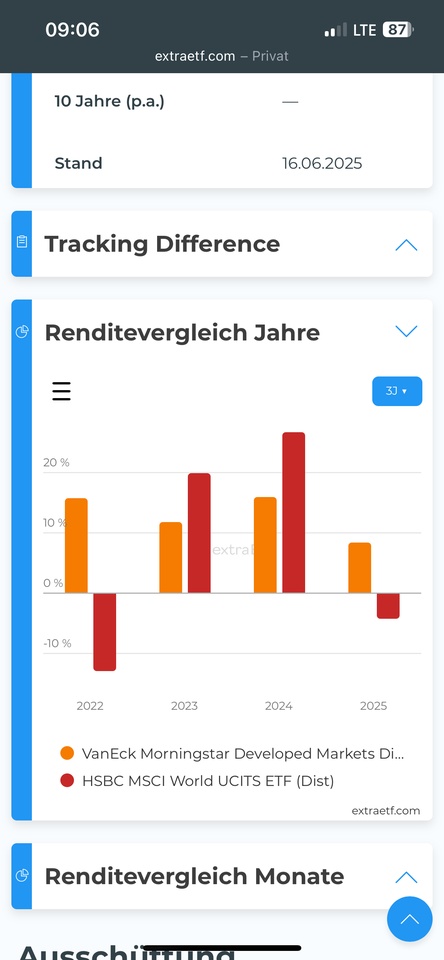

It looks as if the $TDIV (-0,11%) would do particularly well in bear markets. I know that this is a great oversimplification and I don't want to explore the reasons here. Instead, I want to take a much more pragmatic view.

A - someone has both ETFs in their portfolio and is now switching from TDIV to the World.

Thanks to the gains from TDIV, he now invests more in World than he initially had capital for and is currently receiving more World shares due to the price decline.

If the market then returns to the overriding trend, significant price gains can be expected.

In this scenario, two "small" levers take effect, so to speak, and you trade anti-cyclically. The biggest challenge is getting the timing right.

B - someone sees this article and now starts to save in the TDVI or makes a one-off purchase. He trades cyclically and momentum-oriented. (In 2022 he would probably have been right for many months, but who knows how long a bear market lasts and when it is over). The biggest challenge is getting the timing right.

C - continues to run a savings plan on both ETFs and believes he is guaranteed to outperform A and B in the long term. (Of course this is not true) but he has read it so often on Getquin that it is impossible to convince him otherwise. 😢

How do you proceed and what are your thoughts on this simple topic?