The dry bulk market in late February 2025 paints a varied picture. Capesize rates are rallying to near three-month highs, fueled by Australian iron ore and tightening tonnage, while Panamax rates face headwinds from China’s dwindling grain demand. Supramax holds steady with mixed regional activity, as broader economic shifts—like a U.S. recovery and China’s inventory drawdown—shape freight dynamics. Investors eyeing shipping stocks or commodity plays face a market of contrasts: bullish Capesize sentiment meets fragile fundamentals elsewhere.

This update unpacks the latest across Capesize, Panamax, and Supramax segments, weaving in global economic and demand trends. From rising spot rates to oversupply risks, here’s what’s driving the dry bulk space—and what it might mean for the months ahead. Volatility remains a constant; let’s dive in.

⏬ Capesize Market: Rates Climb, but Questions Linger

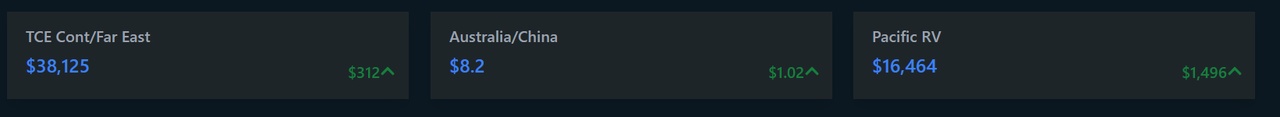

Capesize spot rates hit $15,074/day on Friday, up 83.5% week-on-week and the highest in nearly three months, per the Baltic Exchange. West Australia sees a flurry of enquiries for March 10 onward, with some operators eyeing end-March and April on index-linked terms. East Australia coal and Pacific cargoes are ticking up too, lifting mid-week optimism—C5 crossed $8/tonne, and C3 (Brazil-China) fixtures hit $19-$19.70/tonne. Clarksons notes Rio Tinto fixing multiple vessels in the Pacific, where tonnage lists are thinning, while Vale’s Atlantic interest for early April adds momentum. Yet, BRS Shipbrokers flags sustainability concerns: prompt C3 and C9 (Europe-China via Brazil) positions struggle with oversupply, despite forward dates firming to mid-$19,000s. China’s iron ore stocks dipped 0.3% to 153.4M tonnes, hinting at inventory reliance over new shipments, which could cap demand. Ballasters are easing (SE Africa at 130 vessels, down 20), but levels stay above early-year lows—rates may rise further if March trends tighten, or soften if physical demand lags paper gains.

Capesize - USD/Day , USD/Tons - February 26th

⏳ Panamax Market: China’s Grain Slump Weighs Heavy

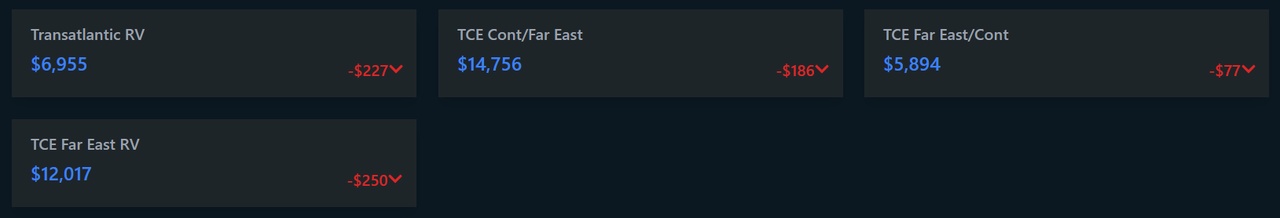

Panamax markets are sluggish, with sentiment mixed across basins. The Atlantic’s North is quiet, and ECSA fronthaul activity has retreated, piling up tonnage and softening rates. In the Pacific, coal and grain volumes ease as Capesizes snatch demand, pushing Australia-China rates down since mid-2024—Drewry sees no near-term recovery to last year’s $19,802/day highs (January 2025 averaged $6,762/day). China’s wheat imports are fading, with four 60,000-tonne shipments rejected this month and no March orders, reflecting a record 140M-tonne domestic crop. Brazil’s corn dominance and U.S. export declines (China’s wheat/corn imports down 37% y-o-y) shrink tonne-miles—Panamax Baltic rates are off 40% y-o-y. SE Africa ballasters dropped to 150 (down 30), and Continent-Far East rates edged to $30/tonne, but without fresh cargo inflows, further corrections loom. Seasonal March strength is possible, yet fundamentals remain shaky—investors might brace for prolonged softness.

Panamax - USD/day , USD/tons - February 26th

⏱️ Supramax Market: Steady with Regional Twists

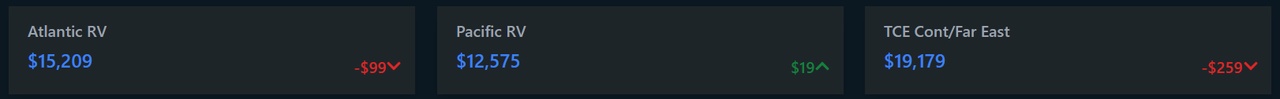

Supramax activity is a mixed bag. The US Gulf lacks fresh demand, holding rates flat as owners resist cuts, while the South Atlantic balances upward pressure and stability. Asia’s market stays firm—Indo-ECI rates hit $9/tonne—but may have peaked, with SE Asia ballasters dipping below 98. The Med-Continent gains from new enquiries, unlike the flat Indian Ocean and struggling US Gulf. Pacific sentiment holds strong, and period charters remain active, signaling confidence. Tonne-day growth outpaces other segments, with congestion easing (down 10 vessels to ~250). NOPAC Far East Handysize rates rose to $30/tonne (up 15% m-o-m), though Handy NOPAC ballasters fell below 27. The week ended quietly, but positive vibes persist—Supramax could offer stability amid larger vessel swings, though regional disparities warrant close watch.

Supramax - USD/day , USD/tons - February 26th

🌐 Economic Context: U.S. Rebound, China’s Shift

Global economic signals are shifting. Commodore Research highlights a U.S. turnaround: retail spending beat inflation for four months straight (unlike 17 of the prior 23), and industrial production grew 2% y-o-y—the strongest since 2018 sans COVID years. This could lift dry bulk demand if sustained. In China, iron ore port stocks fell to 153.4M tonnes despite higher throughput, suggesting reliance on reserves over new shipments—a bearish tilt for Capesize rates. Grain self-sufficiency cuts import needs, pressuring Panamax tonne-miles. The U.S. as a growth engine contrasts with China’s mixed outlook—investors might weigh these against freight trends.

🚨 Outlook: Diverging Paths

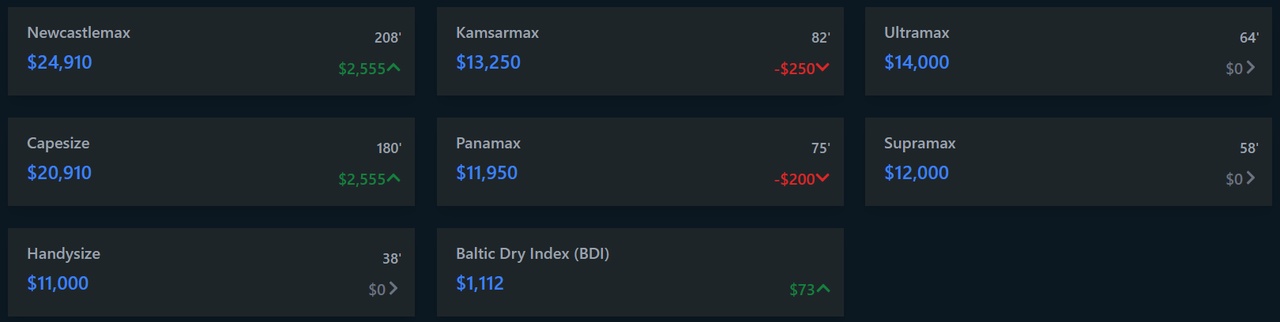

Capesize rates could climb if Pacific tightness and Atlantic forward fixtures hold—FFAs peg March at $19,000/day and Q2-Q4 at $21,200-$22,900/day—but oversupply risks linger for prompt cargoes. Panamax faces a tougher road, with China’s grain pivot and tonnage buildup threatening further declines unless seasonal demand kicks in. Supramax offers a steadier footing, buoyed by tonne-day growth and Asian strength, though US Gulf weakness tempers gains. U.S. economic tailwinds clash with China’s inventory drawdown—bullish Capesize sentiment may not spread evenly. Congestion’s easing (Capesize below 80, Panamax below 140) hints at capacity surplus, yet recovery signs suggest a bottoming out. Investors might find selective opportunities amid the noise.

1 Year T/C Dry Bulk

1 Year T/C Dry Bulk

💬 Your Take?

What’s your read on dry bulk’s next move? Bullish on Capesize rates, or worried about Panamax softness? Share your thoughts—let’s dig into this together! 🚢