$1810 (-1,13%) has evolved from a pure smartphone manufacturer into a versatile technology group whose ecosystem competes with industry leaders such as Apple and Amazon. The company is strengthening its market position and customer loyalty through strategic expansion into premium smartphones, connected IoT devices and electromobility.

Successful expansion in the premium smartphone market

Xiaomi has consolidated its position in the premium segment with models such as the Xiaomi 15 Ultra. These devices are characterized by high-quality workmanship, powerful hardware and innovative functions that appeal to both tech-savvy users and professional users. The integration of AI and advanced camera systems, often in collaboration with renowned brands such as Leica, underlines Xiaomi's commitment to quality and user experience.

Growth in the IoT and lifestyle segment

Xiaomi's IoT and lifestyle segment recorded revenue of RMB 26.1 billion in the third quarter of 2024, an increase of 26.3% year-on-year. The company offers a wide range of connected devices, including smart TVs, home appliances and wearables that are seamlessly integrated into the Xiaomi ecosystem. This strategy promotes customer loyalty and increases the brand's appeal to tech-savvy consumers.

Breakthrough in the electromobility sector

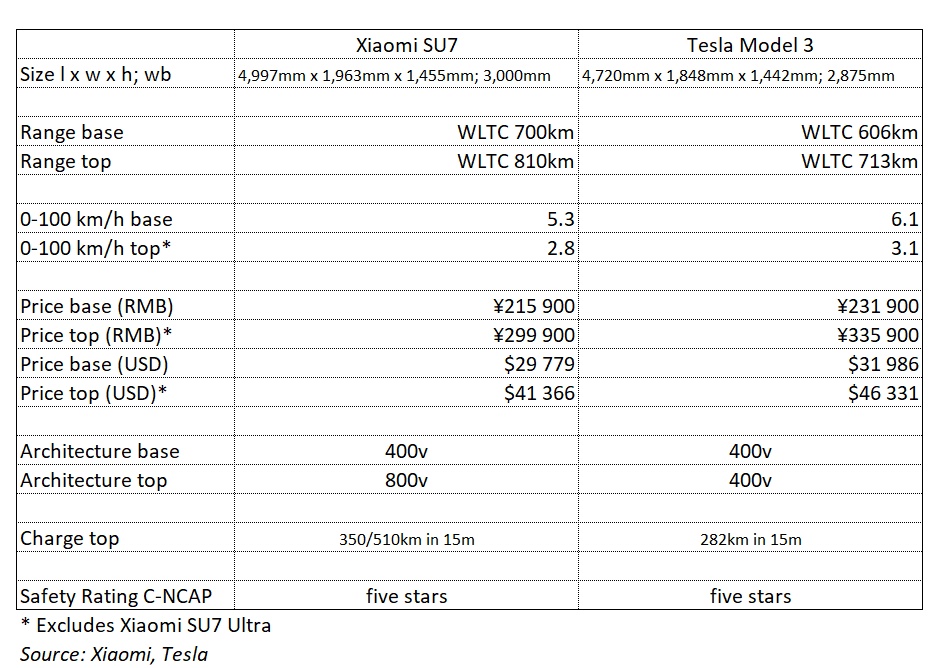

Xiaomi has taken a significant step by entering the electric mobility market. The SU7 electric vehicle exceeded the original sales targets with over 135,000 units delivered in 2024. This model successfully competes with established brands and offers an attractive price-performance ratio. The launch of the upcoming Yu7 model, which is expected to compete directly with Tesla's Model Y, could further strengthen Xiaomi's position in the EV market.

Financial performance and future prospects

In the second quarter of 2024, Xiaomi achieved record revenue of $12.2 billion, marking the third consecutive quarter of double-digit growth Analysts forecast earnings per share of $0.1197 CNY for the fiscal year 2024. Despite this positive development, the share is currently trading at a comparatively low valuation multiple of 2.3x, while competitors such as Apple and Tesla are trading at 8x. A conservative revaluation to a 3x multiple could mean a price potential of 40% to $8.48 per share. If the strategic initiatives continue to be successful, a valuation of 5x would even be possible, which would correspond to a price target of over $10 and a potential upside of 143%.

Risks and challenges

Despite the positive outlook, there are risks, particularly with regard to the acceptance of new products. The upcoming launches of the Xiaomi 15 Ultra and Yu7 will be crucial for future growth. A failure of these products could affect the growth momentum and negatively impact the share valuation. In addition, Xiaomi's EV division is currently operating at a loss; a deficit of USD 0.3 billion was recorded in the third quarter of 2024. Intense competition in the EV market and pressure to bring low-cost models to market quickly pose further challenges.

Conclusion

Xiaomi's transformation into a versatile technology company with a robust ecosystem positions the company as a serious competitor to established brands such as Apple and Tesla. The successful expansion into new business areas, especially electromobility, and the continuous innovation in the premium smartphone and IoT segment underpin the growth potential. However, investors should be aware of the existing risks and monitor market developments closely.