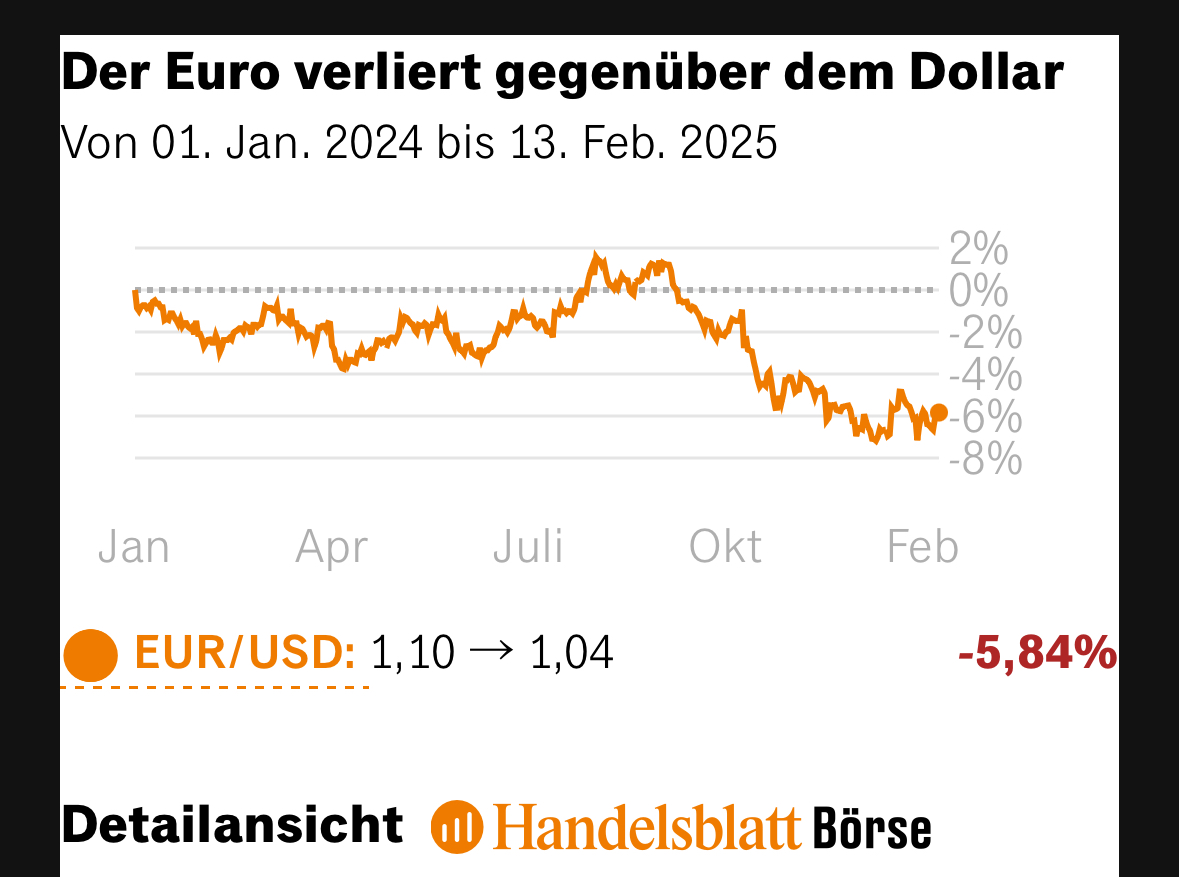

The euro has been weakening since September 2024 and is approaching parity with the dollar - the currency ratio would then be one to one. The dollar is currently still worth around 1.04 euros, up seven cents in the fall.

German companies with strong business in the dollar area can benefit from this development in several ways.

"The strength of the dollar is good news for exporting German companies," comment the analysts at Baader Bank. This is because their products are comparatively cheaper in the USA.

A weak euro makes exports cheaper, making European products and services cheaper and more competitive in the dollar area and thus in large parts of America and Asia. Import duties in the USA would make products more expensive again - but in the end, the two effects could almost balance each other out.

For example, the medical technology group Siemens Healthineers $SHL (+0,08%) is hardly worried about the threat of import duties in the USA. The company shares the fear of a global trade war. However, the company expects that the headwind from tariffs and the tailwind from the stronger dollar will largely balance each other out, says CFO Jochen Schmitz.

The tailwind from the strong dollar could remain with companies for a long time to come. "The euro will become a really weak currency. It should quickly fall below parity with the dollar and be at 0.95 euros per dollar quite quickly," expects the well-known fund manager Jens Ehrhardt, founder and CEO of DJE Kapital.

The European Central Bank (ECB) expects the strength of the dollar to ease the burden on exporting companies in the event of possible import tariffs in the USA. ECB Governing Council member Pierre Wunsch says: "The euro would have to be brought to parity in order to essentially compensate for a tariff of ten percent."

The many companies that produce locally in the USA and sell their goods there also benefit from a strong dollar. This is because the effect on the balance sheet is even stronger as soon as companies convert their earnings generated in the dollar zone into their home currency. For every dollar earned, there are currently seven euro cents more than in the fall.

Companies are already feeling the effects. For example, Infineon $IFX (+0,13%) raised its forecast for the current financial year a few days ago. Previously, the Munich-based semiconductor manufacturer had assumed a slight decline in turnover. The DAX-listed company now expects stable to slightly increasing revenue in 2024.

One reason is the strength of the dollar. Infineon is now assuming a euro-dollar exchange rate of 1.05 euros this year - after previously assuming 1.10 euros. "This adjustment and the better exchange rate in the first quarter increase our revenue expectations by around 450 million euros," calculates Group CEO Jochen Hanebeck.

The estimates show: The biggest currency beneficiaries of a weaker euro are highly globalized companies with strong business in the dollar area. In addition to Infineon, these include $BAYN (+0,08%) Bayer with its strong US business and the DAX heavyweight Airbus $AIR (+0,04%). The European joint venture mainly builds aircraft in Germany and France, but they are sold worldwide at dollar prices.

Rheinmetall $RHM (+0,34%) also benefits: Armaments are usually invoiced in dollars, but the Düsseldorf-based group reports them in euros, which results in higher revenues from the conversion alone.

There are also profiteers in the financial sector. Deutsche Bank $DBK (+0,17%) CFO James von Moltke hinted at the outlook for 2025: There is potential for higher Group revenues than the 32 billion euros targeted so far, he said. So far, the bank has been planning with an exchange rate of 1.10 dollars per euro - i.e. a euro that is more than five cents stronger than it is currently worth. However, as Deutsche Bank has more income in dollars than costs in dollars and does not hedge this currency risk, it benefits from a weak euro, according to Moltke.

The weak euro also helps the automotive industry. Many luxury vehicles are produced in Germany, but sold worldwide, especially in the USA. Porsche $P911 (+0,05%) sells every fourth car there - but does not produce a single one.

"This will have a positive impact of several hundred million euros on Porsche's balance sheet," says a Frankfurt stock trader with a view to this year's results. However, US tariffs on imports of European cars could offset this positive effect.

Source & graphic: Handelsblatt