I don't understand all the shareholders at the moment. $TSLA (+2,09%) shareholders, I find the risk/reward ratio so unattractive.

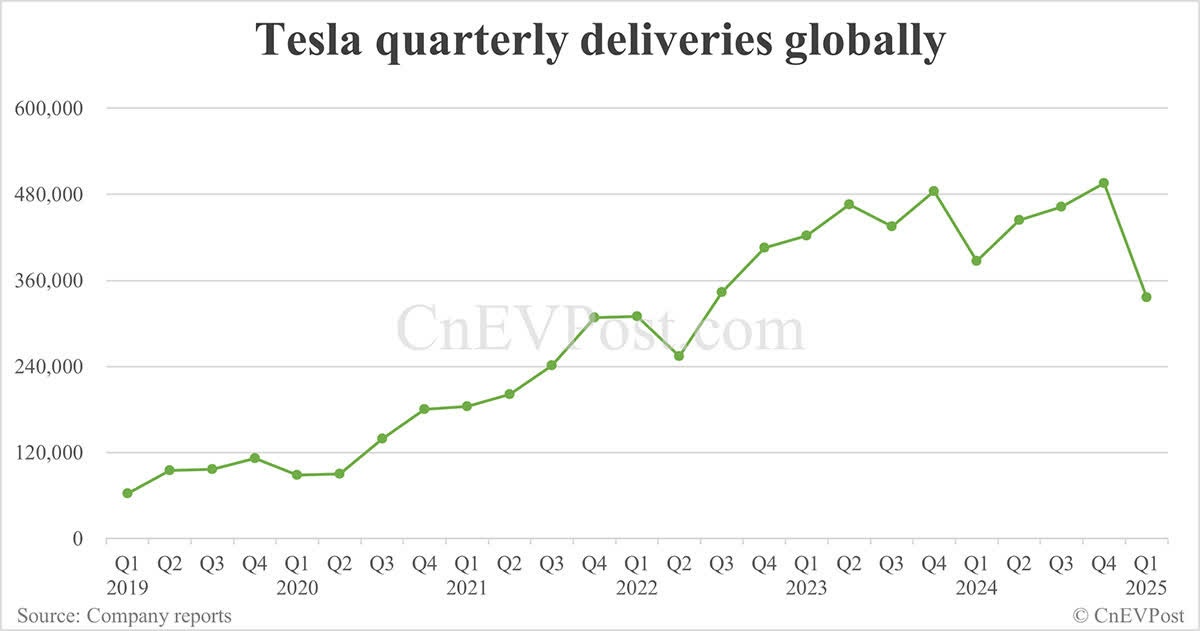

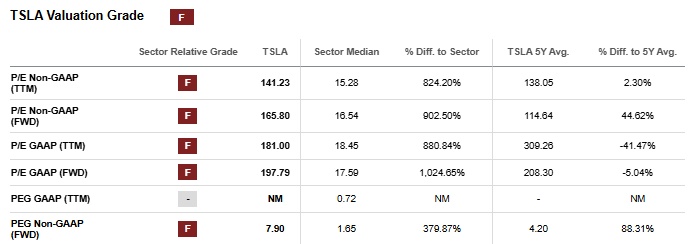

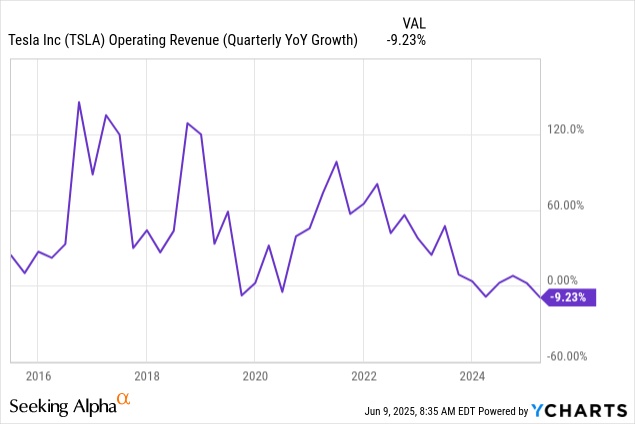

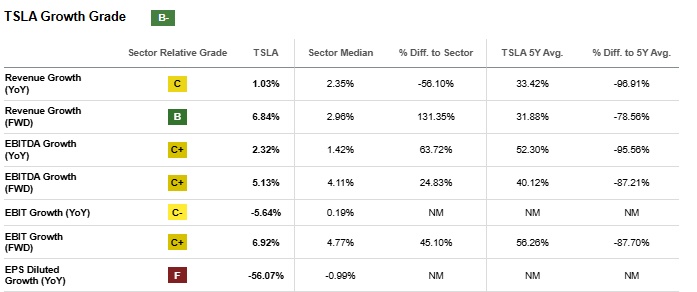

Tesla's valuation is so high, and the core business of EV sales is hardly worth anything, and the bots & autonomous driving is becoming less and less likely. Deliveries are declining too much:

Warehouses are full the runs are declining and Tesla Autonomous Driving is Stuck at Level 2 with no sight of improvement as cameras are not the future.

Or as the ex-Ceo of Waymo said:

If a company were serious about building a safe robotaxi business, the robotaxi wouldn't look anything like this prototype. A serious robotaxi would demonstrate the primacy of safety; the manufacturer would place sensors in optimal positions-on the roof as well as on the sides and corners of the vehicle. These sensors would also have cleaning and drying functions-windshield wipers, compressed air nozzles, and so on.

Forecasts expect that every Tesla on the market would first have to be retrofitted for autonomous driving + it needs a lot of support these days (see Waymo, where some employees have to intervene).

Autonomous driving has been promised every year for a decade without any real improvements, so I'd rather invest in growth opportunities with lower risk... we're talking about a P/E ratio of 170 with 1% revenue growth... just a little food for thought, what do you think?