S&P 500 posts a weekly gain of 2.9% thanks to easing inflationary pressure and strong bank profits

The Standard & Poor's 500 rose for the first time in three weeks on signs of easing inflationary pressures and strong quarterly results from leading banks.

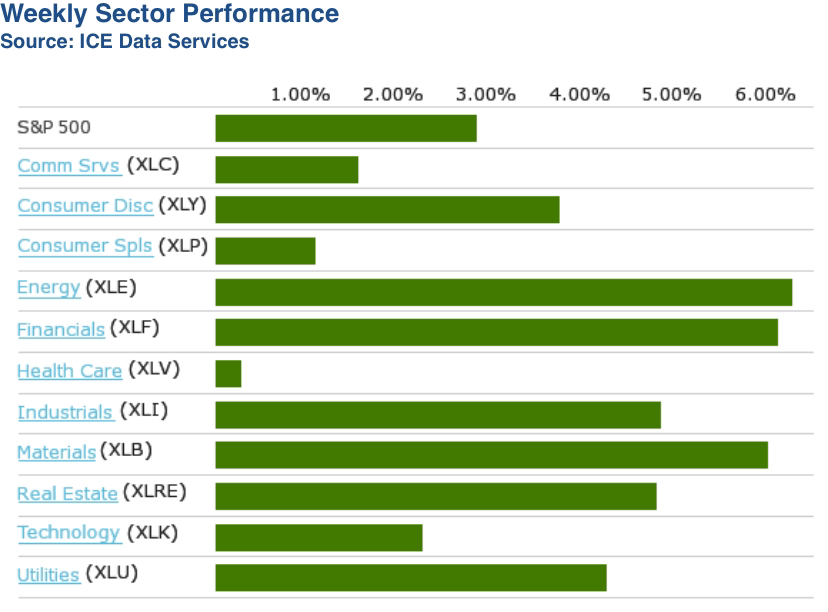

The benchmark index closed Friday's session up 2.9% at 5,996.66 points, after ending the previous week at 5,827.04 points. All sectors recorded gains, led by the financial and energy sectors, which each rose by 6.1%. The materials sector closed 6% higher.

Official consumer price inflation data released this week showed that core inflation, which excludes volatile food and energy costs, unexpectedly eased in December.

"A relatively benign reading of core consumer inflation on Wednesday coupled with a more moderate producer price index on Tuesday provides welcome relief to a (U.S. Federal Reserve) increasingly concerned about rising cost pressures," Stifel wrote in a note to clients.

Retail sales rose at a slower-than-expected pace last month, while builder confidence unexpectedly rose in January. Housing starts also exceeded market expectations.

Markets expect the Federal Open Market Committee to leave interest rates unchanged later this month, according to the CME FedWatch tool.

The International Monetary Fund raised its growth forecasts for the global and US economies this year, but pointed out that the risks to the medium-term outlook remain mostly negative.

US President-elect Donald Trump is due to take office on Monday.

JPMorgan Chase (JPM), Goldman Sachs (GS), Citigroup (C), Bank of America (BAC) and Morgan Stanley (MS) published quarterly results that exceeded Wall Street's expectations. These results boosted bank stocks and contributed to the financial sector's weekly gain.

The rise in the materials sector was supported by a 12% jump in Celanese (CE) after the stock was upgraded by BofA Securities.

The industrial sector gained 4.8%, thanks in part to a 15% rise in United Rentals (URI). The equipment rental company announced it was acquiring H&E Equipment Services (HEES) in an all-cash deal worth around USD 4.8 billion.

The real estate sector also posted a weekly gain of 4.8%, with lumber REIT Weyerhaeuser (WY) rising 11% after CIBC upgraded the stock.

Utilities gained 4.3% despite a 3.5% drop in Edison International (EIX). The Southern California utility is accused in a lawsuit of starting a fire in Los Angeles with its equipment, according to a Bloomberg report.

The consumer discretionary sector posted a 1.3% weekly gain despite a 5.7% decline in Target (TGT), which maintained its fourth-quarter earnings forecast despite raising its comparable sales forecast.

The health care sector rose 0.3% for the week, thanks in part to an 8.5% gain in DexCom (DXCM), which was upgraded by Baird. Drugmakers Moderna (MRNA) and Eli Lilly (LLY) lowered their full-year revenue forecasts, sending their shares down 19% and 9.3%, respectively.

Major companies reporting results next week include Netflix (NFLX), Johnson & Johnson (JNJ), Charles Schwab (SCHW), Intuitive Surgical (ISRG), American Express (AXP) and Procter & Gamble (PG).

Next week's economic calendar includes Friday's December existing home sales report and the University of Michigan's preliminary consumer confidence index for January. The markets will be closed on Monday in observance of Martin Luther King Jr. Day.