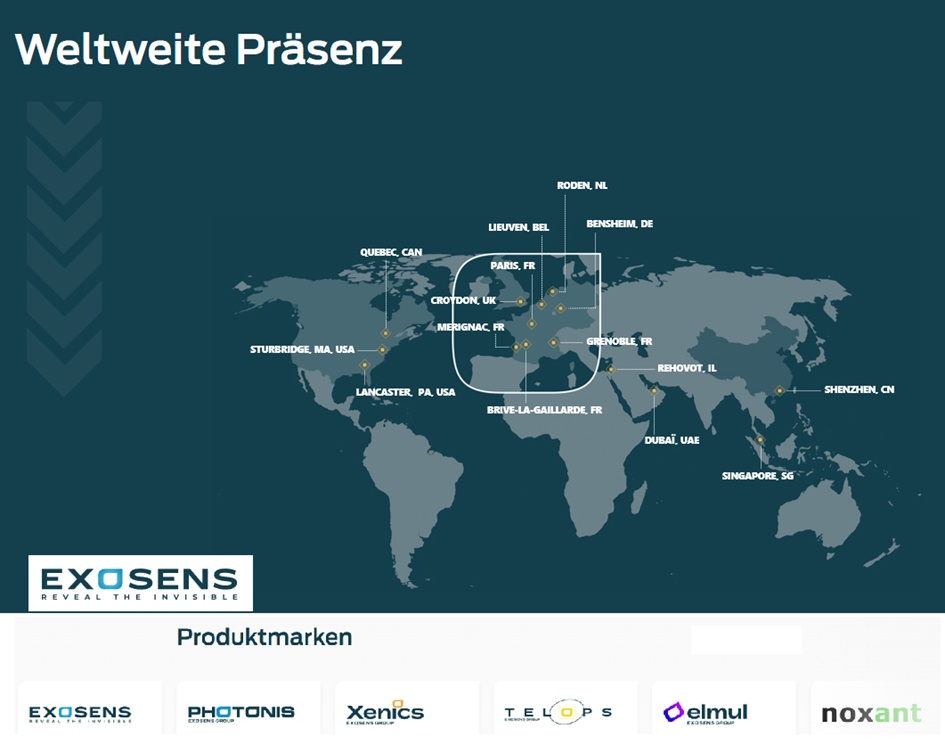

Hello my dears, I have just had a NEW PURCHASE. From the company I introduced a week ago, EXOSENS.

Many of you will probably be wondering why a new purchase, and then in Europe. Although the US. Market there are great price reductions.

That was also my consideration. But I liked the company when I saw it. And it fits in well with my future strategy.

And I don't want to be led astray.

"I simply want to continue to pursue my strategy and stay true to it.

An additional purchase in US. stocks would mean

- further pumping up full positions

- further increase the share in the nervous US. market.

Concerns.

- Dollar weakness

- Change at the top of the FED

- Geopolitical uncertainty

- Difficult to calculate president

This is not to say that I do not consider the US. Market not investable at the moment. But rather that I no longer want to add significantly to my US holding of just over 50%.

I think there is simply no way around the US market, and this is one of the best places to achieve returns. But other markets are also attractive and I think diversification is important. And that's why I won't be dissuaded from my strategy by a SALE.

Of course, if prices become even more attractive, there will also be additional purchases here in due course. E.v.t. when it becomes clear that the bear market in Bitcoin and software has come to an end.

Why now is the right time to BUY:

From a chart point of view, I think buying EXOSENS is very attractive right now.

The price could still go down to €49, but after that I think the long-term upward trend will continue.

Dear all, what do you think about my purchase and the company?