HELP HELP HELP!!!!

I got the stock last week and sold it.

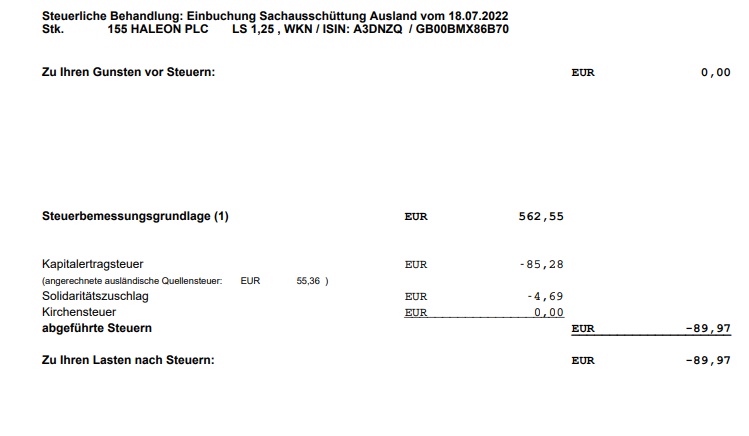

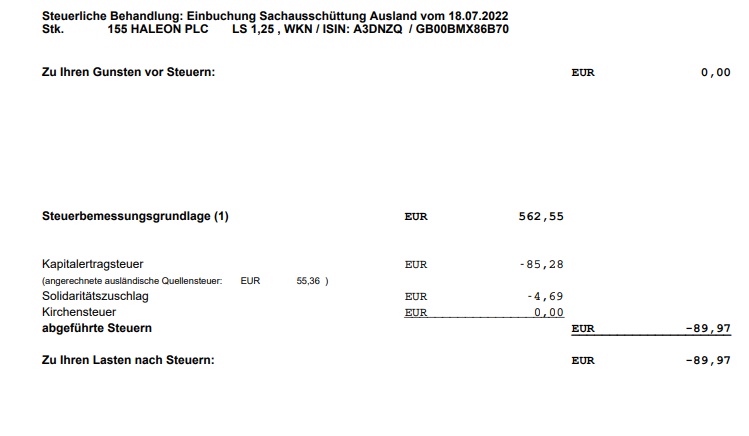

Comdirect deducts 26% tax as normal and I still have a loss pot of about 2000€.

is that correct from comdirect?

HELP HELP HELP!!!!

I got the stock last week and sold it.

Comdirect deducts 26% tax as normal and I still have a loss pot of about 2000€.

is that correct from comdirect?