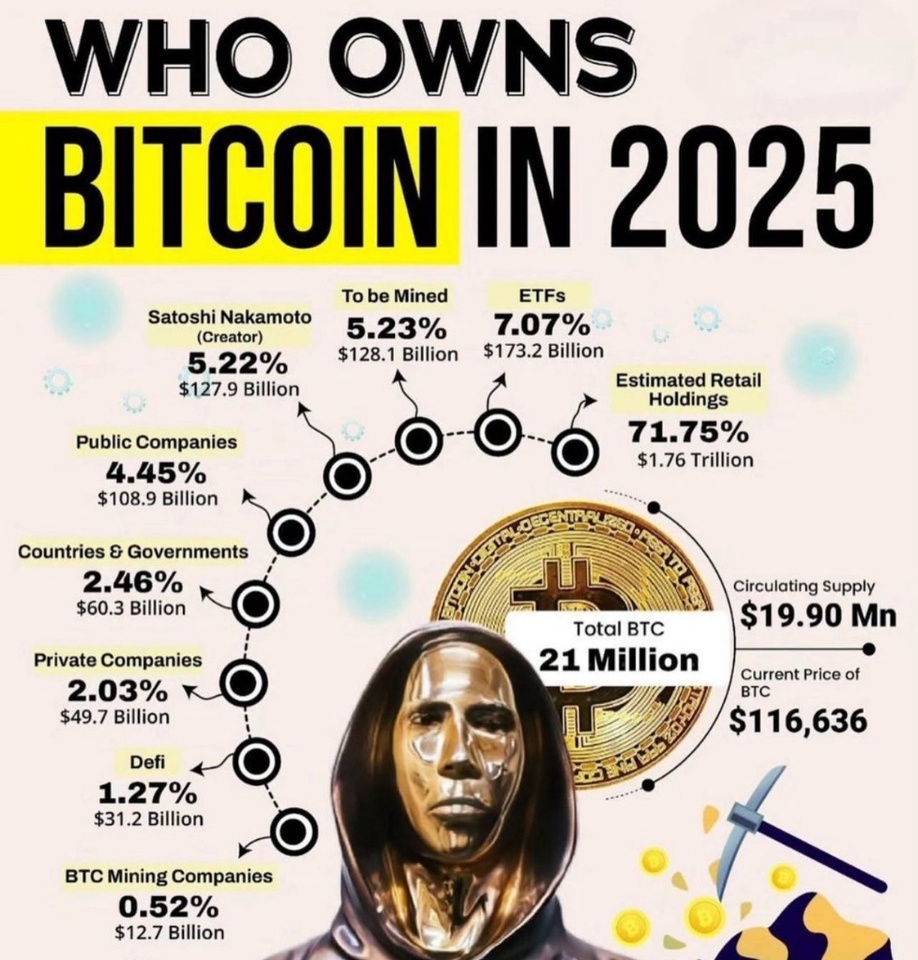

This infographic provides a speculative forecast for the distribution of Bitcoin ($BTC (+1,69%)) ownership by 2025, set against a total supply of 21 million coins and a projected price point of $116,636.

A deeper analysis of these projections, when compared with current market data, reveals several critical trends regarding supply, institutional adoption, and the role of the individual investor.

The Institutional & Corporate Slice

The chart projects a significant institutional and sovereign presence:

ETFs: 7.07% (approx. 1.48M BTC)

Public Companies: 4.45% (approx. 934,500 BTC)

Countries & Governments: 2.46% (approx. 516,600 BTC)

Private Companies: 2.03% (approx. 426,300 BTC)

This combined 16.01% institutional share is an aggressive but plausible continuation of current trends. As of late 2024, global Bitcoin ETFs (led by the US spot ETFs) already hold over 1 million BTC. The projection of 1.48M BTC by 2025 would require sustained, positive inflows.

Similarly, the 4.45% for public companies implies a massive expansion beyond the current dominant holder, MicroStrategy (which holds 214,000+ BTC). This forecast suggests a broader corporate treasury adoption strategy will take hold. The "Countries & Governments" slice (2.46%) is also notable, as it far exceeds the known holdings of El Salvador and must account for large, seized reserves held by entities like the US Government.

The "Retail" Majority: A Question of Definition

The most significant claim is the 71.75% ($1.76 Trillion) share attributed to "Estimated Retail Holdings." This figure suggests that Bitcoin, despite its institutional maturation, remains a fundamentally retail-driven asset.

However, this number warrants scrutiny. "Retail" is notoriously difficult to define. On-chain analytics, which often classify "retail" as addresses holding less than 10 BTC, typically place this figure between 30-40% of the circulating supply.

The 71.75% figure in the chart is likely calculated as a "remainder"—it represents all coins not definitively allocated to the other categories (Institutions, Satoshi, etc.). This means "Retail Holdings" in this context is a broad basket that likely includes:

Individual small holders ("shrimp" and "crabs").

Unidentified "whales" (large private investors).

Vast commingled balances held on exchanges on behalf of millions of retail users.

While the principle of distributed ownership is a core tenet of Bitcoin, the 71.75% figure should be viewed as an estimate of non-institutional supply rather than a precise count of small investors.

The Illiquid & Dormant Supply

Two categories represent a permanent or long-term constraint on liquid supply:

Satoshi Nakamoto (Creator): 5.22% (approx. 1.09M BTC)

To be Mined: 5.23% (approx. 1.1M BTC)

Satoshi's estimated 1.1 million coins have been dormant since their mining in 2009-2010 and are widely presumed to be lost or intentionally locked forever. The "To be Mined" portion represents the remaining supply to be issued via block rewards until the 21 million cap is reached circa 2140.

These two segments combined, representing over 10% of the total supply, are effectively off-market, placing a permanent structural squeeze on the "available" supply for all other participants.

Conclusion

This projection paints a picture of a market in transition. It highlights a "dual-narrative" where Bitcoin is simultaneously experiencing rapid institutional and sovereign adoption while its ownership (for now) remains highly distributed. The primary tension remains locked in its protocol: a fixed, scarce supply of 21 million units competing for an expanding and diversifying base of owners.