But yes, the budget is limited

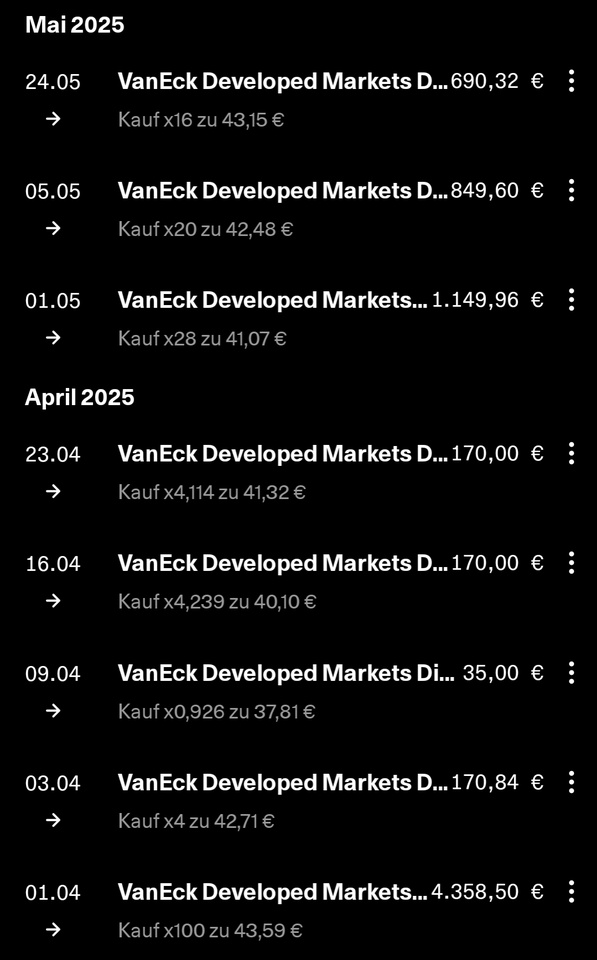

Unfortunately, Ing doesn't have a savings plan and since I've said goodbye to TR completely, it's been one-off purchases since May.

Yesterday, thanks to the Getquin widget at work, I saw that 🍊 must have made another one. So a few bucks could go back into the portfolio.