The latest announcements by the US government to impose import duties on pharmaceutical products are casting a shadow over European pharmaceutical companies. Novo Nordisk, the Danish market leader in diabetes and obesity therapy, is particularly in the spotlight.

🔍 Background

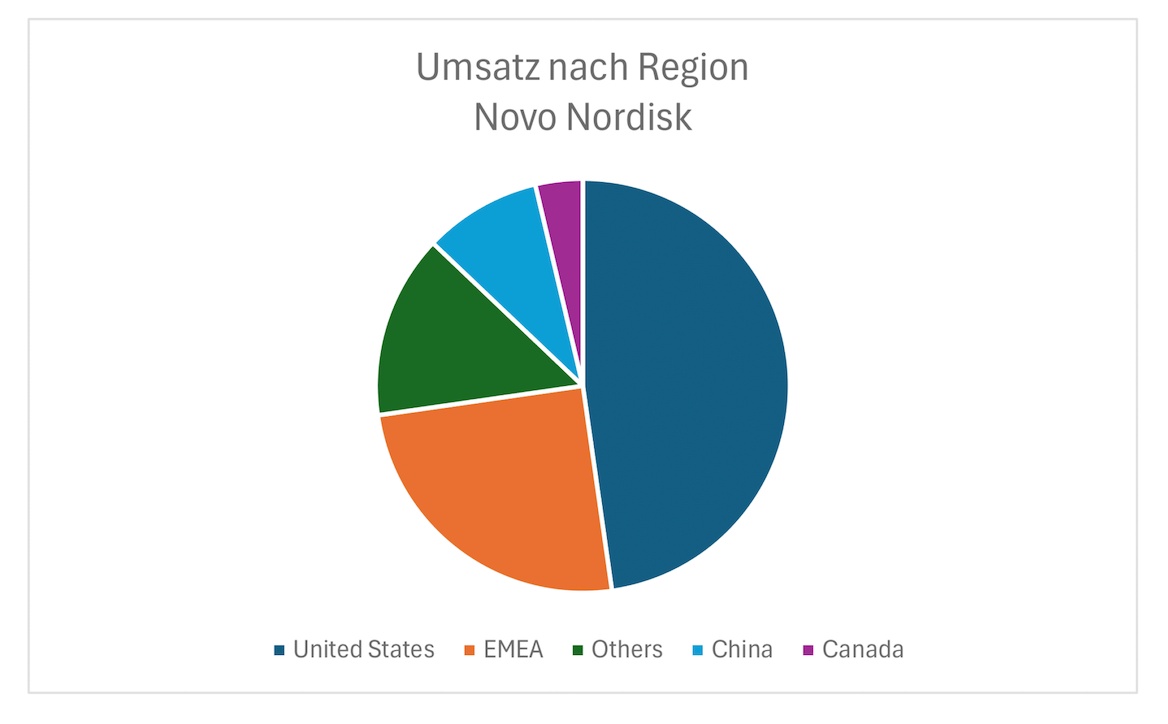

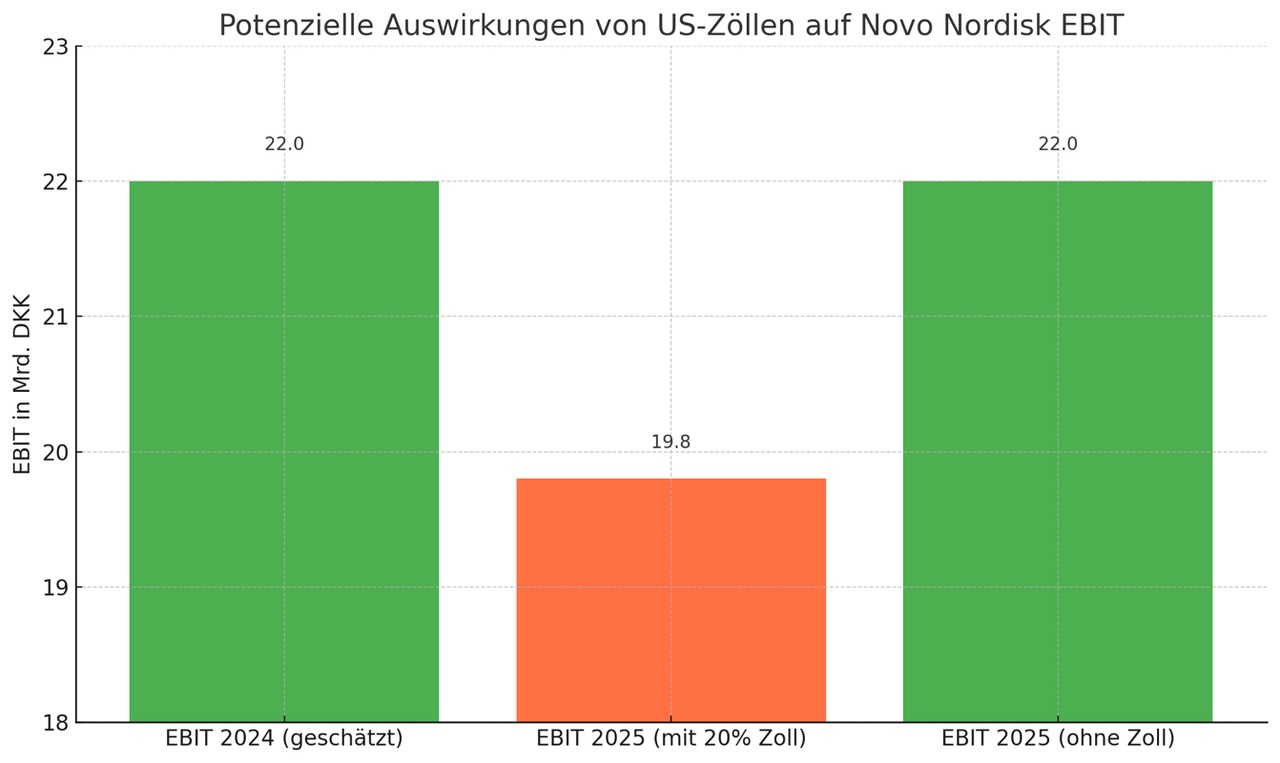

Novo Nordisk generates over 60% of its sales in North America, while only around a fifth of its production takes place there. This discrepancy makes the company vulnerable to trade barriers. Analysts estimate that a hypothetical 20% US tariff on Novo Nordisk's products could reduce the company's EBITA by up to 10% in 2025.

Chart 1:

📉 Potential negative impact

- Margin pressureIf tariffs of e.g. 20% are imposed on pharmaceutical products, Novo Nordisk would either have to increase prices in the US (which is politically and regulatory difficult) or reduce margins - which has a direct impact on EBIT.

- Supply chain complexityThe introduction of tariffs could force Novo Nordisk to relocate parts of its production to the US to avoid additional costs. However, such restructuring requires significant investment and time. They could also disrupt the company's global supply chain and affect the availability of medicines.

- Regulatory challengesDuties could result in additional regulatory requirements that make market access more difficult and increase administrative costs.

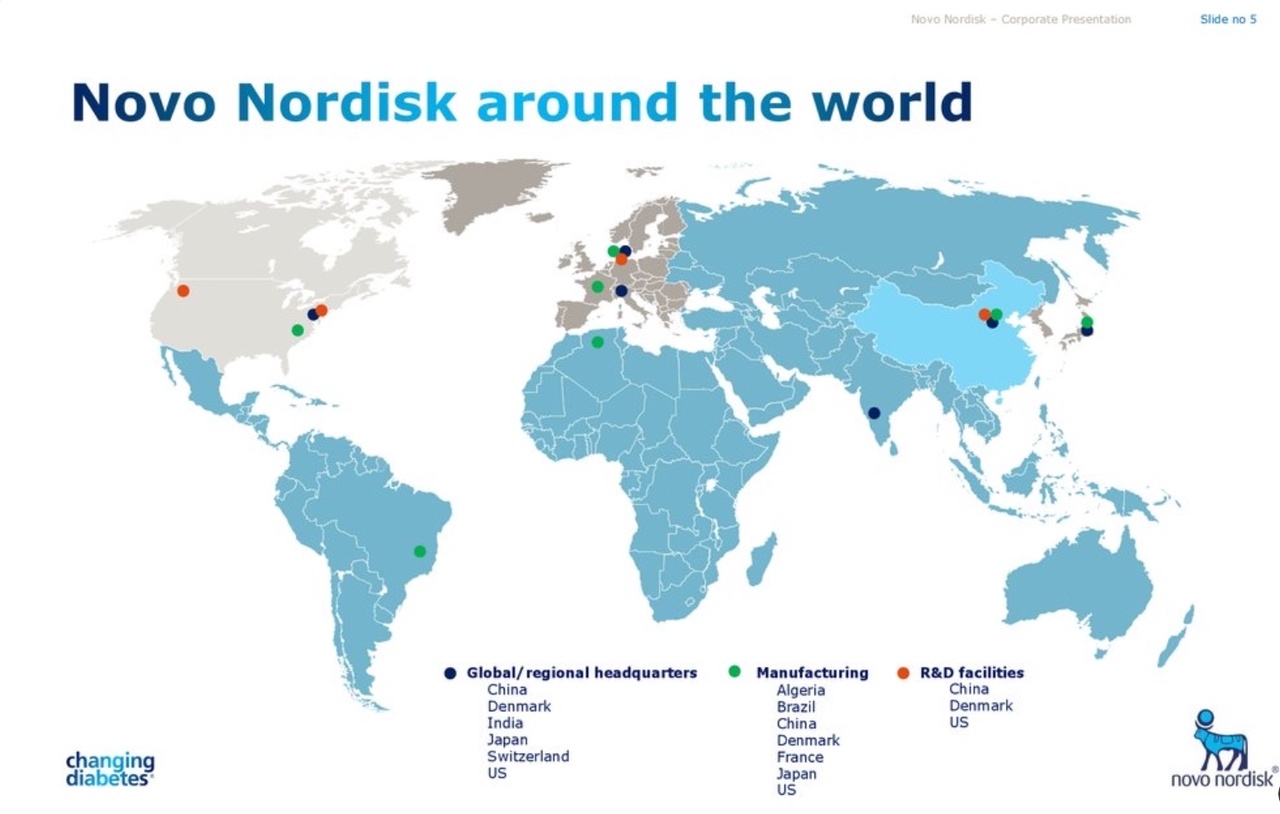

Figure 2:

📈 Potential opportunities

- Reshoring as an advantageNovo Nordisk is already expanding new production capacities in the USA. If the supply chain becomes more local, tariffs could even become less important in the medium term.

- Political tailwindAs a provider of medicines for widespread diseases (e.g. diabetes, obesity), Novo Nordisk generally enjoys a high political standing - which is in contrast to more tariff-critical industries such as automotive or technology.

- DiversificationThe company has a broad global base, which somewhat cushions the risks of individual markets.

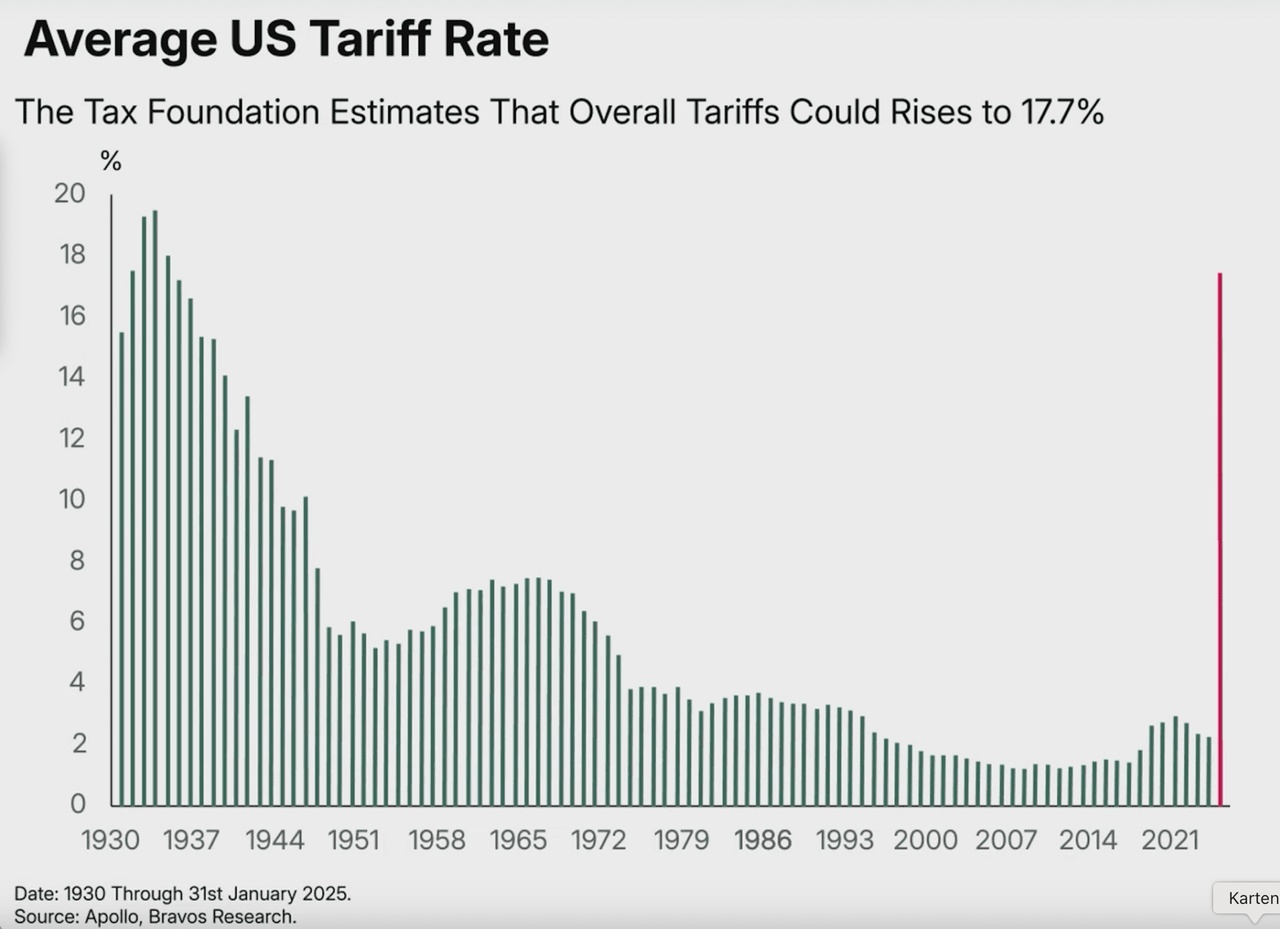

Chart 3:

📊 Infographic: Potential impact on EBIT (estimate)

The following chart shows the estimated impact of a hypothetical 20% tariff on Novo Nordisk's EBIT:

⚠️ Note:

This article does not constitute investment advice. All content is for information purposes only and does not replace individual advice. Please inform yourself independently before making any investment decisions.

🔖 Hashtags for reach & context:

#NovoNordisk

#Zölle

#USHandelspolitik

#Anlagestrategie

#Makroökonomie

#Pharma

#Fed

#Inflation

#Aktienanalyse

#GetQuin

#Investieren

#Wirtschaftspolitik

#EBIT

#TradeWar

Sources:

Graphic 1:

https://goldesel.de/artikel/die-zukuenftig-wertvollsten-unternehmen-der-welt

Graph 3:

https://finanzmarktwelt.de/usa-zoelle-wie-zu-zeiten-der-weltwirtschaftskrise-die-gefahren-338163/