The year is over, the last dividend has been collected. The result is great, next year will be better.

My YTD performance (-3% with dividends) is probably one of the worst on Getquin. I was too busy buying blue chip stocks in drawdown than chasing the market.

The portfolio now pays out over 5% gross p.a..

At the same time, the average dividend growth of the companies in the portfolio is over 8% p.a. based on the last 10 years. (Dividend growth is most important to me).

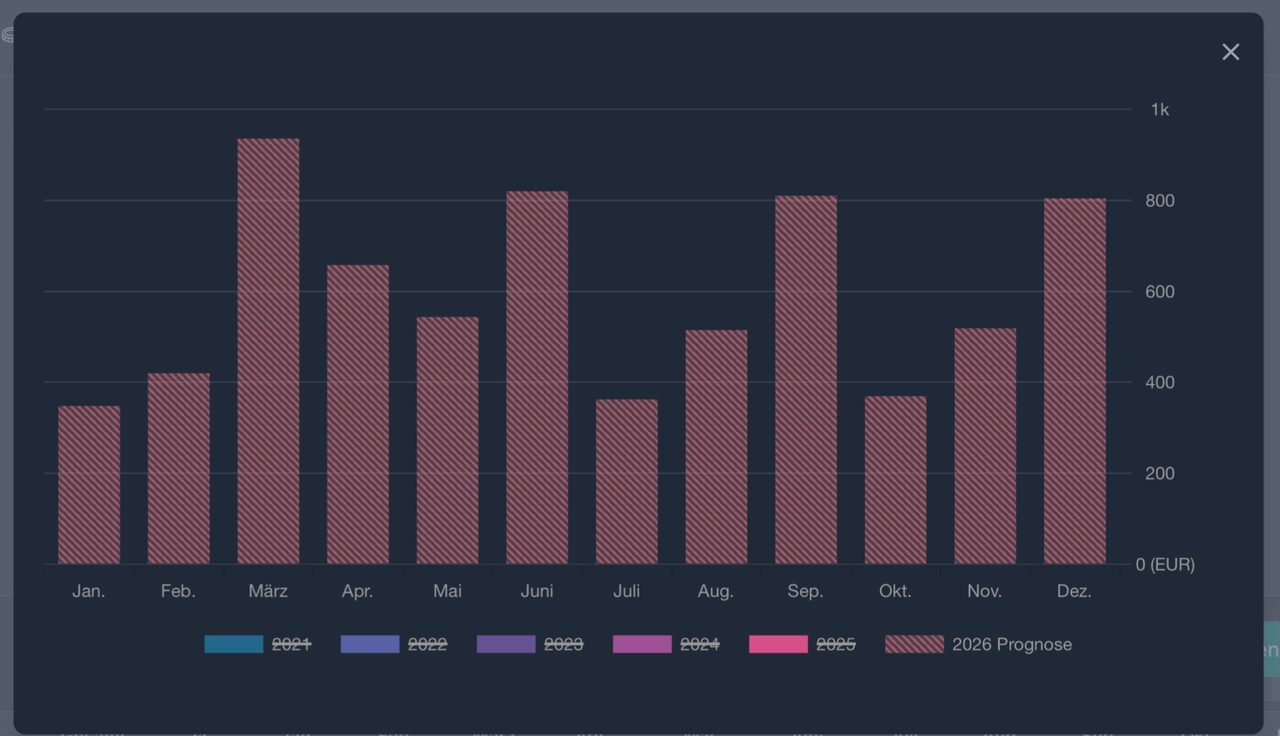

My 2026 target is clearly defined:

Gross annual dividends of over €10,000 without worsening long-term dividend growth.

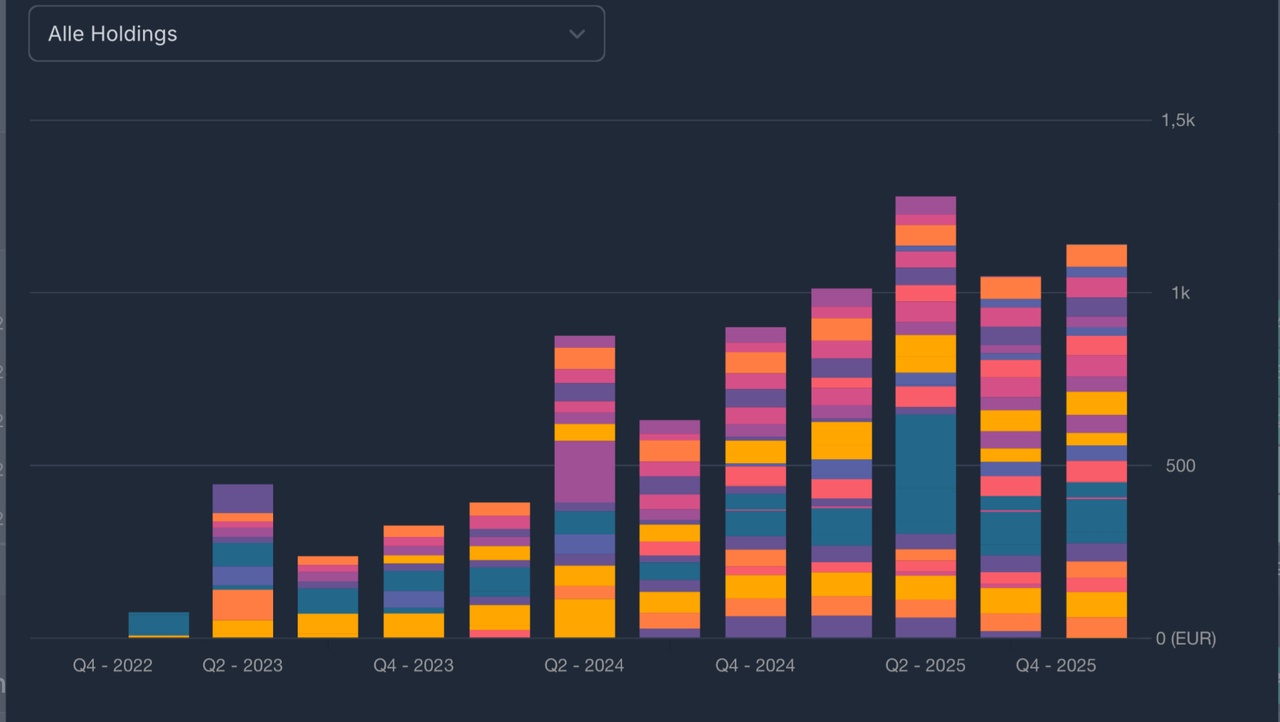

Currently, my dividends are over € 7,100 gross (2026), which corresponds to around € 450 net per month.

Shares like $UPS (-2,35%), $GIS (-3,2%), $TGT (-0,2%), $DGE (-13,93%), $LYB (-4,06%) are unfortunately ruining my share price performance. However, this does not mean that I will no longer buy these companies. I tend to secure historically high dividend yields (YoC).

The focus is not on short-term performance, but on sustainable cash flow, rising dividends and long-term wealth accumulation.

My TTWROR since the beginning of my investment career is 54% (after tax) while an All World is slightly above 60%.