The current market sentiment at $BTC (+0,53%) makes me personally incredibly bullish. We are just scratching the $100k mark again and nobody seems to care.

With New Hampshire, we have the first US state with a strategic BTC reserve.

A bill also came into force yesterday in Arizona that does not allow direct investment, but transfers confiscated BTC to the state reserve. In many other states, SBR laws are currently going through the official legislative process, which you can follow here:

https://bitcoinlaws.io/reserve-race

$MSTR (+1,82%) hosted "Strategy World 2025" in Orlando from May 5-8. A conference at which BTC strategies and use cases for companies were presented.

Among others were:

- Visa $V (+0,08%)

- Dell $DELL

- Salesforce $CRM (-0,22%)

- Siemens $SIE (+1,06%)

- Palantir $PLTR (+2,29%)

- JP Morgan $JPM (+1,87%)

All of these companies are apparently involved with Bitcoin.

There are more and more strategy imitators. More and more companies are dedicating their entire business model to buying as much BTC as possible.

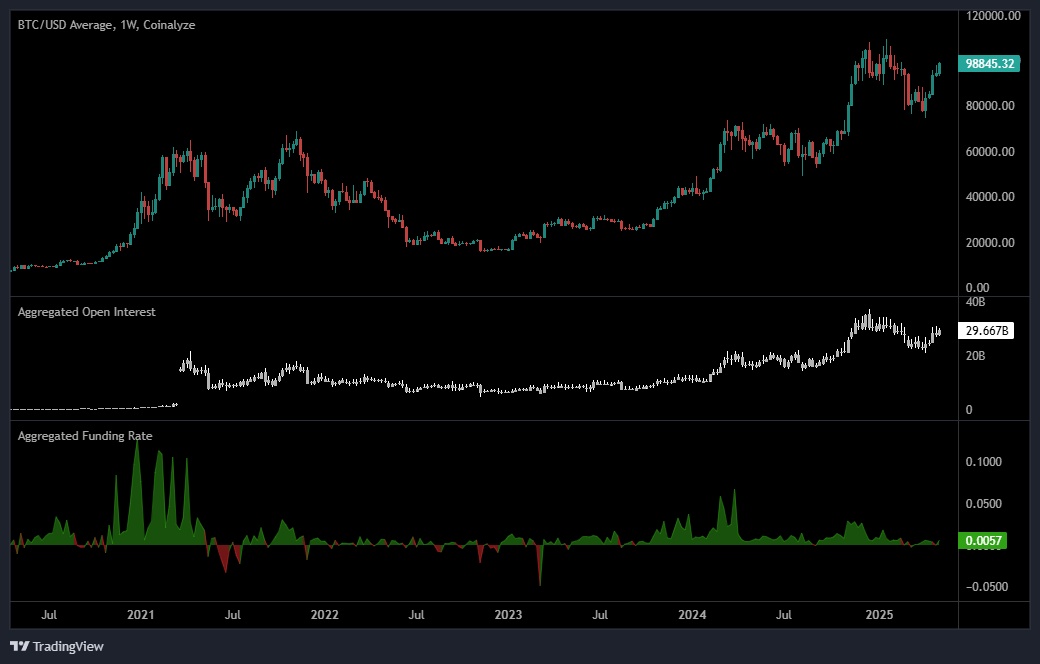

The funding rate is at bear market levels, which indicates a healthy, sustainable increase. There are no over-leveraged long trades in the market.

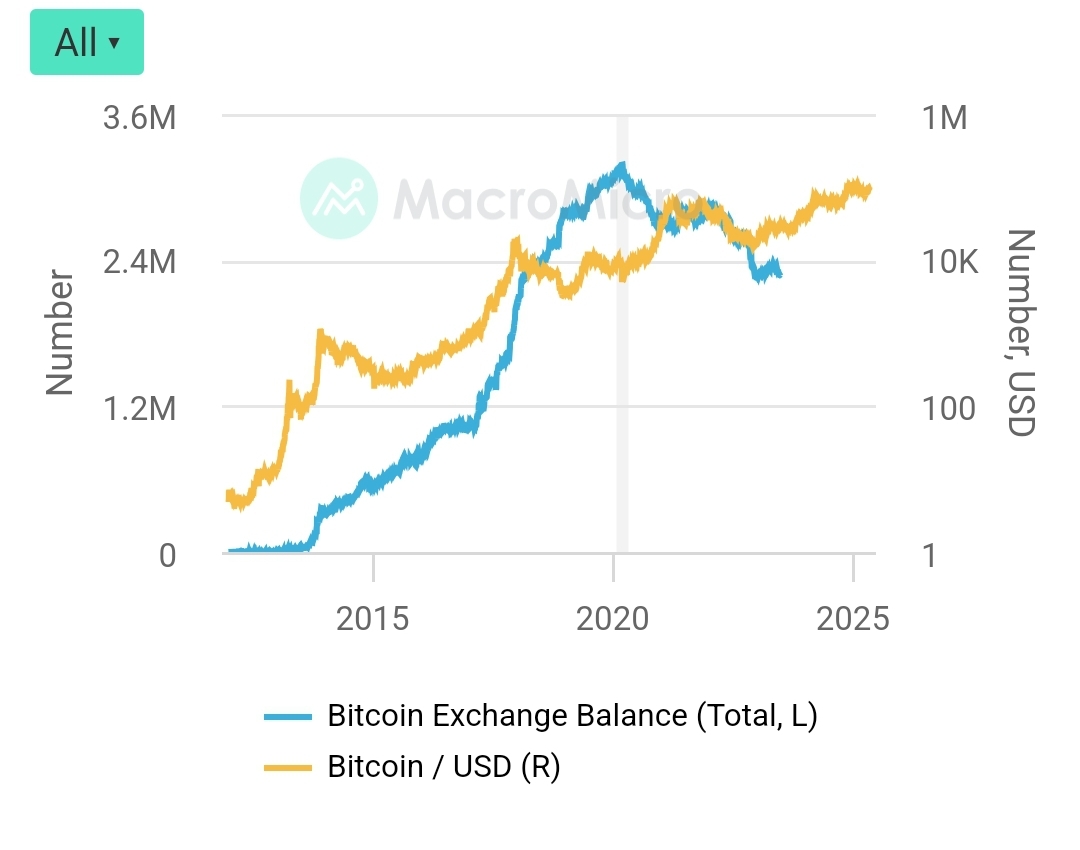

There is less and less BTC on the exchanges. The stock on the exchanges has been falling continuously for 5 years. BTC is not only being bought, it is being withdrawn from the exchanges. The supply is therefore falling continuously.

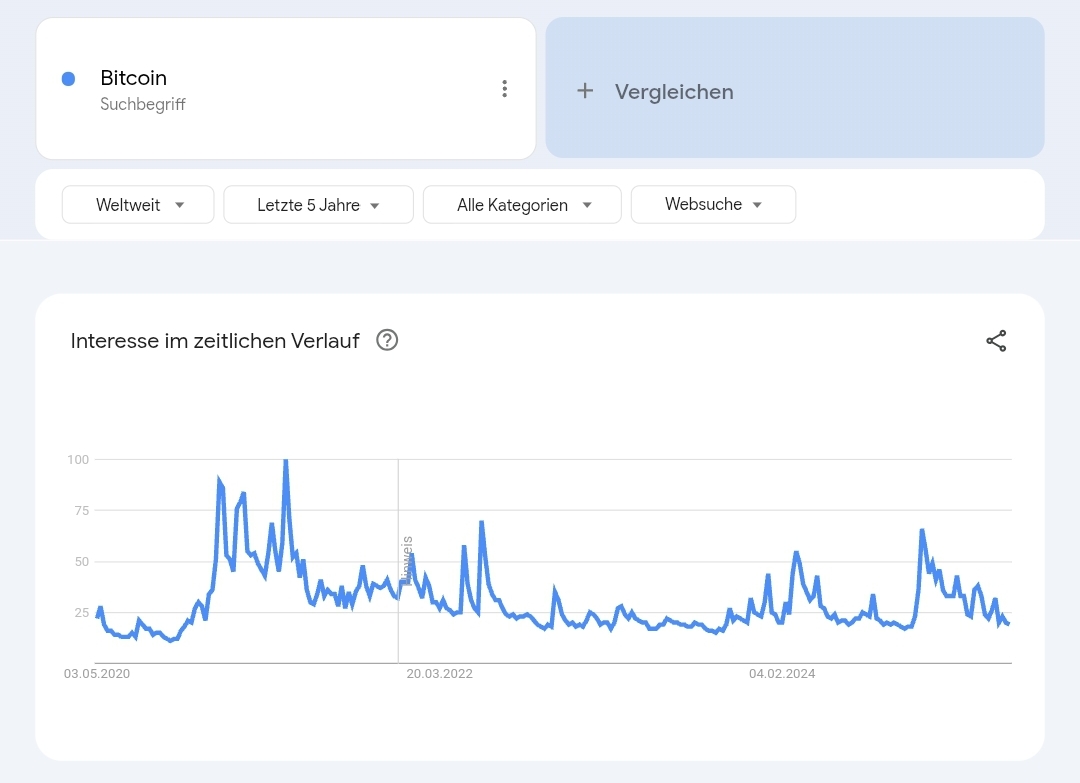

And while all this is going on, interest in Bitcoin is absolutely low, as can be seen from Google Trends.

It's interesting to see the direction in which this is all developing. What do you think?