I am currently studying abroad in Bangkok, Thailand, and I find Grab fascinating.

$GRAB (-0,48%) combines: Cheap transportation (Uber) + Duck (food delivery) + payment system (PayPal)

Here is a short insight + soon possibly a longer analysis

1. company profile

Grab is the leading super app in Southeast Asia with the segments ride-hailing, food delivery, digital payments and financial services. With only ~6 % market penetration and an ARPU of USD 17, there is considerable scaling potential.

2. market environment

- Macro: Southeast Asia has significantly higher GDP growth rates than Western markets.

- Demographics: Young, digitally savvy population; high smartphone penetration.

- Digital payment boom: Region is one of the world's leading markets for mobile payments.

3rd growth driver

- Financial services: Expansion from driver credit business to consumer and dealer credit.

- Product innovations: "GrabFood for One", "Shared Saver", autonomous driving tests, "GrabCab".

- Advertising business: +49 % active advertising customers YoY, currently only 3 % of partners actively advertise.

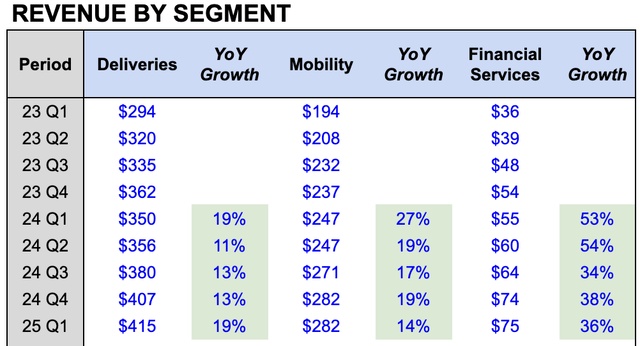

4. current business development (Q1 2025)

- Revenue: USD 773m (+18% YoY)

- Monthly active users: 44.5m (+16% YoY)

- Net profit: USD 10m (positive for the first time)

- Adj. EBITDA: USD 106 million | Forecast 2025: USD 460-480 million (increased)

5. profitability & outlook

- Target: Financial Services profitable by the end of 2026 - this may be achieved earlier.

- Margin potential through higher-value credit products and advertising income.

6. financial position

- Net liquidity: USD 5.9 bn

- No share buybacks in Q1 → possible signal for major strategic acquisition (speculation: GoTo takeover in Indonesia).

7. valuation

- Current share price: ~5.06 USD

- EV/Sales (TTM): 5.3x (cash share ~30%)

- Target price (analysts): USD 7.15 → Upside: ~41 %

8. potential price drivers

- Accelerated growth in the lending segment

- Official confirmation of a Grab-GoTo merger

- Sustainable EBITDA margin increase

Conclusion:

Grab offers an attractive mix of high growth potential, a solid balance sheet and structural tailwinds in the Southeast Asian market. Despite the strong share price performance since the beginning of the year, the valuation is moderate in relation to the market position. The chart looks catastrophic, but this is due to a long phase of overvaluation. In addition, they have virtually no competitors and have bought up Uber in Asia (Uber has a 13% stake in Grab as a result). The company also has 6 billion in cash, which is a lot...