My dears,

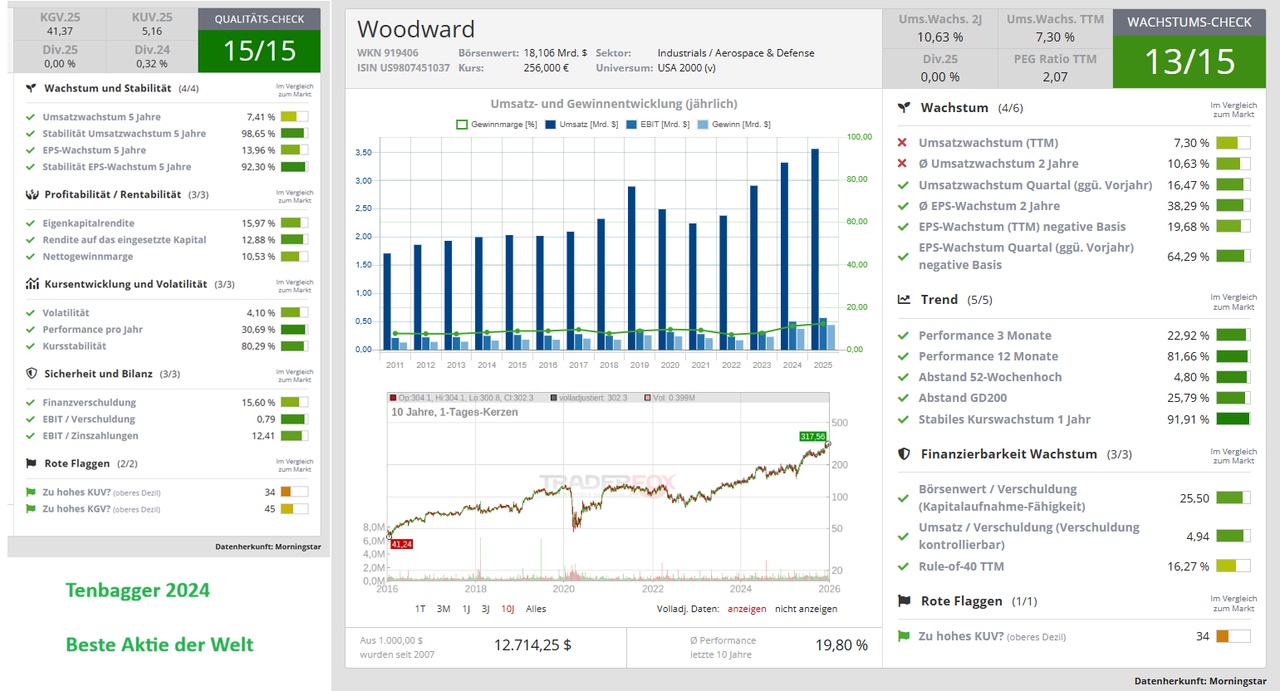

Investors are particularly impressed by quality companies with strong business models, pricing power and technological innovation.

TraderFox has developed a quality check to find the best shares in the world that are suitable for long-term investing. A total of 15 different key figures are evaluated in the following areas:

- Growth and stability

- Profitability and profitability

- Price development and volatility

- Security and balance sheet

- Excessive valuation

Each share is compared with all other shares in order to react dynamically to changing markets. The quality check is designed to help investors reduce the risk of investments. At the same time, the selection offers excellent investment opportunities.

Woodward benefits from demand for efficient drive and energy systems

Woodward Inc. (ISIN: US9807451037) develops and produces control systems for applications in the aerospace, energy and industrial sectors. The company earns its money with highly specialized components and systems that are often used long-term in safety-critical applications. Woodward was founded in 1870 and has been traded on the stock exchange since 1946.

On 24.11.2025, the company reported its figures for Q4 2025, with sales growth of 20% compared to the previous year, clearly exceeding expectations. Higher demand and price realization in the Aerospace segment led to sales of USD 995.26 million. Earnings per share also increased significantly by 48% to USD 2.09. The results create a positive starting point for the forecasts for 2026.

Investors assume that Woodward will continue to be one of the best companies in the future, as its business model is based on highly regulated, technologically demanding niches with high barriers to market entry. The increasing demand for more efficient, lower-emission drive and energy systems strengthens the company's long-term growth drivers.

Conclusion: Woodward demonstrates that a focus on technology-driven niche markets enables sustainable sales and profit growth. The strong Q4 2025 with double-digit growth underlines the operational strength and growing demand in the aerospace and industrial segment. Thanks to high market entry barriers, technological leadership and the trend towards more efficient, lower-emission systems, the company is also well positioned for the long term.

@Simpson Perhaps of interest to the star investor.

Dear all, what do you think of Woodward, and would you like more analysis of quality stocks with 15 points?

Feel free to do so in the comments, a 👍 is already a nice reward for the hard-working.

Woodward (WWD) supplies energy conversion and control solutions for the aerospace and industrial sectors. These are used in aircraft, propane, natural gas or diesel engines in forklift trucks, agricultural and mining machinery, trucks, buses, trains and ships. In addition to strong demand in the defense sector, the commercial services business for the aviation industry is a particularly important growth driver with a 40% increase in sales in the last quarter.

The acquisition of the electromechanical actuator business of Safran Electronics & Defense, completed in July, provides the first direct supply contract with Airbus. In addition to elevator trim systems (HSTA), wing spoilers for the Airbus A350 will also be supplied from the end of 2028, increasing the component share per aircraft to USD 550,000. In addition, modern LEAP and GTF engines are increasingly moving into more intensive maintenance phases, where UBS analysts expect annual aftermarket growth of 42% p.a. for narrow-body aircraft until 2030.

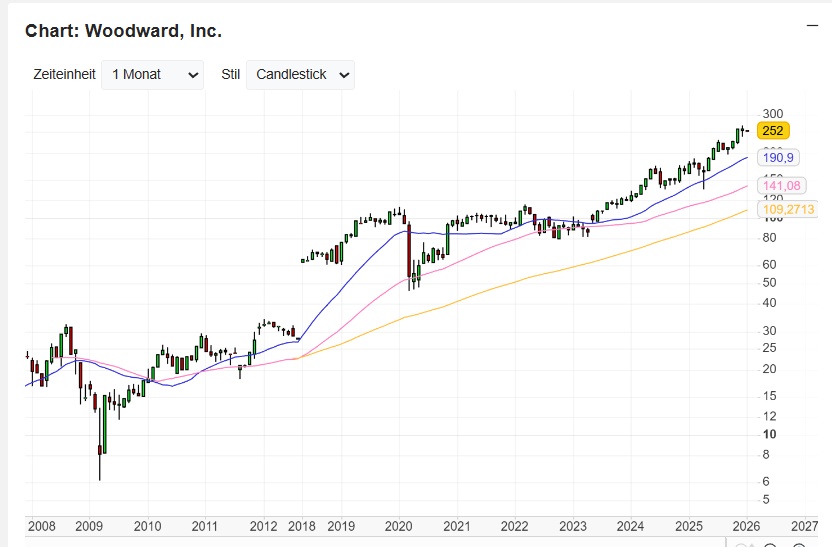

With a sales increase of over 16% and a net profit increase of 48% in the 4th quarter, there was already a new pivotal news point. In addition, a new USD 1.8 billion share buyback program will support the company over the next three years. In the new fiscal year 2026, net revenues are expected to be 7% to 9% higher, led by growth of 9% to 15% in the Aerospace segment. Deutsche Bank raised its price target from USD 360 to USD 400 (Buy) on December 22, thus ensuring the continuation of the trend.

A global market leader in energy control solutions

Woodward is a global leader in the design, manufacture and maintenance of power conversion and control solutions for aerospace and industrial equipment.

Quarterly-Investor-Deck-11242025-1100am-final-Q4-PDF.pdf

December 22, 2025

Woodward veröffentlicht Jahresbericht zum Geschäftsjahr 2025

November 24, 2025

Woodward meldet Rekordverkäufe und Gewinne für das Geschäftsjahr 2025

November 20, 2025

Woodward kündigt eine deutliche Erhöhung der Aktienrückkaufgenehmigung an

Woodward acquires EthosEnergy's iCON controls business to expand gas turbine capabilities

Woodward completes the acquisition of Safran's North American electromechanical actuation business

Woodward named to the 2026 Forbes Best Companies list

November 19, 2025

Woodward 2026 auf der Forbes Best Companies Liste genannt | Woodward

easYsim

Woodward's easYSIM simulation tool revolutionizes power system testing by developing digital twins of complex equipment, including generators, circuit breakers and renewable energy integrations such as battery energy storage systems (BESS) and photovoltaic (PV) systems.

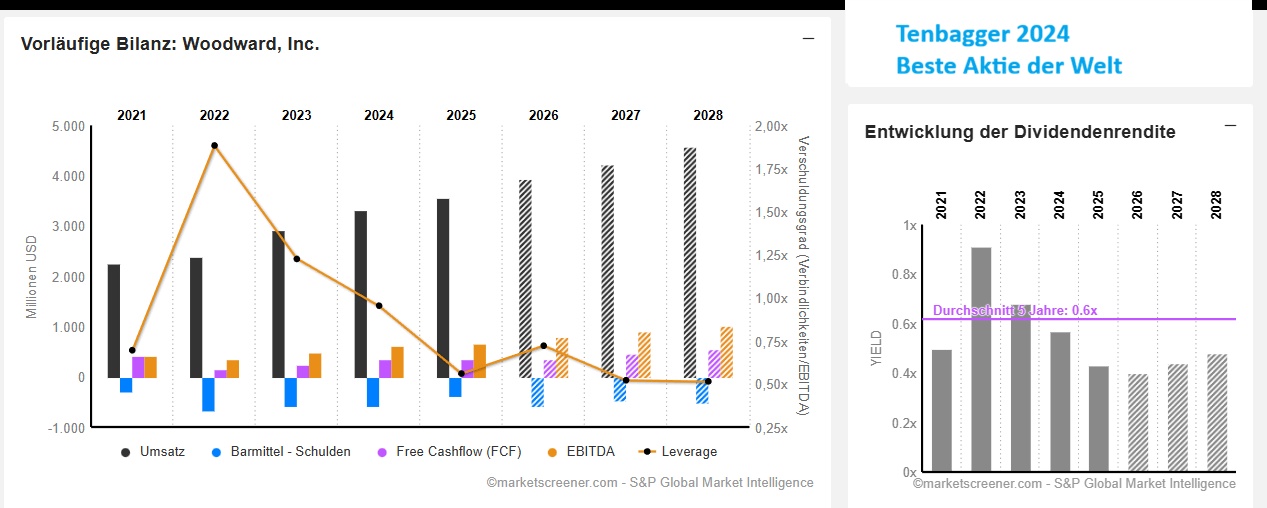

Performance

2025

+55,42 %

2024

+37,19 %

2023

+36,72 %

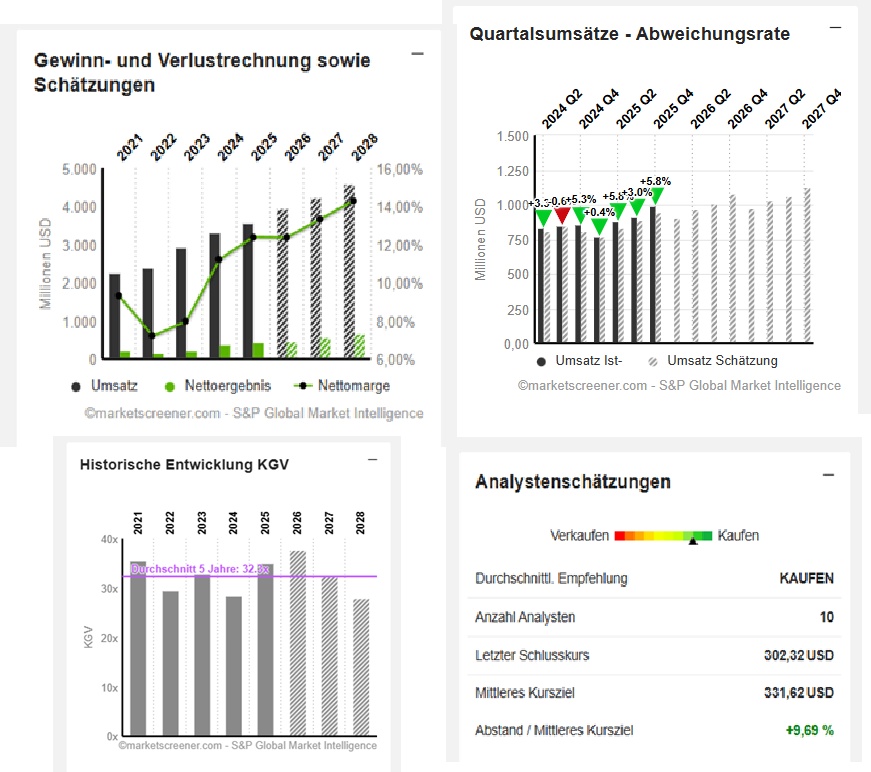

USD in millions (date of publication

estimates 24,11,2025)

Year

Turnover

Change in

2025 3.567 7,3 %

2026 3.944 10,58 %

2027 4.234 7,33 %

2028 4.583 8,25 %

Year

EBIT

Change in

2025 556,2 10,45 %

2026 665,8 19,7 %

2027 752 12,94 %

2028 854,1 13,58 %

Year

Net result

Change in

2025 442,1 18,54 %

2026 487,8 10,33 %

2027 564,1 15,65 %

2028 655,4 16,2 %

Year

Net debt

CAPEX

2025 375 130,9

2026 576 287,4

2027 468 194,2

2028 516 172,2

Year

Free cash flow

EBIT margin

ROE

2025 340,4 15,59 % 18,64 %

2026 350,1 16,88 % 19,5 %

2027 467,5 17,76 % 23,25 %

2028 551 18,64 % 26,26 %

Year

Earnings per share

Change in

2025 7,19 19,63 %

2026 8,017 11,5 %

2027 9,333 16,42 %

2028 10,79 15,58 %

Number of shares in thousands 59,997

Market value 18,138

Year

P/E RATIO

PEG

2025 35.1x 1.8x

2026 37.7x 3.3x

2027 32.4x 2x

2028 28x 1.8x

Sector comparison

P/E RATIO

GE Aerospace 42.71x

RTX Corporation 36.91x

Rheinmetall 59.73x

L3 Harris 30.88x