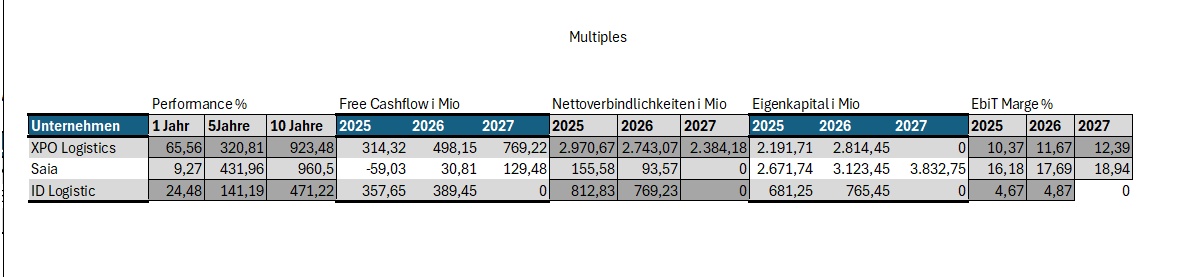

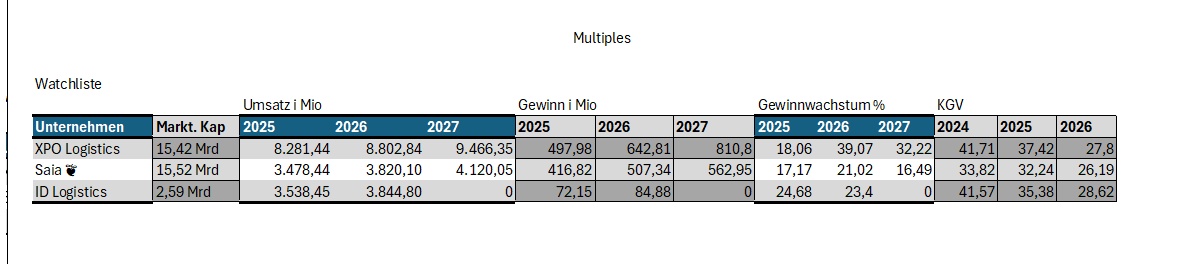

now at the request of @Max095 still with $IDL (-0,78%)

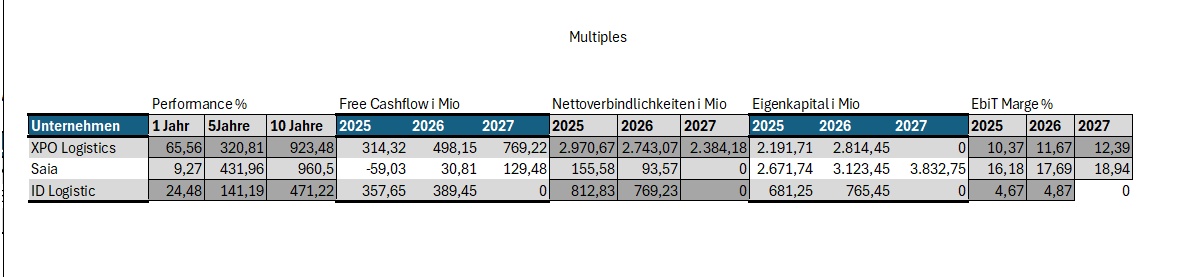

What immediately strikes me as negative is that ID makes a significantly lower profit with similar sales to Saia. This fact is reflected in the low EbiT margin of 4.67%.

now at the request of @Max095 still with $IDL (-0,78%)

What immediately strikes me as negative is that ID makes a significantly lower profit with similar sales to Saia. This fact is reflected in the low EbiT margin of 4.67%.

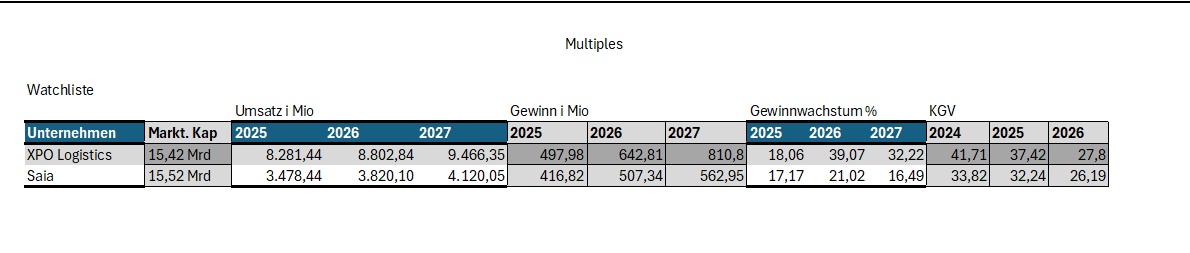

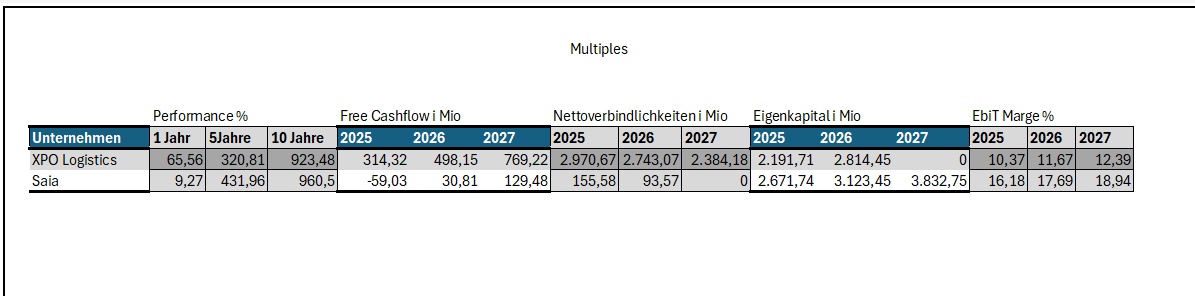

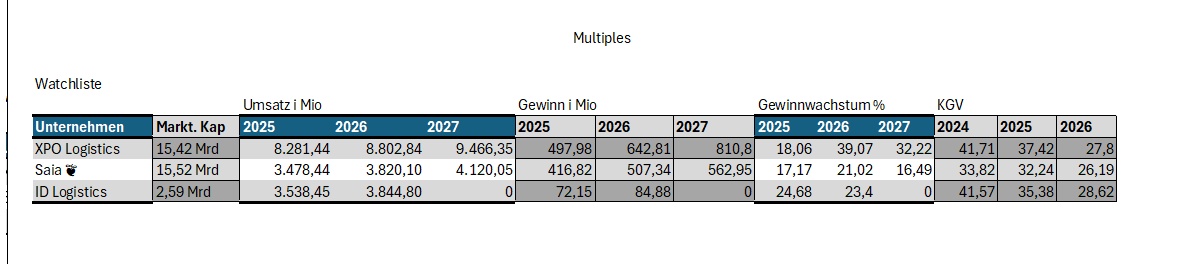

for the dear @Max095 the logistics company $XPO (-1,42%) and $SAIA (-0,34%) in comparison.

I really like the profit growth of XPO over the next few years. I also like the better free cash flow.

Saia impresses with a better EbiT margin, but both companies can increase this.

However, I think both companies are interesting.