📆 July 2025 PatitosFortune Portfolio Recap in:

The sun’s out, dividends are dripping, and some of our high-conviction picks are flying . ☀️💸

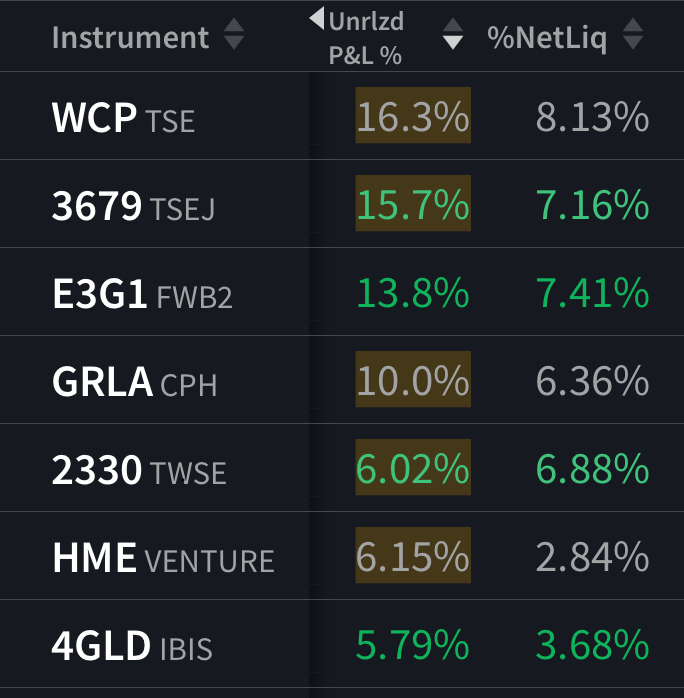

The top 7 now make up 34% of the portfolio — a slight reduction from 37.33% in June — and the focus remains: stock-picking with Patito Score + WB Score at the core.

🐣 Top Gainers of the Month:

- $WCP (+0,91%) (Canada): Monthly dividend darling surges to the top with +16.3%, now the biggest holding at 8.13%. 🍁💵

- $3679 (+0,85%) (Japan): Our trusted performer stays strong with +15.7%, now at 7.16% weight.

- $EVO (-0,36%) (Sweden): Gaming momentum continued — +13.8%. 🎮

💼 New or climbing contenders:

- $GRLA (Denmark): quietly compounding — a clean +10.0%, holding 6.36% of the nest

- $2330 (Taiwan): tech titan with +6.02%, pushing past the 6% line

- $HME (+2,59%) (Canada): small cap, big potential — +6.15%

- $4GLD (+1,68%) : the lone ETF survivor keeps its glimmer with +5.79%

💾 Holdover Stars from June:

✅ $3679 and $E3G1 stay strong

✅ $4GLD returns to the top 7 after a month away

✅ $WCP rockets to the top spot — a new leader with a familiar dividend drip

$BETS B (+0,73%) fell hard from the short term rally it has been showing but this is a marathon and not a sprint. While the fundamentals remain solid we will patiently wait for recovery.

Ironically the inspirer behind the Patito Scoring system, has $BRK.B (-0,27%) as the worst scoring of our current portfolio and one of the heaviest laggers. Holding with conviction still.

🔍 Strategy Update:

Patito’s conviction nest is now ~35% concentrated in the highest-performing 7 stocks.

These aren’t lucky ducks — they’re Elite and Excellent scorers, with high WB conviction and real returns to match.

From Canada to Japan to Denmark, the feathers are globally diversified but always fluff-optimized. 🪶🌍

See you in August (where changes to the portfolio are already taking place) — and of course don’t forget to check the dividend mailbox. 📬🤑