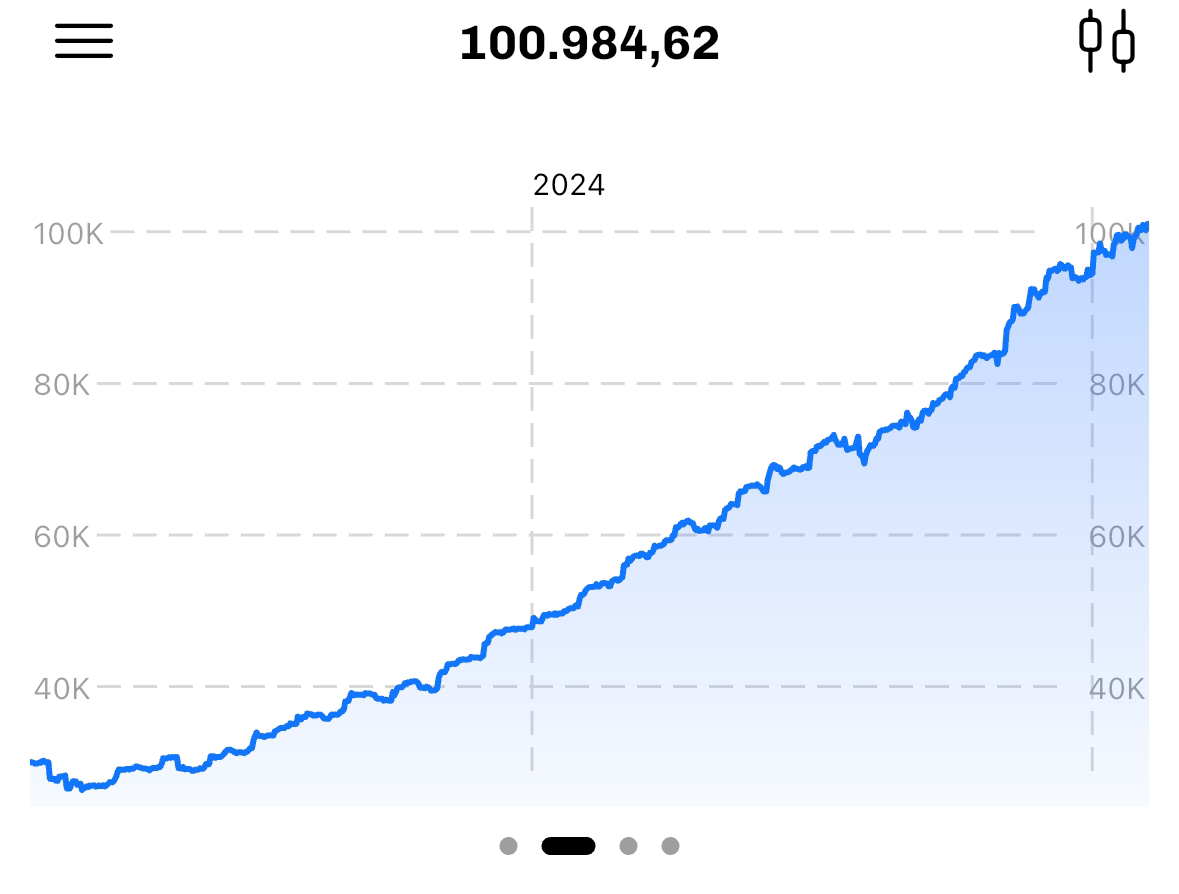

A lot has happened in the last two years - savings performance and value development. I'm totally happy that I've now cracked the 100k mark.

The biggest item in total is the S&P 500, then the $VWRL. Gold and Bitcoin also play a role. 5% is earmarked for cash/security-oriented stabilization.

Next goal is 100k alone in $VWRL (-0,91%) and then expansion of $CSPX (-1,14%) . With the latter, the cost ratio, volume and return are just right. Possibly Amunbo again at some point.

Have you done anything differently from 100k or what new goals have you set?