Good morning everyone,

Can someone explain the difference to me?

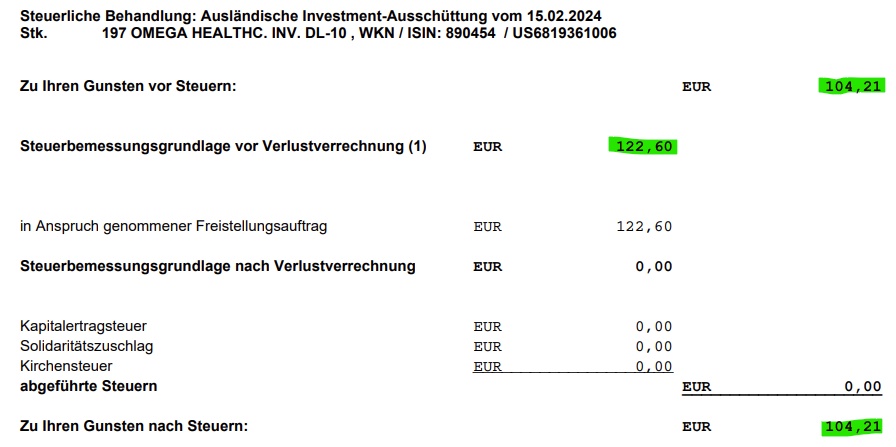

I don't understand why something is deducted from the €122.60 so that I'm only left with €104.21.

In this case, we are talking about dividends of $OHI (-0,92%) . But the same thing also occurs with $PG (+0,45%) , etc.

I look forward to help and clarification :)