@Epis nice review of the year has motivated me to also publish a few thoughts and observations on my strategy, which I have wanted to report on for some time. This is about what we call 1xGTAA, 3xGTAA and SPYTIPS/LETSGO, how it has developed in recent months and years and how I think it works best together. What is behind these strategies in detail has been @Epi described quite precisely in many posts. If you want to know more, please read there.

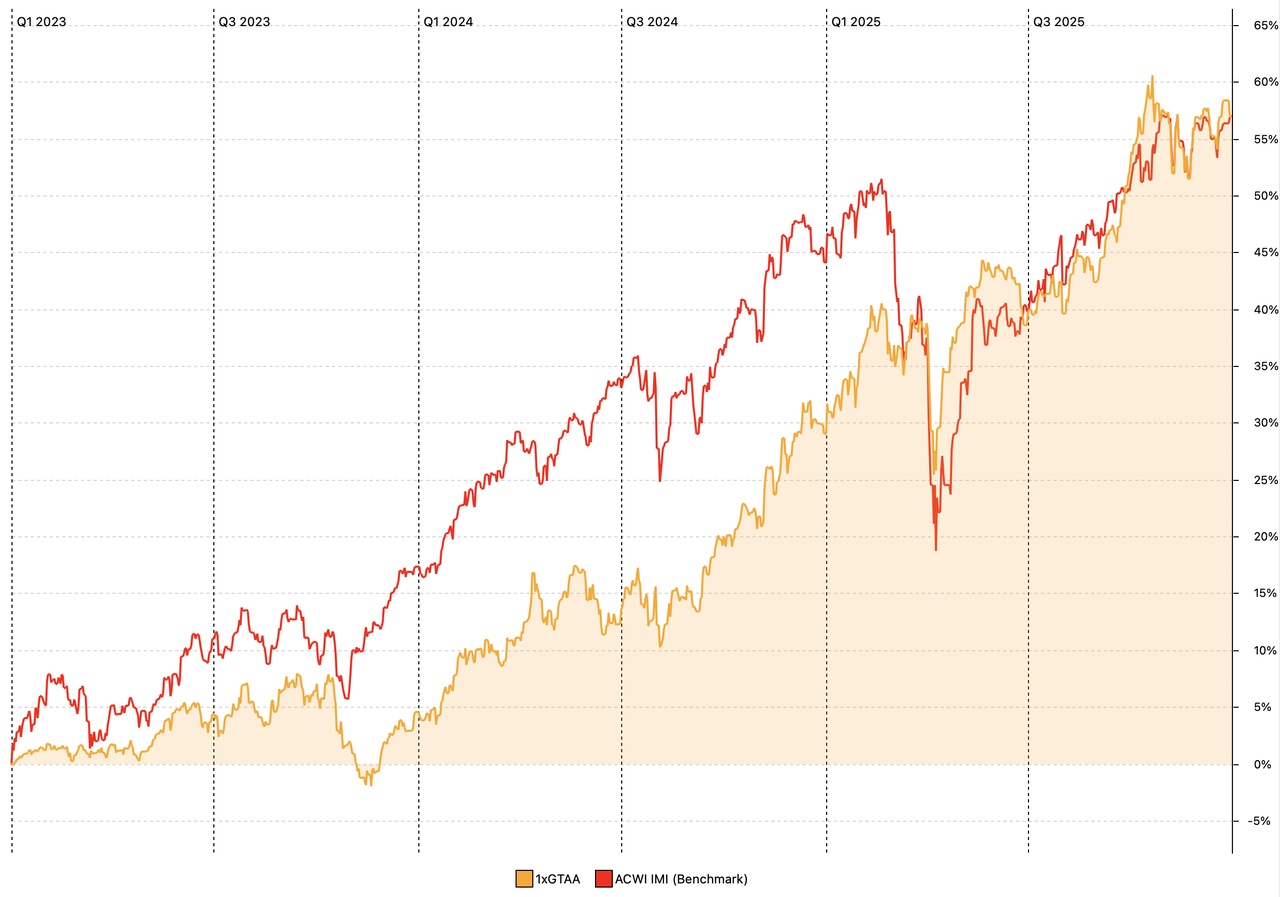

After initial attempts with a classic buy & hold world portfolio, I started with 1xGTAA at the beginning of 2023. After a lot of research, deliberation and backtesting, I had put together a model that I expected to deliver equity-like performance with significantly lower volatility. I was still somewhat shocked by what the events of 2022 had done to the capital markets and my expectations were not high. As you can see from the first screenshot, things got off to a leisurely start. I was surprised that the global equity market (represented here by the ACWI IMI as a benchmark) rallied so quickly and outperformed my model.

I wasn't thrilled, but I was able to put it into perspective. After all, GTAA is known to lag behind in bull markets and to draw its strength primarily from avoiding major drawdowns. And that is exactly what happened last spring. Comparatively unimpressed by the stock markets' reaction to Liberation Day, gold and European equities continued to perform, with the result that 1xGTAA and the ACWI IMI are back on a par after three years. But: 1xGTAA had around 20% lower volatility and the maximum drawdown was only 10% and not the more than 20% of the ACWI IMI. Which also contributed to what I consider to be a very good result: In the spring of 2023, I got in touch with getquin here at @Epi and we quickly outsourced the further development of the strategy to a separate chat together with a few others. A lot of fine-tuning - with still very simple rules - has ensured that 1xGTAA can now be expected to generate 15% and more p.a.

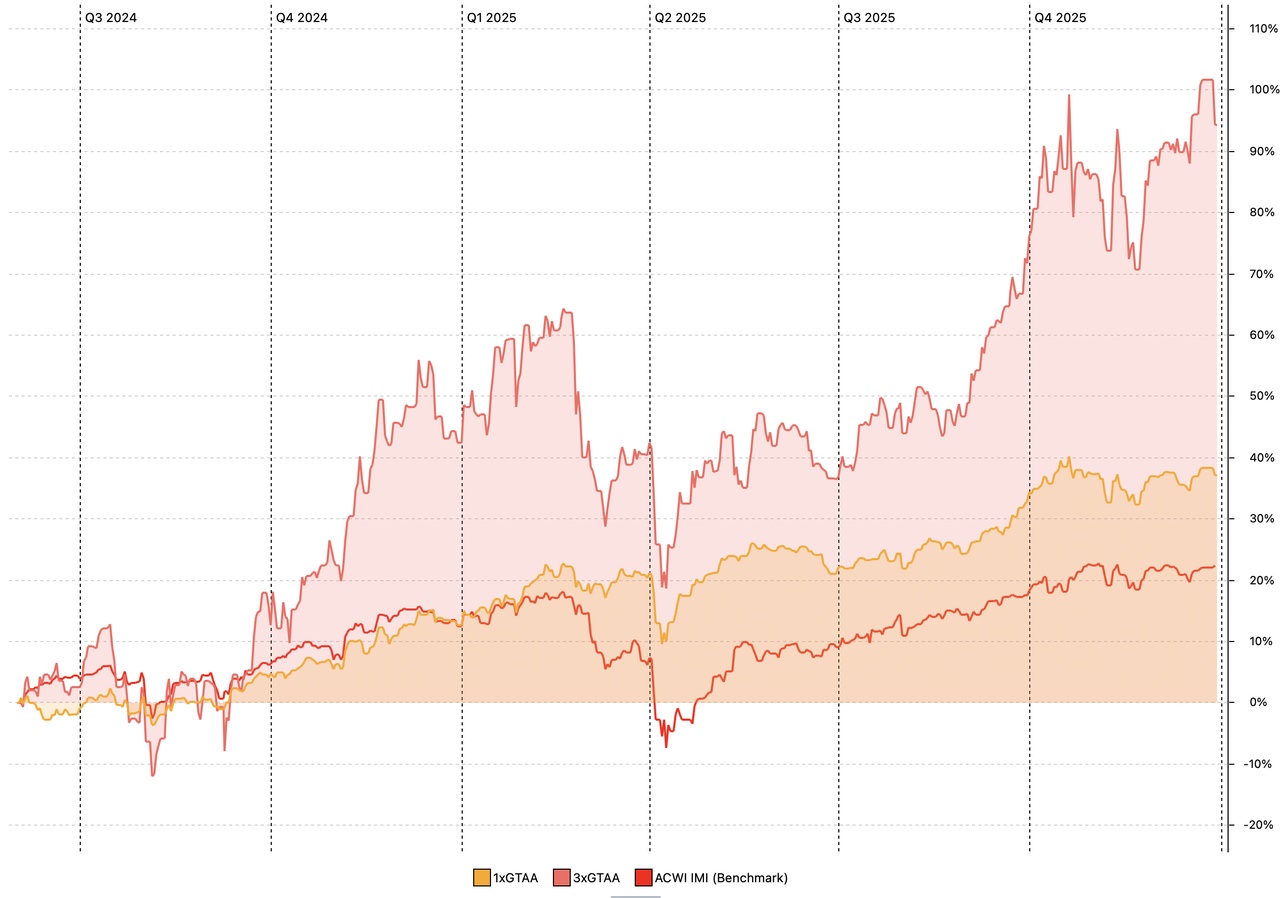

The next step was 3xGTAA. Although I was also involved in the development, I was initially skeptical about implementing it myself. From June 2024, however, I plunged into the leveraging adventure and - it was worth it:

It's quite clear: with 3xGTAA, the focus is on performance and not on the lowest possible volatility. And I think just under 100% in 19 months is quite impressive. In the meantime, I have also become accustomed to the sometimes violent daily fluctuations. This is because we are dealing with a completely rule-based model that offers very extensive protection against losses despite the outperformance in all market phases.

As soon as 3xGTAA was finished @Epi the idea for SPYTIPS arrived. I entered this model in February 2025 as the third and final component of my strategy. Fortunately with a rather small amount, because the timing couldn't have been worse. You really don't need -17% in one month. I had done my backtests here too, but perhaps not quite as precisely and in as much detail as necessary. There came @SemiGrowth came in handy with his analyses and the further development of the model. Over the course of the spring, I set up the notifications for the trading signals (https://getqu.in/s6pSSC/) according to his instructions and have done very well with them so far. In the medium term, however, I would also like to stand on my own two feet with this sub-strategy. One consideration is to turn my Riester custody account into a retirement provision custody account (if it comes as planned at the beginning of 2027) and to run SPYTIPS-only in a tax-free shell. As this involves a 6-figure sum, this approach has to be right from the start. For example, I need my own access to the signals that do not pass through several APIs.

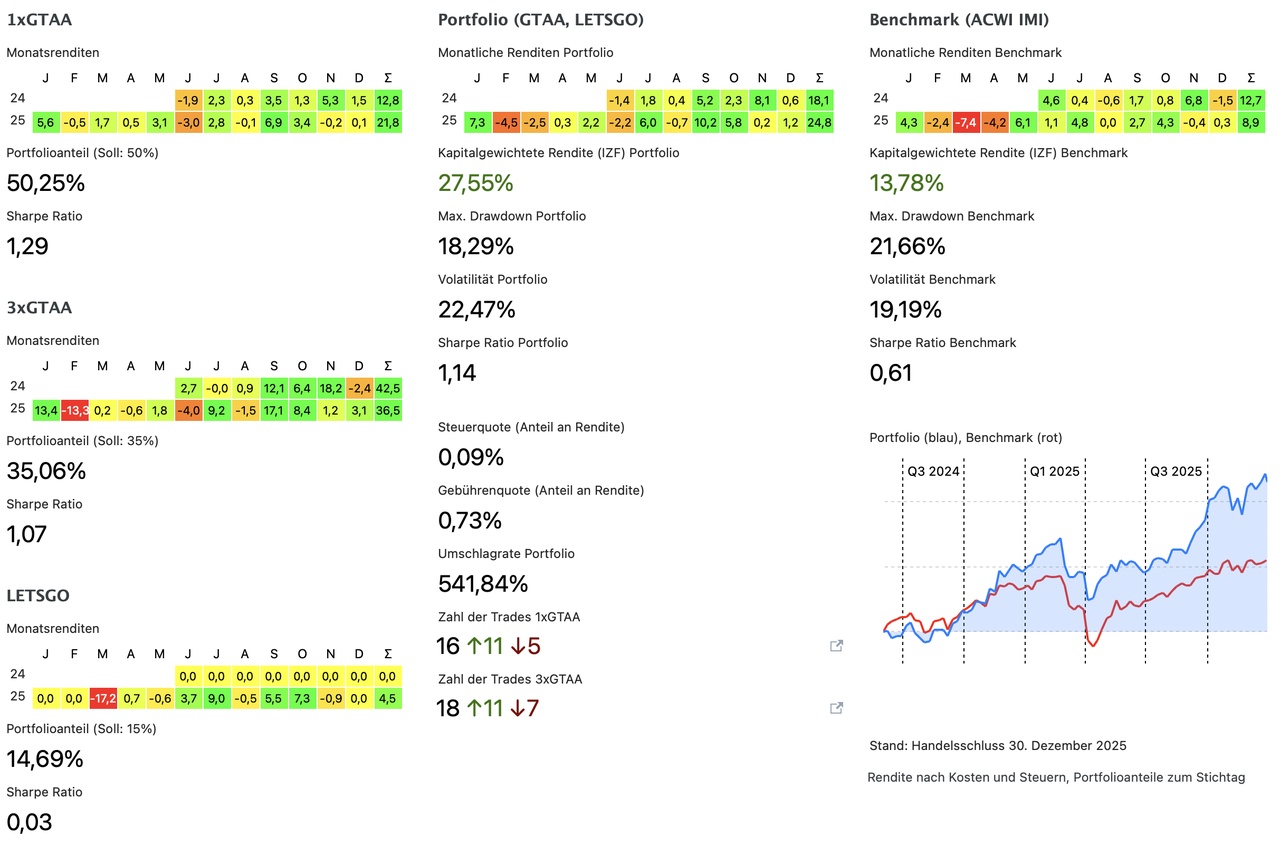

But now to the interaction between the three models: If you know the respective key performance data and their correlation, you can calculate the optimal relationship between the sub-strategies. In short: I opted - rather intuitively in the end - for 50% 1xGTAA, 35% 3xGTAA and 15% SPYTIPS/LETSGO. The result since June 2024 is shown in the following dashboard:

Twice as high performance with the same volatility results in a Sharpe ratio that is twice as high - according to the capital asset pricing model - after all, one of the pillars of modern financial market research - this should not actually exist!

Oh yes: The figure shows the tax and fee ratios. So far, they are negligible because a) I have managed quite well with the tax allowances and the loss offsetting pots with a portfolio size in the mid 5-digit range and b) I basically trade free of charge with smartbroker+. The fees quoted are almost entirely from the storage costs of the $4GLD. (-0,9%) However, as the securities account grows, the previous tax exemption will end next year.

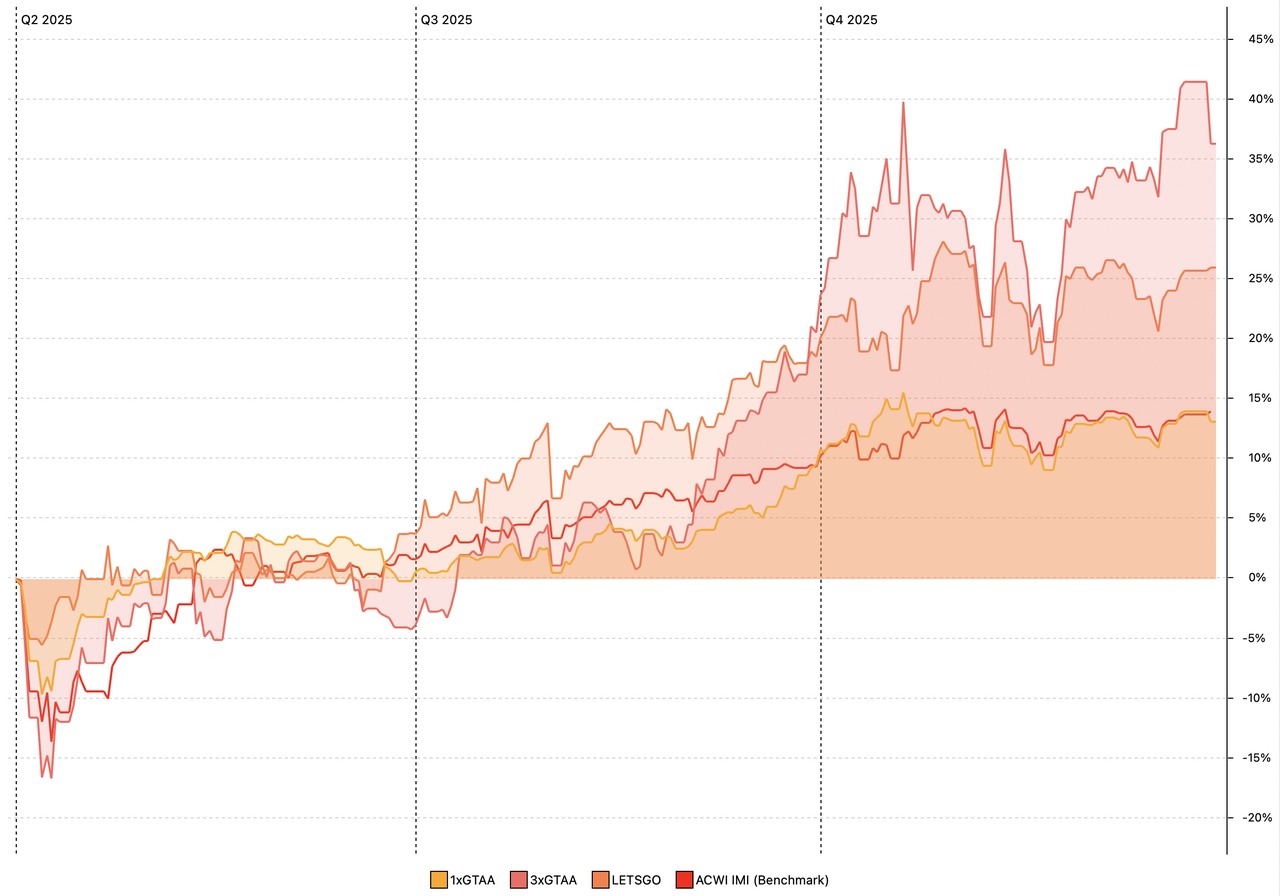

Finally, a further insight into the interaction of the three sub-models since April 2025:

I chose this time period to look at in order to exclude the somewhat atypical dip in SPYTIPS in February. Sure, we only have a small section of a bull market here, but it shows the expected behavior of the three strategies quite well.

I hope to have given some insight into the way I think about strategy development. Maybe it will be a little inspiration for one or the other. I would be delighted!

PS: All screenshots are from Portfolio Performance.