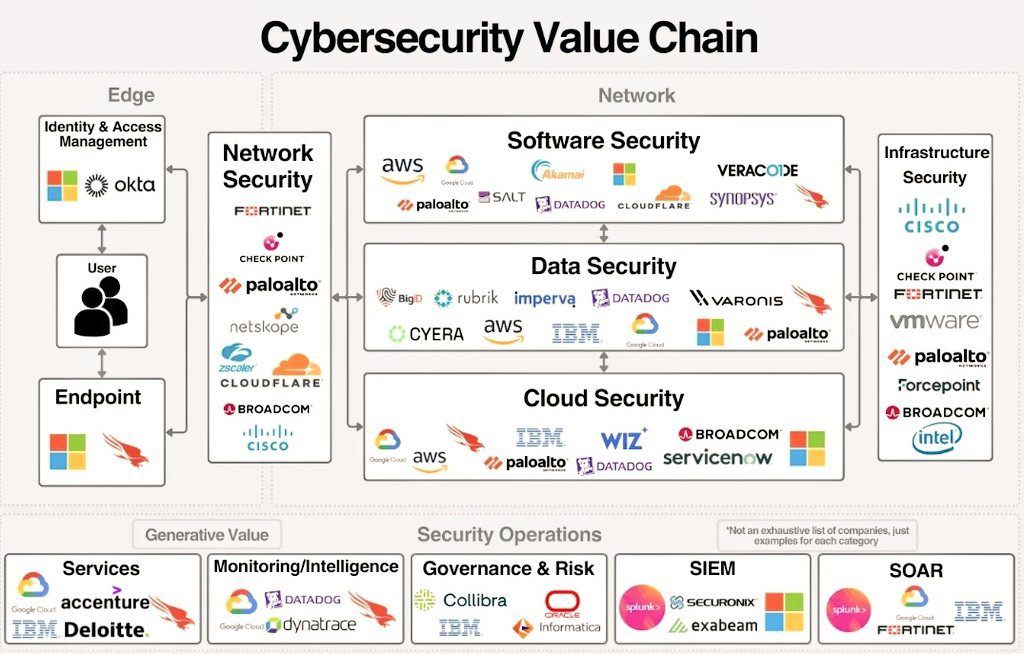

How large companies fit into the ecosystem:

How some of the largest security companies in the world fit into the ecosystem. All of these companies offer products across the security ecosystem and strive to provide security platforms on which customers can consolidate.

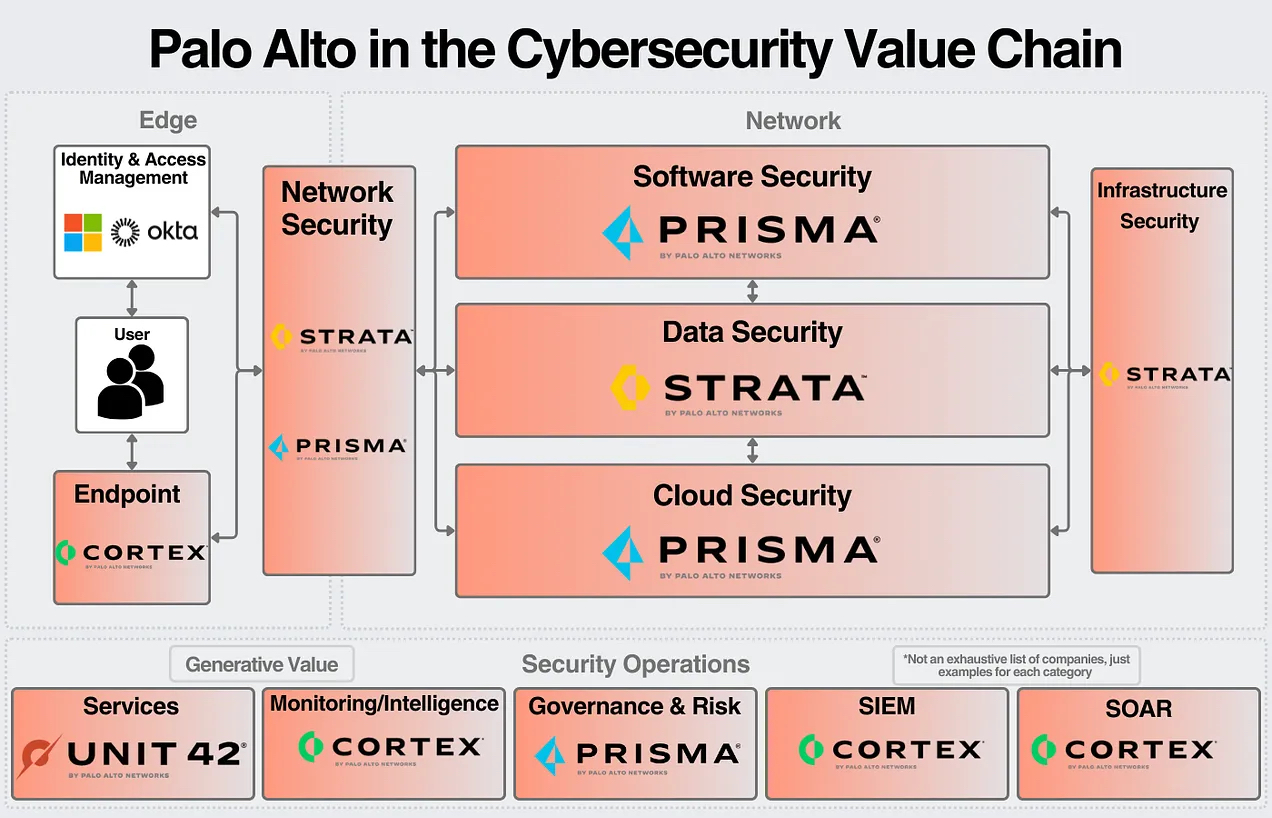

$PANW (+2,06%) - Palo Alto Networks

Palo Alto is the largest pure-play cybersecurity company in the world, both by market capitalization and revenue. Their core product is network firewalls (hardware and software); they have significantly expanded their portfolio through an aggressive acquisition strategy. Their goal is to be the consolidator for cybersecurity, and they continue to show progress towards that goal.

Palo Alto has four main solution areas: Strata (Network), Prisma (Cloud, Access), Cortex (Endpoint, SecOps) and Unit 42 (Managed Services). The only area in which they do not compete is Identity. They have achieved a turnover of 7.5 billion dollars in the last 12 months.

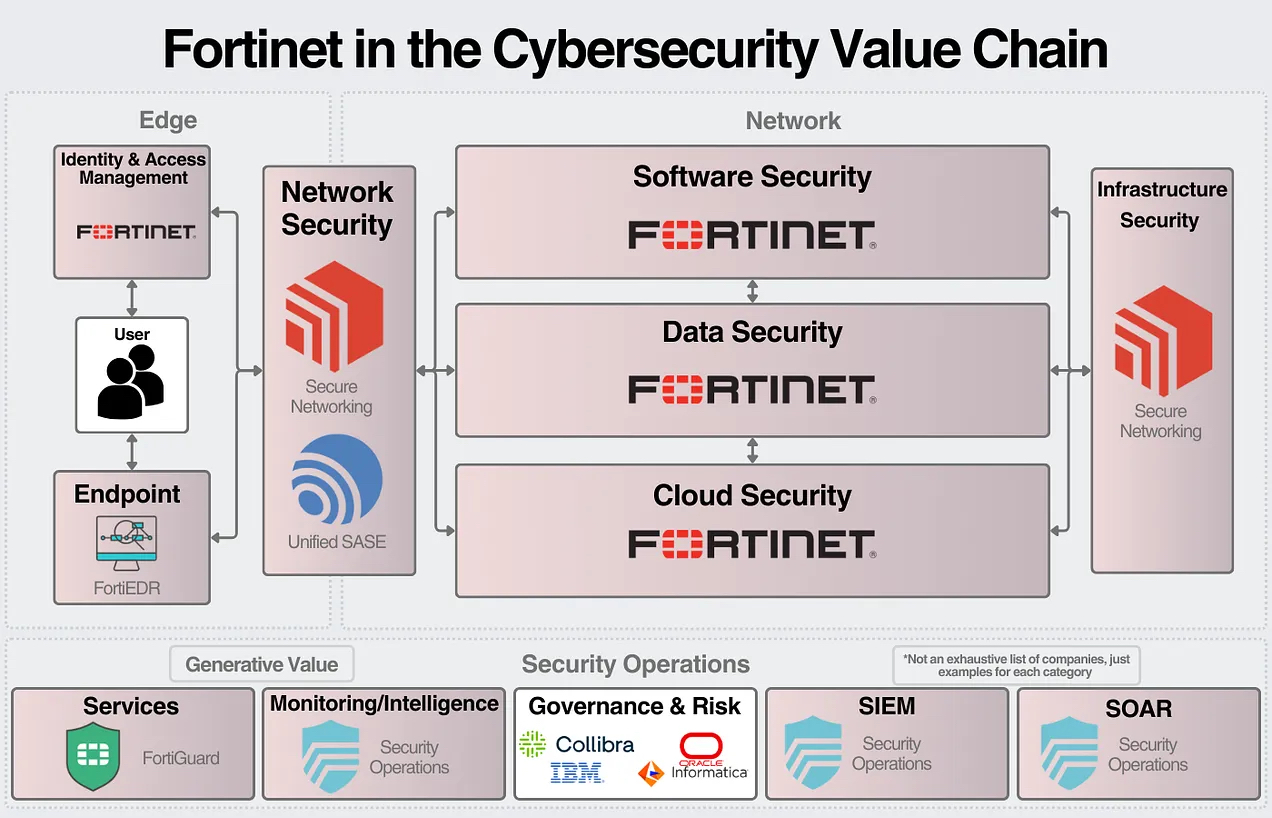

$FTNT (+0,78%) - Fortinet:

Fortinet is the second largest pure-play cybersecurity company by revenue. Like Palo Alto, their core product is the firewall (both hardware and software). Fortinet is still primarily a network security company (60-70% of revenue) and is focused on providing a strong SASE (Secure access service edge) product for growth. Apart from that, they have an extensive portfolio of security products including cloud security, app security, data security and managed services. Fortinet has achieved a turnover of 5.3 billion dollars in the last 12 months.

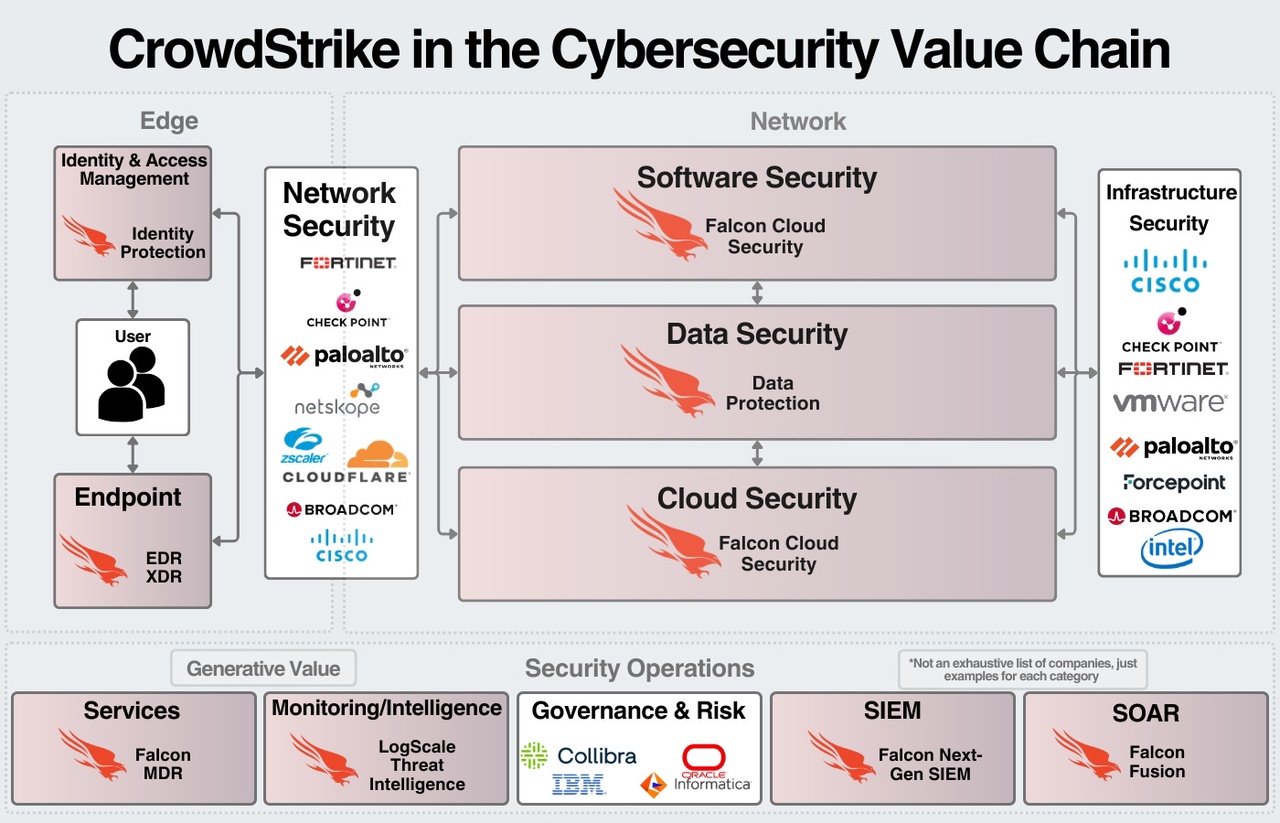

$CRWD (+0,57%) - Crowdstrike:

Crowdstrike's core product is endpoint security; they are another example of being able to expand to a platform. In endpoint security, they are one of the two market leaders (Microsoft is the other). In cloud and software security, they have a unified platform for posture management, workload protection, and app protection. They offer a data protection suite as well as services for security operations. They do not offer Identity & Access Management, but they do offer identity security that protects other IAM (Identity & Access Management) products.

Their product is based on a unified data layer. CEO George Kurtz explained that the

true value comes from centralizing data, using AI/ML to detect threats and anomalies, and responding to those threats. This value can be continually delivered through new products that give us the overall roadmap for how CrowdStrike expands in the future. CrowdStrike has generated $2.8 billion in revenue in the last 12 months.

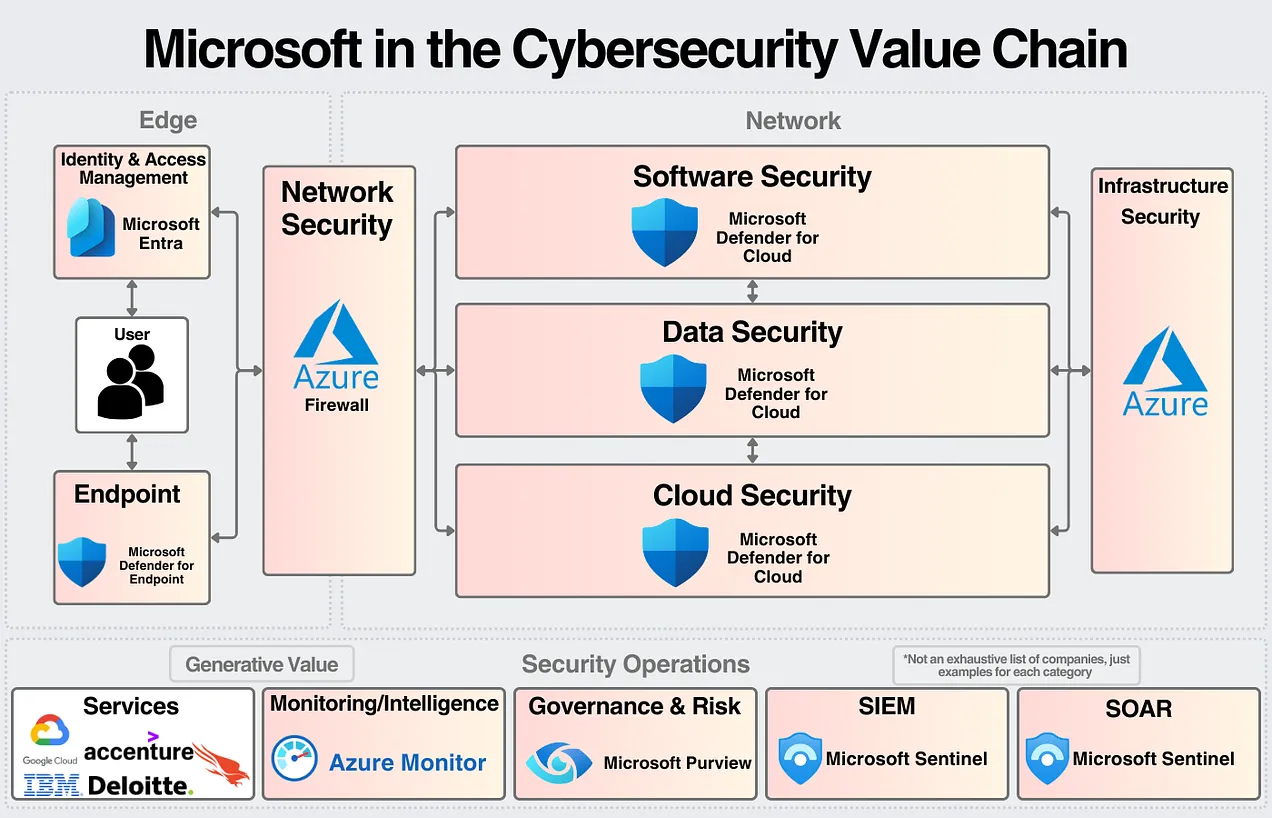

$MSFT (+1,62%) - Microsoft:

In January 2021, Microsoft surpassed 10 billion dollars in security revenue. Just two years later, Microsoft announced that they had surpassed 20 billion dollars in revenue from Microsoft security.

Microsoft has 6 main segments of its cybersecurity portfolio: Microsoft Defender, Microsoft Sentinel, Microsoft Entra, Microsoft InTune, Microsoft Priva and Microsoft Purview. Defender (Cloud, Apps, Endpoint, IoT) is Microsoft's security product across all solution areas. Sentinel is a SIEM/SOAR solution. (SOAR = Security Orchestration, Automation, and Response) (SIEM = Security Information and Event Management) Entra is Microsoft's IAM solution (market leader by market share). InTune is a unified endpoint management tool. Priva covers data protection and compliance. Finally, Purview is a data governance tool.

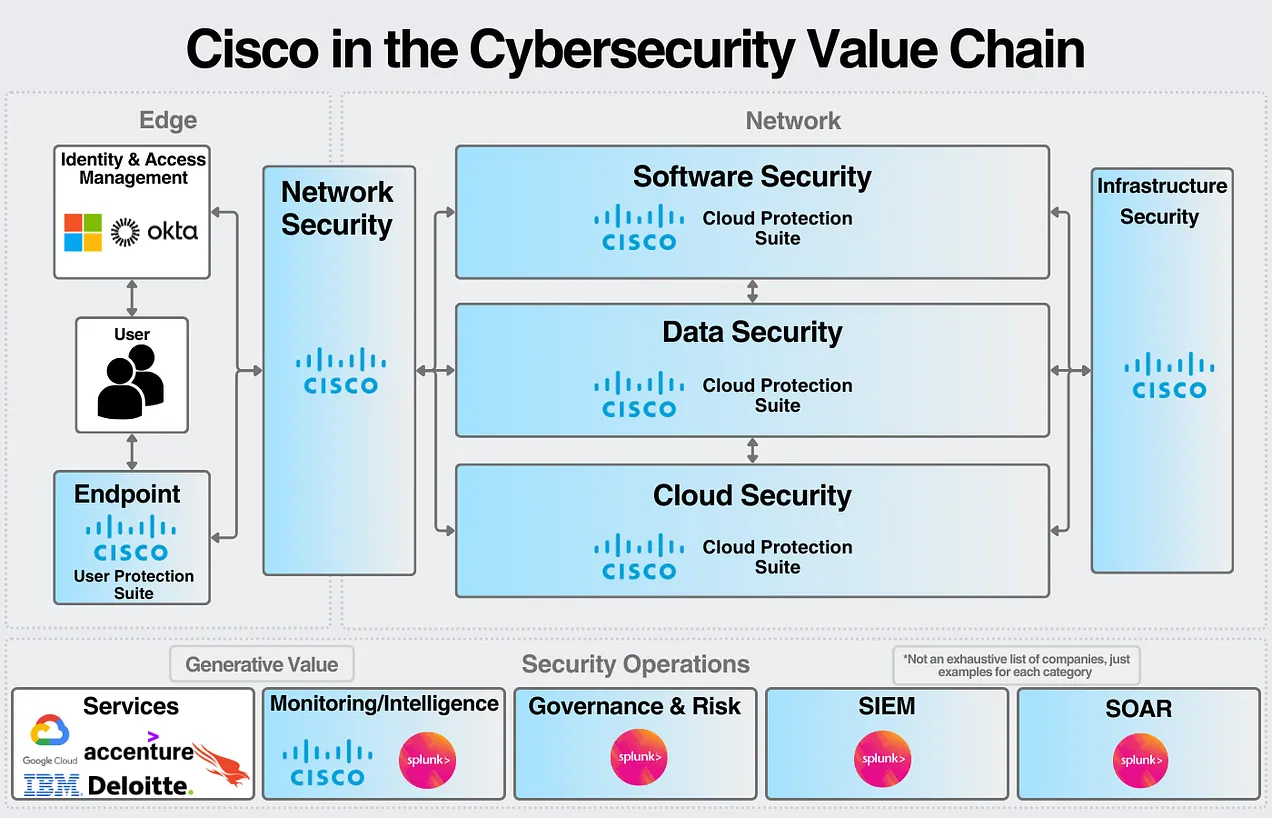

$CSCO (-0,12%) - Cisco Systems:

Cisco has an impressive collection of security products; with the acquisition of Splunk, it became one of the largest security companies in the world. In FY2023, Cisco generated ~$4 billion in security revenue, while Splunk had $3.7 billion in ARR at the end of the same quarter. Together, this puts Cisco in the same revenue range as Palo Alto.

Cisco's core security strength comes from its massive networking business. They have also expanded into cloud, endpoint and SASE. Splunk brings a strong SecOps presence with SIEM, SOAR and analytics. It will be interesting to see what synergies Cisco can further create between the two companies.

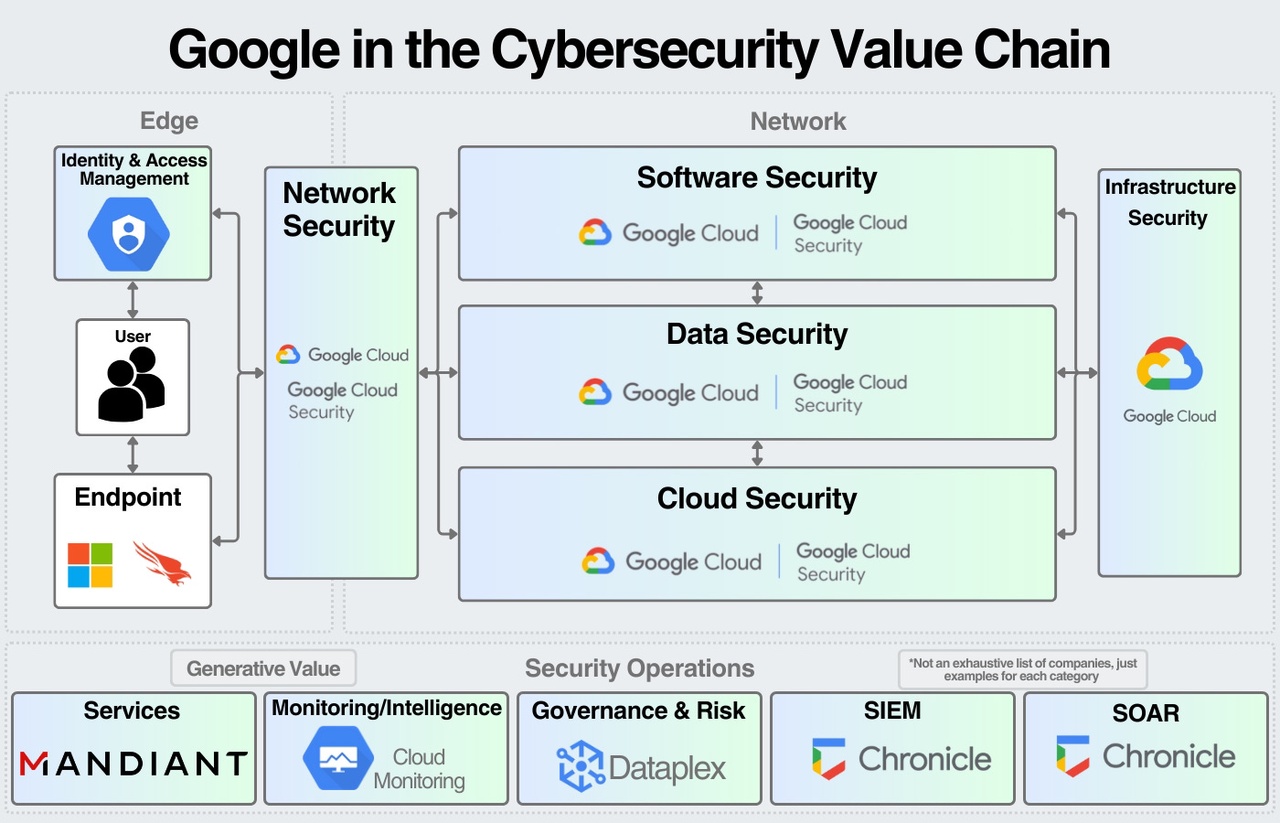

$GOOGL (-0,44%) - Google:

One of Google's main goals is to be the go-to cloud for security, and they have done an impressive job building their portfolio. They offer network security with load balancing, cloud firewalls and secure web proxies. GCP (Google Cloud Platform) offers several services for data protection (building on their strength as a data company). They also focus on securing DevOps with several SecDevOps tools.

In 2022, Google completed the acquisition of Mandiant for $5.4 billion, which strengthened GCP's managed services offering (in addition to other products). Combined with their data governance, observability and SIEM/SOAR solution, it makes GCP a formidable player in the security space. It will be interesting to see what revenue figures management reveals for security in the future.