Recently I had the pleasure of $MBR (+0,57%) introduce to you.

Today I would like to report on an important topic in this regard:

What it's about 🚯💸

From 2015 - 2020, the Marshal of the Lower Silesian Voivodeship issued an increased fee against mobruk for unlawful storage or late removal of waste.

However, mobruk disputes these and took legal action against all decisions, as they consider these decisions to be excessive or incorrect.

What is the legal process? 👨🏼⚖️

Decisions that have been issued are first reviewed by the SKO (a regional self-governing chamber for appeals) before going to the next instance in the event of an appeal: the WSA (Voivodeship Administrative Court). This is comparable to our courts at provincial level.

The last instance is the NSA (Supreme Administrative Court of Poland).

What is the current status of these proceedings?

In the last press release, Mobruk reported on the status of the respective proceedings. https://mobruk.pl/wyrok-nsa-w-sprawie-oplat-podwyzszonych/

2015

The NSA dismissed Mobruk's claim and ordered Mobruk to pay the ~ PLN 5.8 million/ € 1.4 million. The amount was already secured, but Mobruk must pay an additional PLN 1.9 million/ € 0.45 million for accrued interest.

2016

The claim for the increased fees in the amount of ~ PLN 17.5 million/ € 4.12 million expired due to negligence.

2017

NSA dismissed the SKO's appeal against the WSA's ruling. Mobruk had previously paid the requested sum as a precautionary measure, which will now be returned to the company in the amount of PLN 29.4 million/€ 6.92 million.

This sum will now be secured as a precautionary measure for the 2018/2019 proceedings.

2018

The SKO issued a decision on the increased fees, which now amount to ~ PLN 38m/ € 9m. PLN 2.7m/ € 0.64m has already been seized. Outstanding plus interest is now ~ PLN45.6m/ €10.7m. An appeal was lodged with the WSA in January.

2019

In its decision in May, the SKO charged fees plus interest in the amount of PLN 16.6 million/€ 3.9 million. An appeal was also lodged in June.

2020

In the SKO's decisions for 2018 and 2019, the SKO refers to a calculation basis that can be made until March 19, 2019 at the latest. This virtually eliminates the risk for later periods.

What are the effects?

Mobruk has now decided to pay the outstanding amounts plus interest for the 2018 and 2019 proceedings in the amount of ~ PLN 62.1 million/€ 14.6 million subject to reimbursement. These are to be settled using the funds from the 2017 proceedings (PLN 29.4 million/€6.92 million) and own funds (PLN 32.7 million/€7.69 million) and written off in Q3.

By paying the outstanding balances, Mobruk eliminates the risk of being excluded from tenders.

Quote from CEO Hendryk Siodmok 🗣️

"Despite the fact that the company will continue to assert its rights in relation to fees for 2018 and 2019 and will await the SKO decision for 2017, we are pleased that we have managed to reduce the total financial risk from around PLN 268 million to around PLN 58 million. This reduced the risks for investors and strengthened the company's financial credibility in the eyes of the market and financial institutions. The dismissal of the cassation complaint for 2017 by the NSA is beneficial for the company, and our decision to voluntarily pay the above amounts for 2018 and 2019 has no impact on the company's current operations, and the liquidity situation remains stable. The company also secured funds for the payment of dividends from the profit for 2024 in the amount of PLN 46.3 million, which are planned for October 30 this year. We focus on operational activities and full use of the potential of modernized facilities. At the same time, we are working to maximize the synergies resulting from the acquisitions made."

Opinion:

In my opinion, these increased fees highlight one of the most fundamental causes of Poland's waste problems. While the country is drowning in illegal dumping, the legal dumps are, quite rightly, massively controlled. These expensive fines and fees make legal disposal more expensive and illegal disposal all the more attractive.

The 2017 decision gives hope for the ongoing cases.

By settling the open cases, the risk of being excluded from public tenders has now also been eliminated. (e.g. for ecological bombs)

Regardless of the outcome of these proceedings, all risk would now be reflected in the balance sheet and the cases could be shelved.

As a result of this additional write-down, I expect that the net margin could fall to as low as 13% this year. This would further reduce the net margin, which was still at 50% in Corona times. ...However, due to a one-off effect and, of course, the 77% higher depreciation of the new capacities. On the other hand, I still expect a very positive development of the actual business, which will again be overshadowed by the falling margin.

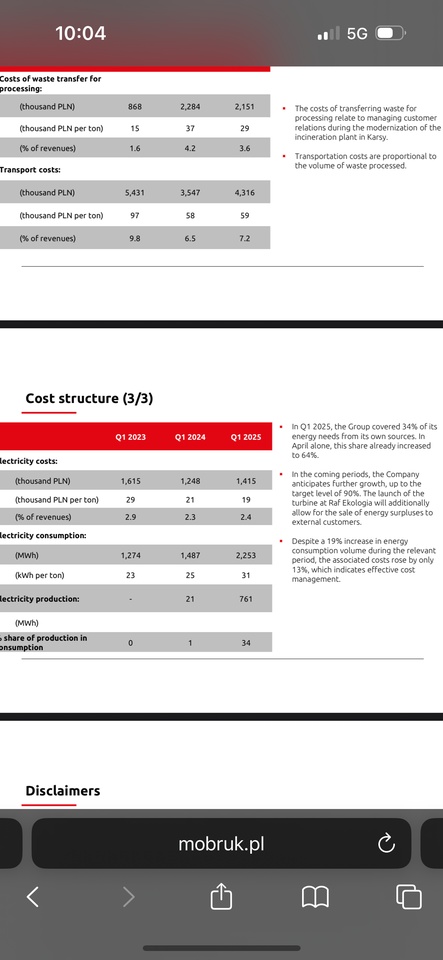

Among other things, I expect energy costs to fall significantly this year. In April 2025, 64% of the company's own energy requirements were already covered by the new PV systems and the new turbines from RAF Ekologia. The aim is to cover up to 90% in the next few quarters!

A brilliant synergy for me. I'm paying for waste that has to be incinerated for certain reasons must be incinerated and even cover my own energy needs with it.

I assume that the sums paid for the 2018/2019 proceedings will be dropped as in the 2017 precedent case and that we will see these sums again sooner or later ... perhaps even as a nice special dividend.💰