Both $V (-0,03%)

visas and $MA (-0,42%)

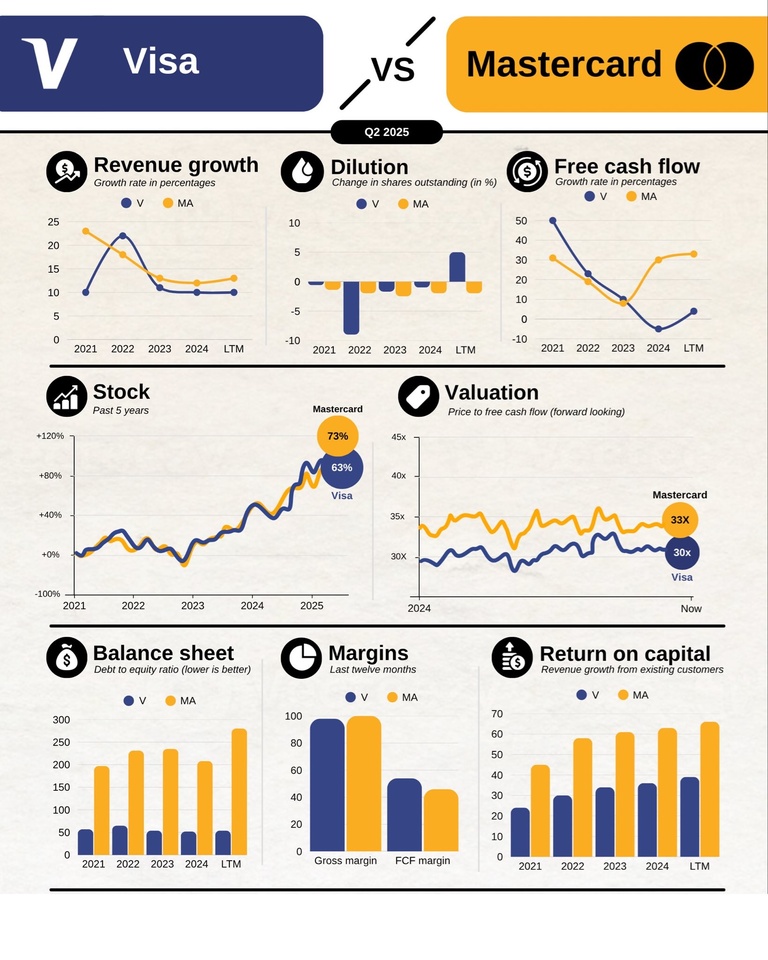

Mastercard will publish their quarterly figures next week - and from a fundamental point of view, the two payment payment giants are still in a really close race.

Visa - strong profits, strong margins

Visa really delivered in the last quarter really delivered:

Sales increased by 14 % to 10.2 billion US dollarsearnings per share rose by as much as 23 % to 2.98 US dollars.

The transaction volume also looks good - up up 8 % worldwidedriven primarily by strong foreign sales.

With a gross margin of almost 98 % and a return on equity of around 52 % Visa is one of the most efficient companies in the fintech sector.

In addition, it has an extremely solid balance sheet - debt-to-equity just 0,07 - and a moderate P/E ratio of around 31.

In short: Visa is operationally well positioned and remains one of the most stable fintech stocks on the market.

Mastercard - solid growth, but more expensive valuation

Mastercard publishes on October 30 analysts expect EPS of 4.30 US dollarsi.e. around +10,5 % compared to the previous year, with sales of 8.5 billion US dollarsalso +14 % YoY.

The free cash flow is with 13.6 billion US dollars in 2024 is also strong.

But - the share is valued significantly higher:

P/E ratio around 40 and a higher debt with a debt-to-equity of 0,34.

Nevertheless, Mastercard scores with global presence in over 210 countries and pure innovation - for example with biometric security and contactless payment.

Many analysts remain bullishwith an average price target of 652 US dollars and a rating of "Strong Buy"

Comparison & Conclusion

Key figure: Visa (V) vs Mastercard (MA) :Sales growth (YoY), FCF (YoY) etc

In a nutshell:

Visa convinces with stability, high profitability and a defensive valuation - ideal for long-term investors.

Mastercard offers slightly more growthbut at a higher price and with slightly higher risk.

Both clearly benefit from the megatrend of digital payments - but in the current environment with high cost pressure and increasing regulation seems Visa is fundamentally somewhat better positioned.

My Youtube channel for more stock analysis: www.youtube.com/@Verstehdieaktie