Hello my dears,

because Christmas is coming soon I also have the wish of dear @All-in-or-nothing, for a screening of IMAX $IMAX (+1,7%) fulfilled.

I did this, among other things, because the love for my posts almost always gives a👍. And now also comes out of the woodwork and comments.

That means a lot to me and is praise for the artist.

IMAX is a company that I didn't have on my radar.

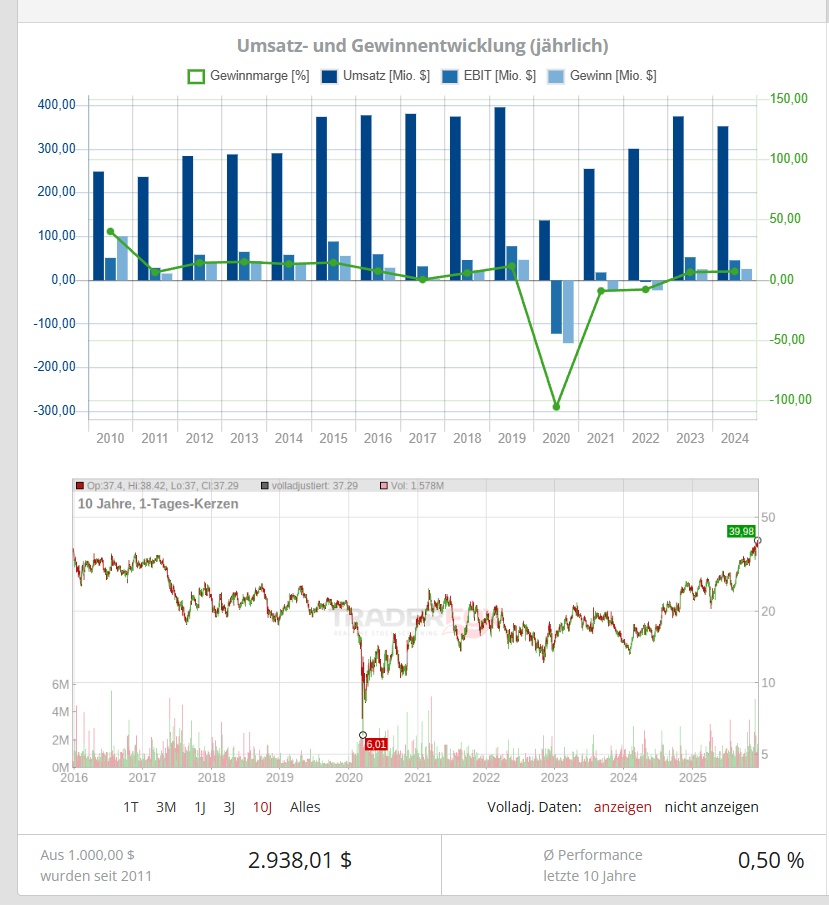

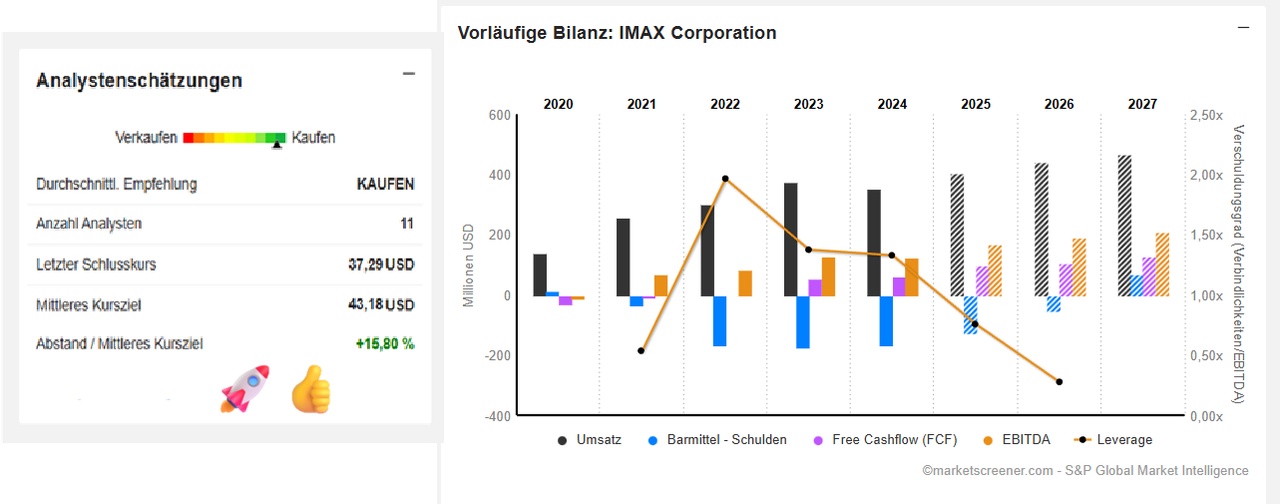

You can see from the key figures that I have added some data from the history.

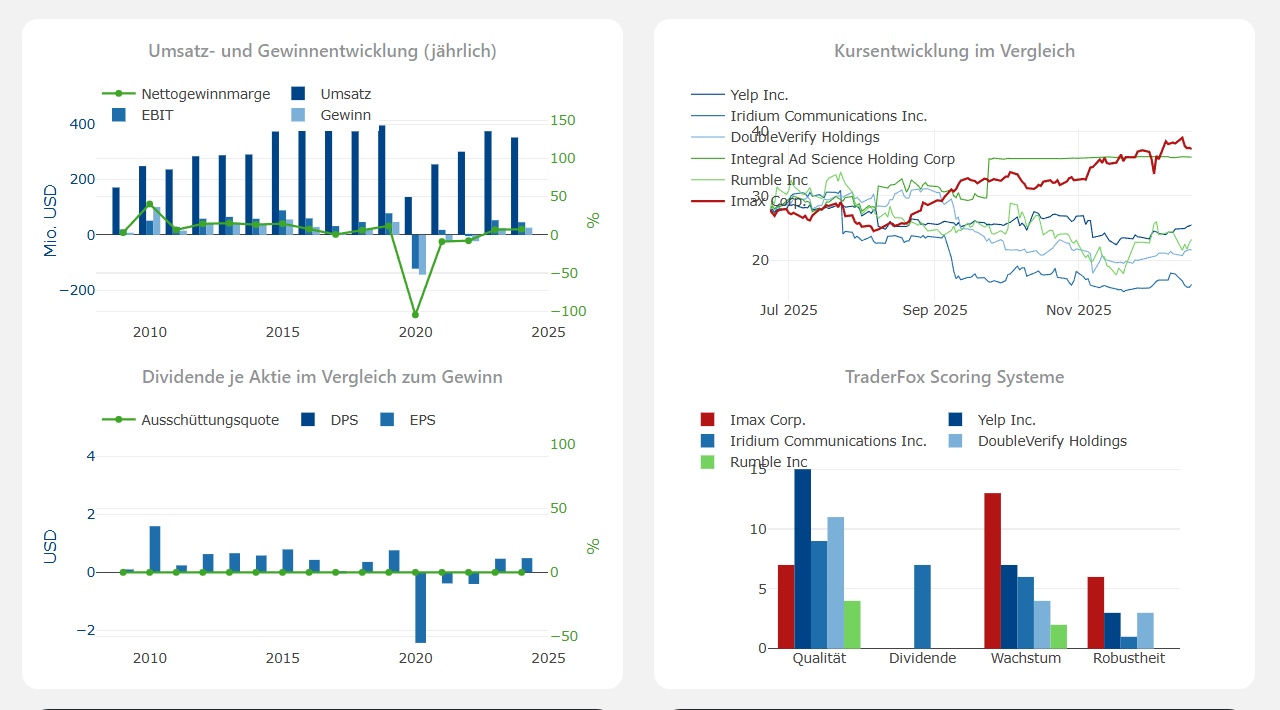

Here you can see how the company has fought its way back to profitability after the pandemic. Which you can also see from the graph.

But you can also see from the graph that the company is just about to reach its pre-pandemic level.

It's also nice to see how growth is reflected in the chart.

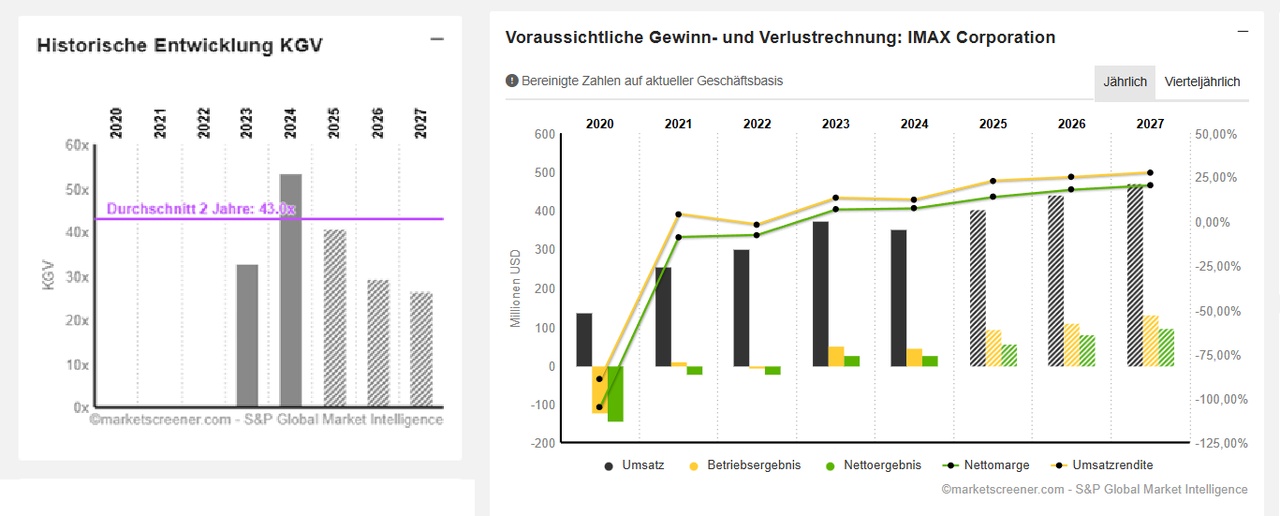

If I had any concerns about IMAX, it would be how the share price is now developing after the very successful year 2025.

Growth will continue, but no longer at this high level.

The already good EBIT margin can also be increased further, but we are already seeing a decline in ROE.

Even if the CEO tries to refute this in an interview below.

The big question is how will investors react?

The analysts' view remains POSITIVE.

Expansion is continuing and IMAX is growing. But will it be possible to continue to inspire and maintain or increase box office results?

In addition, new technologies and augmented reality is conquering the mass market.

Do you see a danger for IMAX here and what do you think of an investment in IMAX?

@All-in-or-nothing I'm sure you'll be very happy to hear your opinions in the comments.

IMAX: From Hollywood to Tokyo! IMAX is growing thanks to blockbuster power and global expansion!

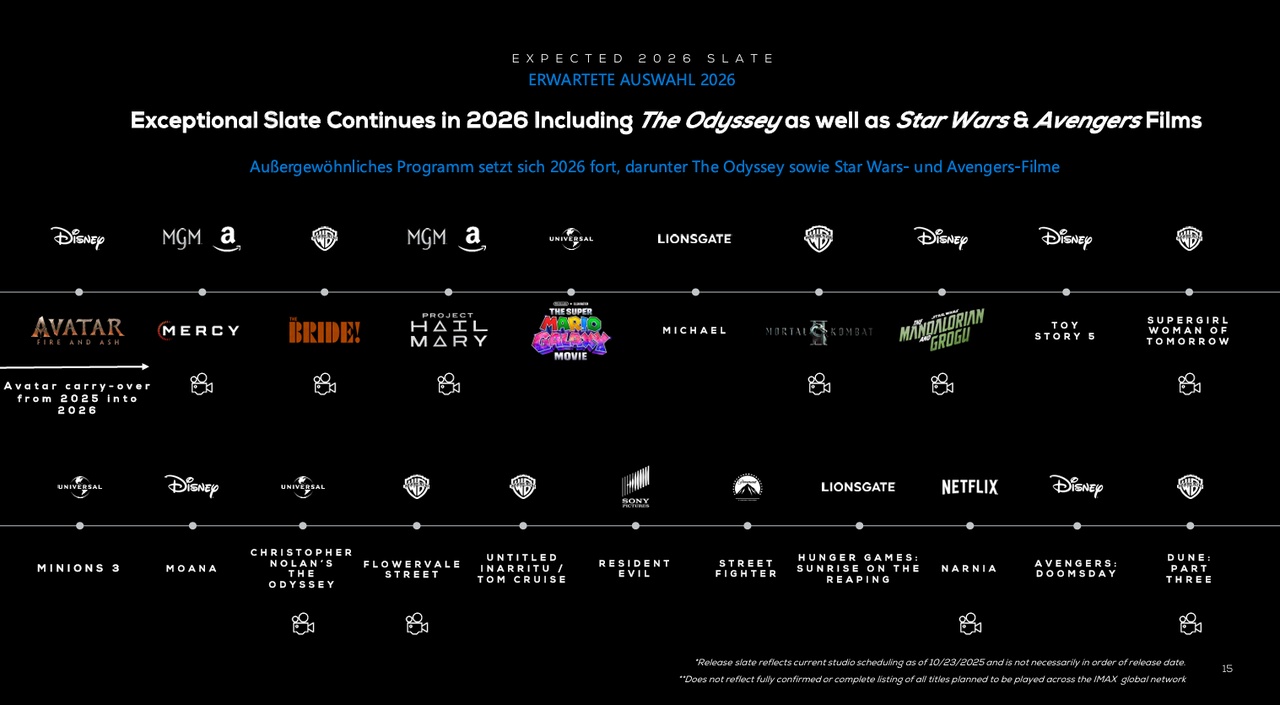

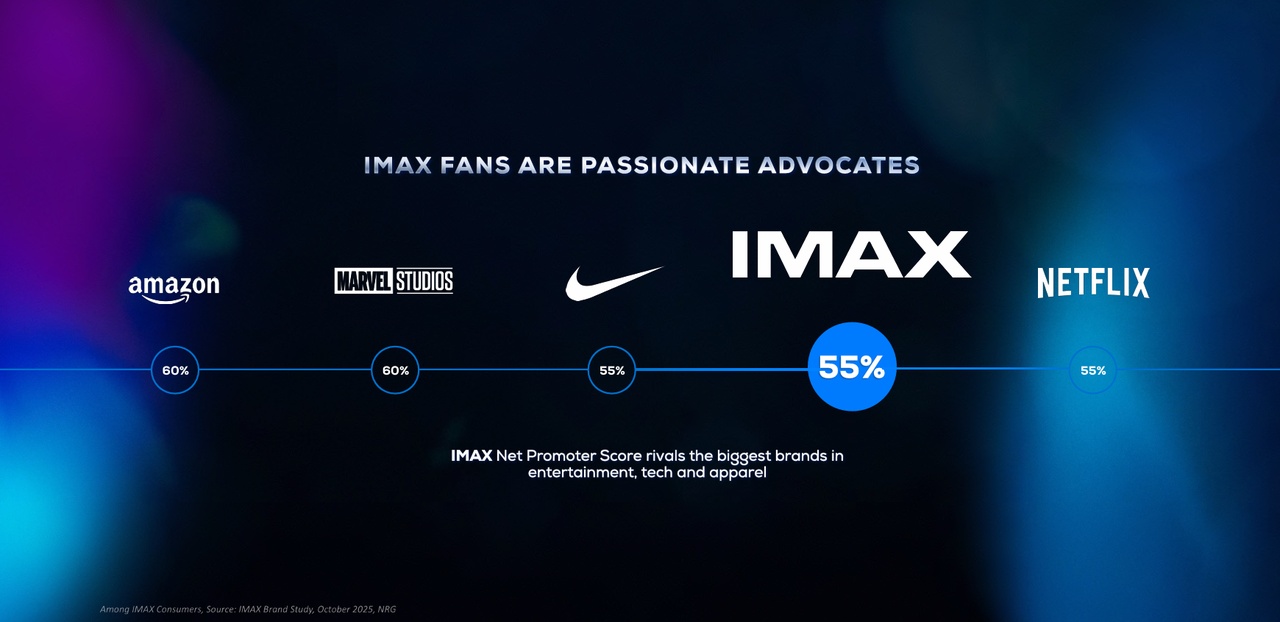

The "Communication Services" sector has been the undisputed number 1 in our ranking for weeks. For this reason, we take a closer look at the "Entertainment" sector. IMAX in particular stood out with an increase of almost 18 % in one month. What makes the company so unique? IMAX brings a unique cinema experience to screens around the world International expansion to Poland and Australia through partnerships Packed cinema program 2025/26 to generate further profits Imax Corp (IMAX).

Hollywood's cinema comeback is giving the premium movie theater provider IMAX a dream phase. While blockbusters such as "Superman" are breaking records, the company is expanding massively and exceeding the expectations of Wall Street analysts. But can the boom continue?

Cinema boom fuels share price rally

The recent rise of almost 8 percent within a week is no coincidence: IMAX is benefiting more than almost any other company from the return of audiences to the cinemas. The DC film "Superman" grossed over 30 million US dollars in IMAX cinemas worldwide alone and achieved a record market share for films with an opening of over 100 million dollars in North America. This performance underlines why studios are increasingly producing their blockbusters specifically for the premium format.

Expansion offensive in full swing

IMAX is using the momentum for aggressive expansion. This year alone, 130 new or modernized systems have already been agreed - as many as in the entire previous year. A particular coup: the partnership with Apple Cinemas is being doubled, with five new laser systems in the USA and a return to Philadelphia from 2026. These strategic moves are consolidating the company's market leadership in premium film distribution.

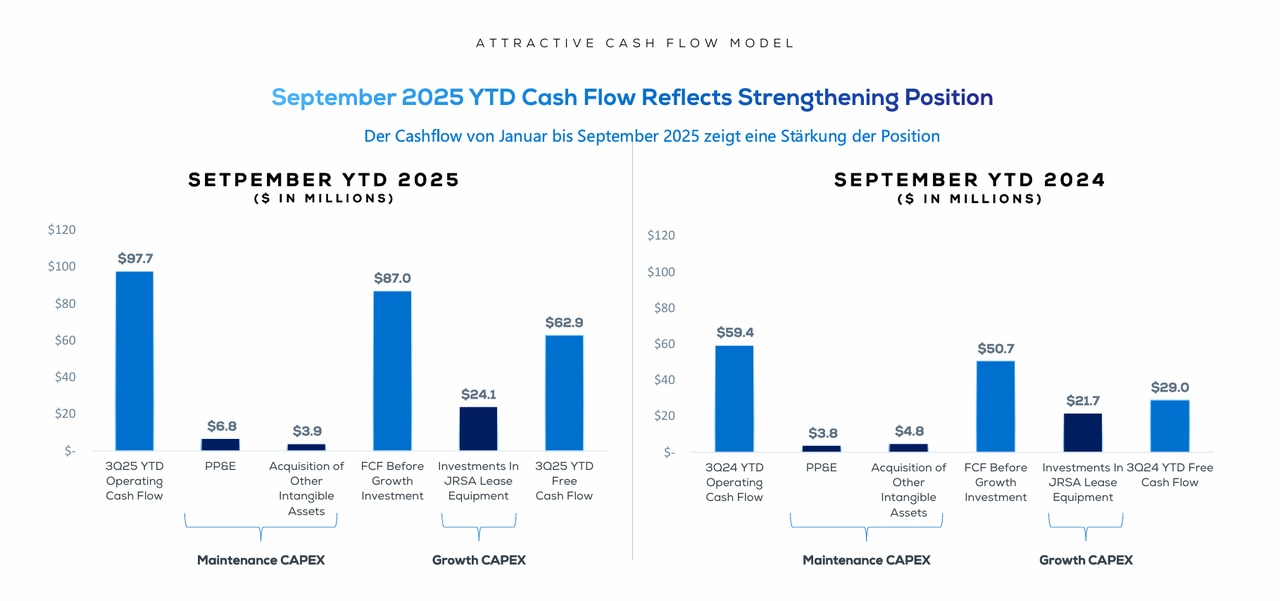

Financial firepower for further growth

The recent increase in the credit line from 300 to 375 million dollars - with an option for up to 515 million - gives IMAX additional scope for investment. The timing could hardly be better: The global box office already stands at 240 million dollars and is heading towards surpassing Q3 estimates of 286 million.

Benchmark analysts are impressed, pointing to a "record Q4 agenda" and "unprecedented studio support" into 2026. While some institutional investors such as Nishkama Capital reduced their positions, others such as Jane Street Group massively increased their stakes - a sign of the stock's dynamic appeal.

The key question remains: Can IMAX maintain this momentum beyond the current blockbuster season?

- IMAX expects 2025 to be a record year with projected box office revenues of 1.2 billion dollars.

- The company recorded growth in profits despite a decline in revenue.

IMAX's shares have recently seen a significant rise in price as expectations for a record year in 2025 increased following the publication of quarterly figures. Despite a decline in revenues compared to the demanding 'Oppenheimer' benchmarks, the company reported growth in profits. IMAX CEO Richard Gelfond spoke with Catalysts hosts Julie Hyman and Brad Smith about the results and the company's future plans.

In an interview with Yahoo Finance, Gelfond explained that 2025 could be a turning point for IMAX. During the current earnings call, the company announced forecasts for box office revenue of around 1.2 billion dollars, with the business environment remaining very positive. Following successful films such as 'Oppenheimer' and the recent release of 'Dune' (Part Two), IMAX continues to enjoy great popularity as a premium moviegoing experience, with growth in several areas.

Gelfond calmly dismissed concerns about a decline in IMAX's annual revenue, noting that comparisons to last year's exceptionally successful performance were somewhat blinding. Nevertheless, the past quarter was strong.

IMAX's traditional image as the home of superhero spectacles and sci-fi extravaganzas is undergoing a fascinating transformation. Das jüngste weltweite Wochenende mit einem Preisgeld von 12,5 Millionen US-DollarThe image of "Mufasa: The Lion King" from The Walt Disney Studios and "Nosferatu" Focus Features shows how IMAX is now successfully moving beyond its action-heavy roots to encompass a more diverse range of cinemas. Premium large formats aside, this is good news for the cinema industry as a whole.

Consider this intriguing juxtaposition: a family-oriented animated film and an arthouse horror film sharing supremacy in the premium large format. "Mufasa" scored an impressive $8 million worldwide weekend with a drop of just 4%, while Robert Eggers' gothic film "Nosferatu" grossed $1.7 million domestically. This isn't just counter-programming; it's a strategic repositioning of what constitutes "IMAX-worthy" entertainment.

The ecosystem is becoming more diverse, especially when we look beyond Hollywood. In Asia, we see how Wanda Medias faszinierend betitelter Kriminalthriller "Octopus with the Broken Arms" 1.6 million US dollars on Chinese IMAX screens, while the South Korean biographical historical drama (!) "Harbin" grossed 630,000 US dollars in just 27 locations. Only in India was a more traditional IMAX-artiger Actionthriller "Pushpa 2: The Rule" gedreht, that pushed the "Interstellar re-release" off the biggest screens. The upcoming Hollywood series further emphasizes this diversity, with James Mangold's Bob Dylan biopic "A Complete Unknown" starring Timothée Chalamet. This is followed by the romantic psychological thriller "Companion" by Warner Bros. Entertainment and New Line Cinema .

This change reflects a maturing understanding of premium cinema. While IMAX built its brand on the promise of grandeur and spectacle, it now recognizes that immersion is not just about action sequences and visual effects. Horror benefits hugely from the format's ability to create an overwhelming atmosphere, as "Nosferatu" demonstrates. The rich detail of the animation and the carefully crafted worlds take on a new dimension on the bigger screen. Even intimate dramas can use the superior sound and picture quality of IMAX to heighten the emotional impact. It's worth remembering that last year's IMAX favorite "Oppenheimer" contained only one big explosion and instead was mostly about middle-aged white men talking to each other in rooms.

What's particularly interesting is how this diversification seems to be broadening the audience base rather than dividing it. The strong performance of "Mufasa" and "Nosferatu" suggests that IMAX has successfully positioned itself as a premium viewing experience for discerning audiences of all genres. This is also evidenced by the re-release of Fincher's "Se7en", suggesting that the format can also enhance classic cinema experiences, in addition to Nolan's successful "Interstellar", which zur größten IMAX-Wiederveröffentlichung aller Zeiten wurde.

The financial impact is significant. By freeing itself from reliance on traditional blockbuster windows, IMAX can maintain stronger year-round occupancy and attract demographics that may have previously viewed the format as something only for action enthusiasts. This strategy also provides valuable differentiation at a time when streaming platforms continue to play hot and cold when it comes to getting their films into theaters.

For theater operators and studios alike, this development represents an opportunity to reshape the premium cinema offering. It's no longer just about being bigger - it's about offering the definitive version of every cinematic experience, regardless of genre or even whether it's a new or old movie. This could prove particularly valuable for mid-budget films looking to maximize their theatrical potential in a difficult market.

Looking to the future, this trend suggests that IMAX will successfully transition from a specialty format to a hallmark for premium cinema presentations across all genres. The question now is not whether a movie will fit into the traditional IMAX form, but rather how the format can enhance the specific narrative qualities of each release. An important test will be the upcoming release of Golden Globe winner and heiß gehandelten Oscar-Favoriten "The Brutalist" of A24 which will have a very strategic IMAX rollout: Large Format Cinema Meets Long Format Arthouse.

At a time when movie screenings still face several challenges, the genre diversification of IMAX could prove to be one of the industry's most forward-thinking strategic moves.

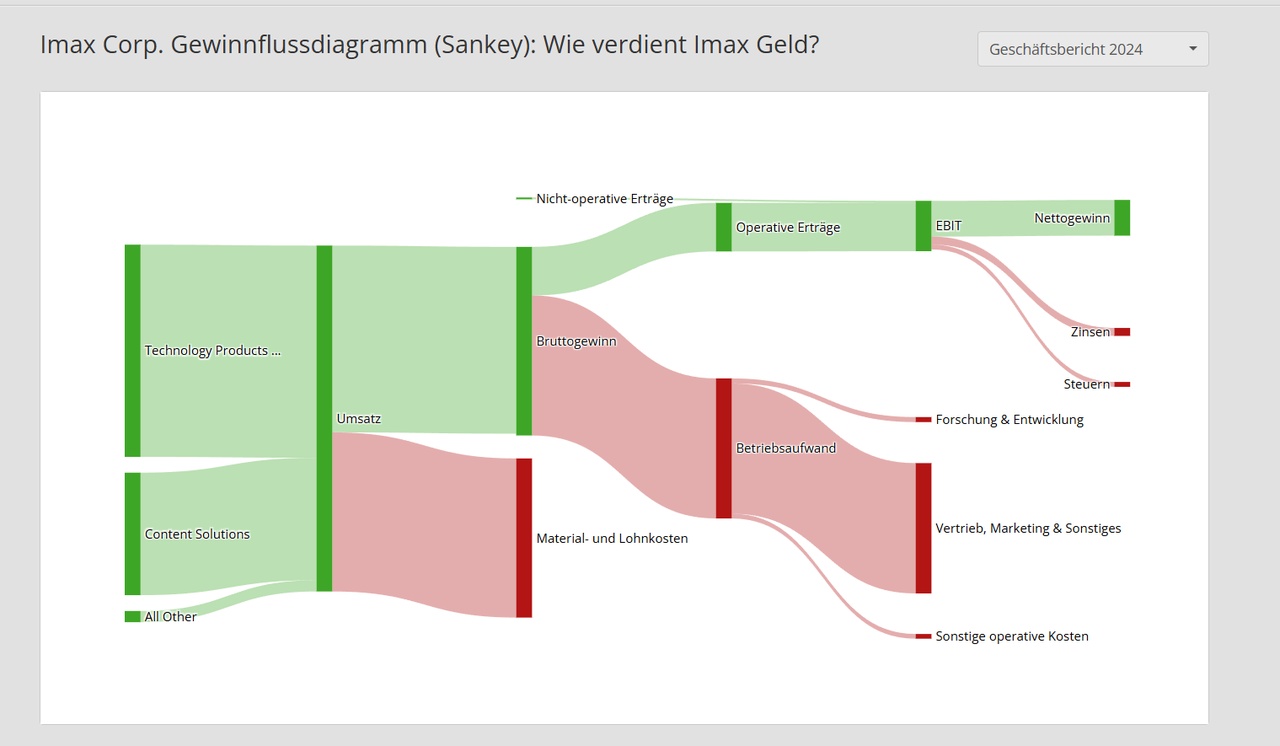

Imax Corporation is one of the world's leading technology platforms for entertainment and events. With its proprietary software, auditorium, architecture, patented intellectual property and specialized equipment, the company provides an end-to-end solution for creating content experiences. The company operates in two segments: Content Solutions and Technology Products and Services. The Content Solutions segment primarily includes content preparation and distribution services. This segment also includes the distribution of large-format documentaries and exclusive experiences ranging from live performances to interactive events with artists and creatives, as well as post-production services for films. The Technology Products and Services segment mainly comprises the sale, rental and maintenance of IMAX systems. This segment is also involved in certain complementary business activities for cinemas, including the sale of IMAX system parts and three-dimensional (3D) glasses after sales.

Number of employees: 700

IMAX celebrates at the global box office with a record Thanksgiving weekend of 40.8 million dollars

December 1, 2025

IMAX price target raised as Investor Day boosts analyst optimism

Published: 13:22 08 Dec 2025 EST

IMAX Corp (NYSE:IMAX) received a price target increase from Wedbush analysts following Investor Day 2025, with the company raising its price target to $46 from $39 and maintaining an 'Outperform' rating.

IMAX shares rose more than 8% after the event and were trading at around $38 early Monday afternoon.

Wedbush highlighted several factors supporting the outlook for IMAX, including a projected increase in volume and quality of titles filmed for IMAX (FFI) from 2026 to 2028, which analysts said "should drive greater market share gains."

The company also pointed out that IMAX's global box office is increasingly reliant on a mix of local language and international releases, and that alternative content offerings are expected to drive revenue.

The expansion of the company's global footprint further underpins Wedbush's positive outlook. "IMAX remains on Wedbush's list of best ideas," they wrote. "Driven by these factors, IMAX is poised to exceed 50% EBITDA margins by 2028."

They also emphasized that the company's premium valuation "is reasonable given the trifecta of FFI's 2026 titles across geographies, global footprint and margin expansion."

During the investor day, IMAX provided guidance for 2026, forecasting a worldwide box office on IMAX screens of approximately $1.4 billion, an increase of approximately 12% year-over-year. Wedbush noted that this exceeded both the previous estimate of $1.31 billion and consensus expectations of $1.34 billion.

System installations are expected to increase 8% year-over-year to between 160 and 175, which is above Wedbush's 5% estimate and the consensus median of 4%.

Adjusted EBITDA margins were forecast in the mid-40% range, compared to Wedbush's previous estimate of 46.1% and consensus of 40.7%.

Wedbush highlighted the company's strategy to create a "virtuous cycle" in which additional FFI and alternative content drives value from IMAX screens to theaters.

"This confluence of revenue growth drivers can easily lead IMAX to achieve its target of high single-digit to low double-digit revenue growth by 2028, while growing margins should help IMAX achieve its new 2028 target of over 50% adjusted EBITDA margin," the analysts wrote.

IMAX's next near-term catalyst is the Dec. 19 release of Avatar: Fire and Ash, which Wedbush noted could further help both box office and revenue growth.

Tiziana Life Sciences begins dosing in Phase 2 Alzheimer’s trial - ICYMI

Shareholders: IMAX Corporation

Name Shares % Valuation

Kevin Douglas 7,584,080 14.1 % 281 million $

Orbis Investment Management Ltd. 5,241,883 9.743 % 194 million $

Macquarie Investment Management

Business Trust 4,657,865 8.658 % 173 m $

Fidelity Management & Research 4,143,882 7.703 % $154 million

BlackRock Advisors LLC 2,316,439 4.306 % $86 million

Liste der Aktionäre von IMAX CORPORATION

Company ownership: IMAX Corporation

Name Shares % Valuation

IMAX CHINA HOLDING, INC. 243.262.600 71,72 % 252.460.359 $

USD in millions

Estimates

Year

Turnover

Change in

2024 352,2 - 6,04 %

2025 404,5 14,85 %

2026 440,6 8,92 %

2027 469,4 6,55 %

Year

EBIT

Change in

2024 43,86 -12,97 %

2025 93,53 113,23 %

2026 110,8 18,49 %

2027 130,5 17,74 %

Year

Net result

Change in

2024 26,06 2,86 %

2025 55,93 114,64 %

2026 79,14 41,49 %

2027 96,06 21,38 %

Year

Net debt

CAPEX

2024 166 8,428

2025 127 10,66

2026 52,4 11,13

2027 -67 11,83

Year

Free cash flow

Change in

2024 62,41 19,73 %

2025 98,87 58,42 %

2026 105 6,16 %

2027 126,7 20,71 %

Year

EBIT margin

ROE

2022 -1,61 % 1,04 %

2023 13,45 % 19,41 %

2024 12,45 % 17,82 %

2025 23,12 % 21,13 %

2026 25,15 % 19,31 %

2027 27,8 % 16,62 %

Year

Earnings per share

Change in

2024 0,48 4,35 %

2025 0,9171 91,07 %

2026 1,267 38,16 %

2027 1,406 10,96 %

Year

P/E RATIO

PEG

2022 -36.7x -6.97x

2023 32.7x -0x

2024 53.3x 12.26x

2025 40.7x 0.4x

2026 29.4x 0.8x

2027 26.5x 2.4x

Market value 2,006

No. of shares (in thousands) 53,799

TOEI Animation $4816 P/E ratio 24.92x (alternative)

INVESTORDAY

2deeaba6-3c3c-400f-9be7-205f80ec73cb

INVESTOR PRESENTATION

IMAX Commercial Locations

2010 396

2025 1759

SELECT UNDERPENETRATED MARKETS

Country OPEN ZONES PENETRATION

INDIA 100 23%

JAPAN 81 39%

UK & IRELAND 65 42%

SOUTH KOREA 63 29%

AUSTRALIA 61 11%

GERMANY 57 15%

FRANCE 57 30%

MEXICO 50 27%

BRAZIL 42 22%

INDONESIA 39 30%

Box office results

November 30, 2025 YTD

Domestic box office

404 million dollars

Rest of the world box office

362 million dollars

Greater China box office

363 million dollars

Global (including booking fee in China)

1129 million dollars

Global (excluding booking fee in China)

1095 million dollars