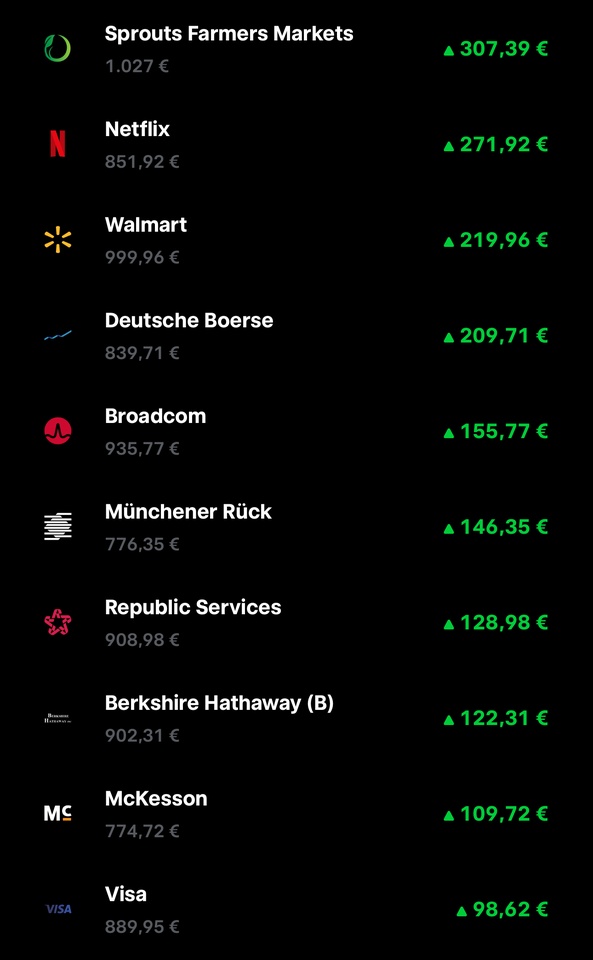

Tops

Still at the top 🥇Sprouts Farmers$SFM (-0,24%) which are stable 📈 followed by 🥈Netflix $NFLX (+0,15%) which has fought its way up to second place despite all the market turbulence.

Walmart $WMT (+0,38%) who have always been in the top 3 since I started covering the position.

Unlike the country 🇩🇪 where it feels 📉. Things are looking surprisingly good on the stock market for 🇩🇪 shares $DB1 (-0,33%) & $MUV2 (-0,37%) in the top 10 💪😊

Surprisingly, there is no sign of Magnificent 7 far and wide 😂 although $TSLA (+0,5%) is no longer represented in the "ETF".

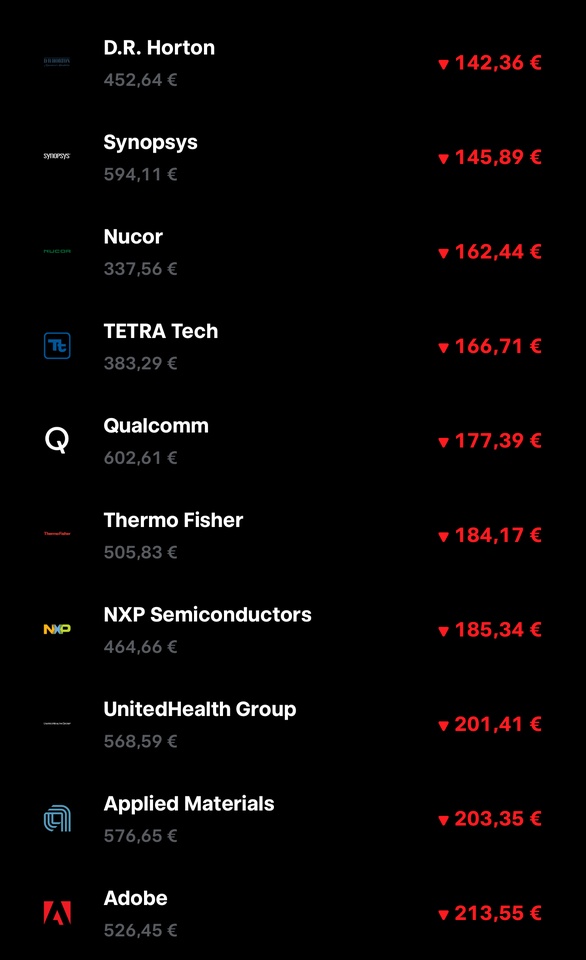

Flops

Although Adobe$ADBE (-0,03%) actually has good figures, the position has not really gotten off the ground since I started holding it, worse still, so far it has brought me the most losses, although it does not pay a dividend 😂

Of course the savings plans are still running this month, but not all positions.

The winners are still running, some of the losers have been paused for the time being and only the flops are still running. $QCOM (+0,65%)

$AMAT (+0,07%) continue.