The recent fall in the Bitcoin price has been fueled not least by the fact that early adopters have sold large quantities of coins from long-term storage. The revived supply of coins that are more than six months old has already reached new highs and exceeded the 500 billion dollar mark for the first time. Coins in even older supply groups have also been moved in unprecedented dollar-denominated volumes, with the revived supply of coins more than three years old already surpassing the 150 billion dollar mark by the end of November.

A simple and intuitive way to recognize whether older coins are being moved in large quantities is to look at the metric Bitcoin Days Destroyed. It adds up the daily product of the number of coins moved and the number of days they have remained unchanged since their last movement. In other words: If 1000 #bitcoin are moved after standing still for 1000 days, one million Bitcoin Days are "destroyed".

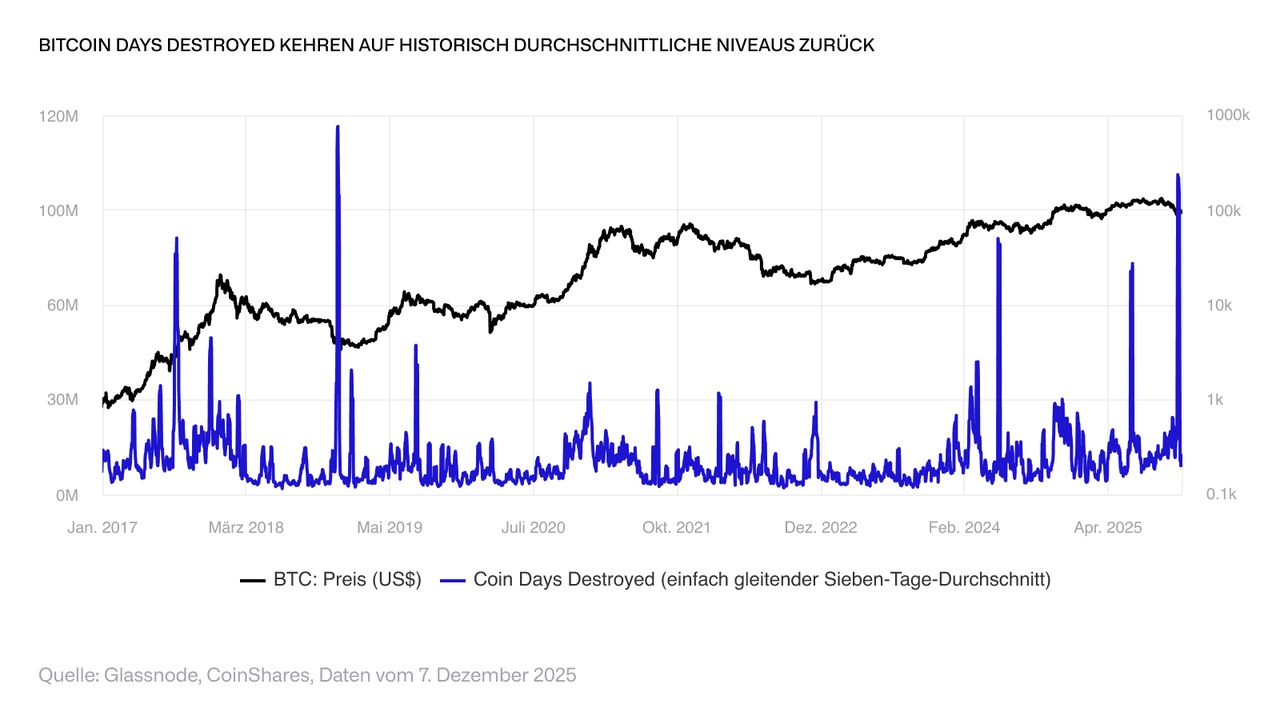

Since 2017, the daily average of destroyed coin days has been slightly less than twelve million. However, during periods of high market volatility, it is not uncommon for the metric to rise to over 30 million or even higher as early adopters with large holdings dump sizable stashes of coins.

During the recent sell-off, destroyed coin days skyrocketed to over one hundred million - the second highest figure since 2017 - indicating significant selling pressure from early adopters that had a strong impact on the market. The figure has since fallen back to historically more normal levels; in the first week of December, the average was around twelve million per day. At this level, the amount of old coins coming onto the market is roughly in line with the more recent historical average. This reduces the recent excess selling pressure and a more balanced market is emerging in the short term.