Away from the usual suspects in the healthcare sector - from $NOVO B (+0,13%) to $UNH (+1,21%) to $MRK (+0,33%)

$HIMS (+1,27%) and so on - there are still some rather unknown but highly exciting players.

One such gem recently came across my path - Catalyst Pharmaceuticals $CPRX (+1,12%) A company in the biotech sector that rarely or never appears in the headlines, but has been growing consistently for years and impresses with its skillful scaling.

$CPRX (+1,12%) Catalyst Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company focused on the development and commercialization of drugs for patients with rare diseases in the United States.

The company was founded in 2002 and is headquartered in Coral Gables, Florida.

What exactly does $CPRX (+1,12%) Catalyst Pharmaceuticals do?

THE BUSINESS MODEL of $CPRX (+1,12%) 🧠

The company focuses on the development and commercialization of therapies for people with rare, chronic neuromuscular and neurological diseases.

Catalyst Pharmaceuticals $CPRX (+1,12%) has strategically positioned itself as a commercial-stage biopharmaceutical company dedicated to addressing the significant unmet needs of patients with rare and difficult-to-treat diseases. The company's business model is focused on the in-licensing, development and commercialization of novel, high-value medicines, a strategy that has successfully transitioned it from a development-focused company to a profitable, multi-product commercial company. This journey, funded primarily through product sales and strategic capital raises, has culminated in a diversified portfolio of three key therapies: FIRDAPSE for Lambert-Eaton Myasthenic Syndrome (LEMS), FYCOMPA for epilepsy and AGAMREE for Duchenne Muscular Dystrophy (DMD).

At the heart of the Catalyst approach is a deep commitment to patients, manifested in comprehensive support programs such as Catalyst Pathways and financial support initiatives designed to ensure access to treatment. This patient focus, coupled with a disciplined "buy and build" strategy, forms the core of the investment thesis: leveraging operational excellence and financial strength to acquire and successfully commercialize differentiated rare disease assets to create sustainable value.

The company offers the following products:

The top product is Firdapsewhich treats a range of muscle diseases. These include myasthenic Lambert-Eaton syndrome, a disorder in which the immune system attacks the body's own tissue. It causes muscle weakness and mobility problems.

FIRDAPSE is protected by several patents and regulatory property rights in the USA. As only FDA-approved treatment for LEMS in the USA, FIRDAPSE enjoys FIRDAPSE enjoys a strong market position. The company has consistently demonstrated its ability to drive organic growth for this therapy years after its initial launch

The key compound patent protecting methods of administering 3,4-diaminopyridine was granted in October

2020 and runs until April 7, 2034.

Further products:

- FycompaA novel, non-competitive selective antagonist at the postsynaptic ionotropic glutamate receptor of the AMPA (alpha-amino-3-hydroxy-5-methyl-4-isoxazolepropionic acid) type. It is used for the treatment of focal seizures and tonic-clonic seizures.

- AGAMREEthe recently launched DMD treatment, is rapidly establishing itself in the market and shows promising early adoption, balanced patient recruitment from competitors and potential for long-term differentiation supported by ongoing real-world evidence studies.

In addition, there are several other patents relating to bioavailability and specific dosage forms, which run until June 2032.

One particularly strong patent on the stability of the active ingredient even runs until February 25, 2037.

In addition, a settlement was reached with the generics manufacturer Teva, which stipulates that generic versions of Firdapse may not be launched in the USA until February 25, 2035 at the earliest.

The patent protection for Firdapse is comparatively long, so Catalyst $CPRX (+1,12%) is therefore in a comfortable situation 💪

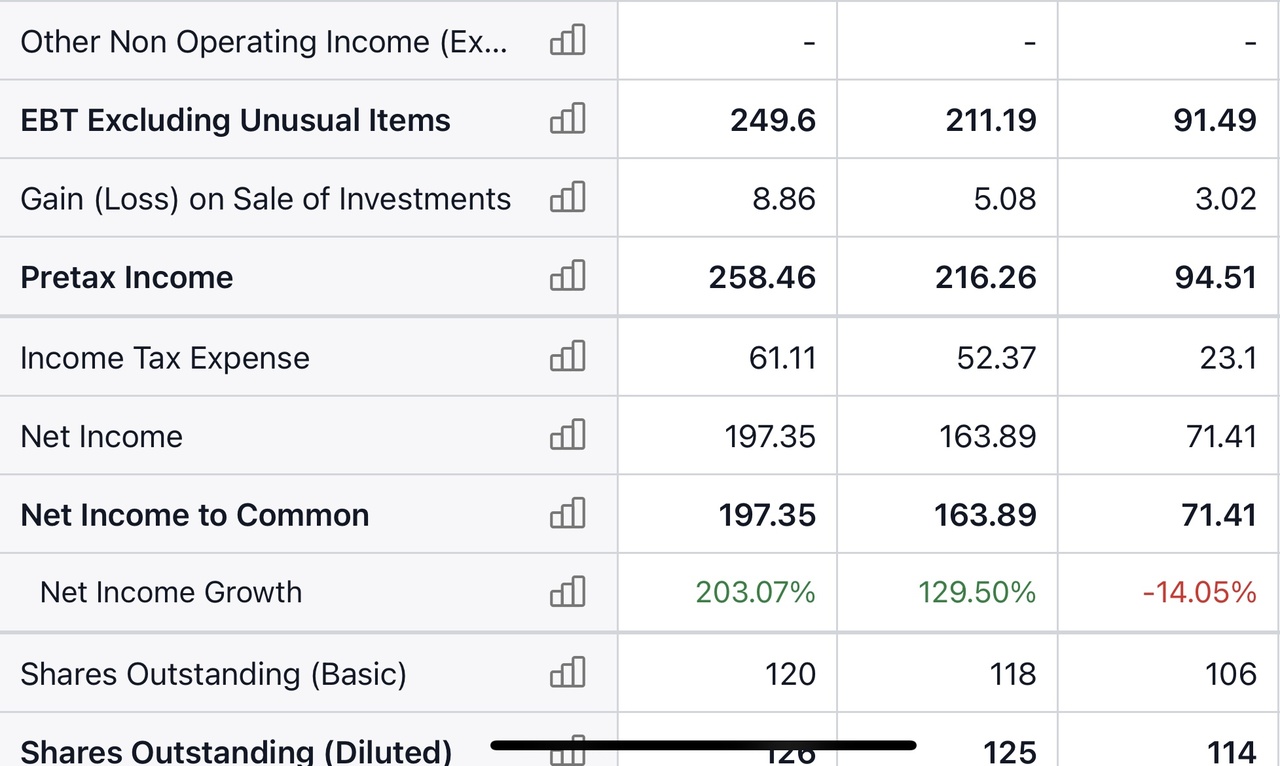

Since the leap into profitability Catalyst Pharma has been able to $CPRX (+1,12%) multiplied its earnings from USD 0.30 to USD 1.31 per share.

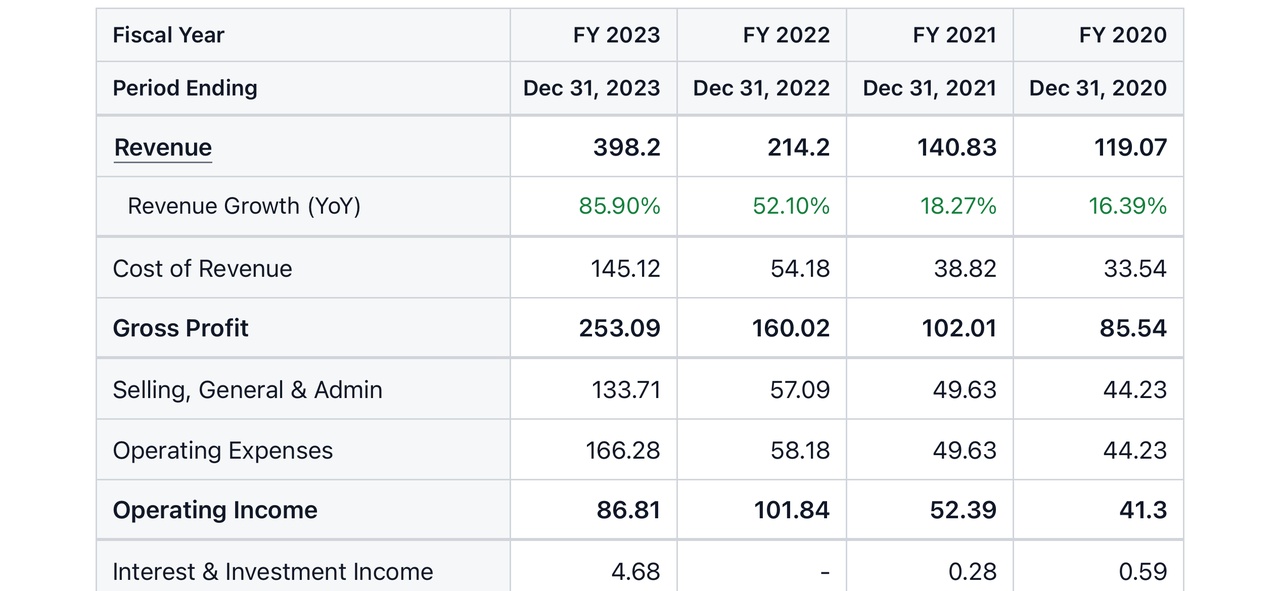

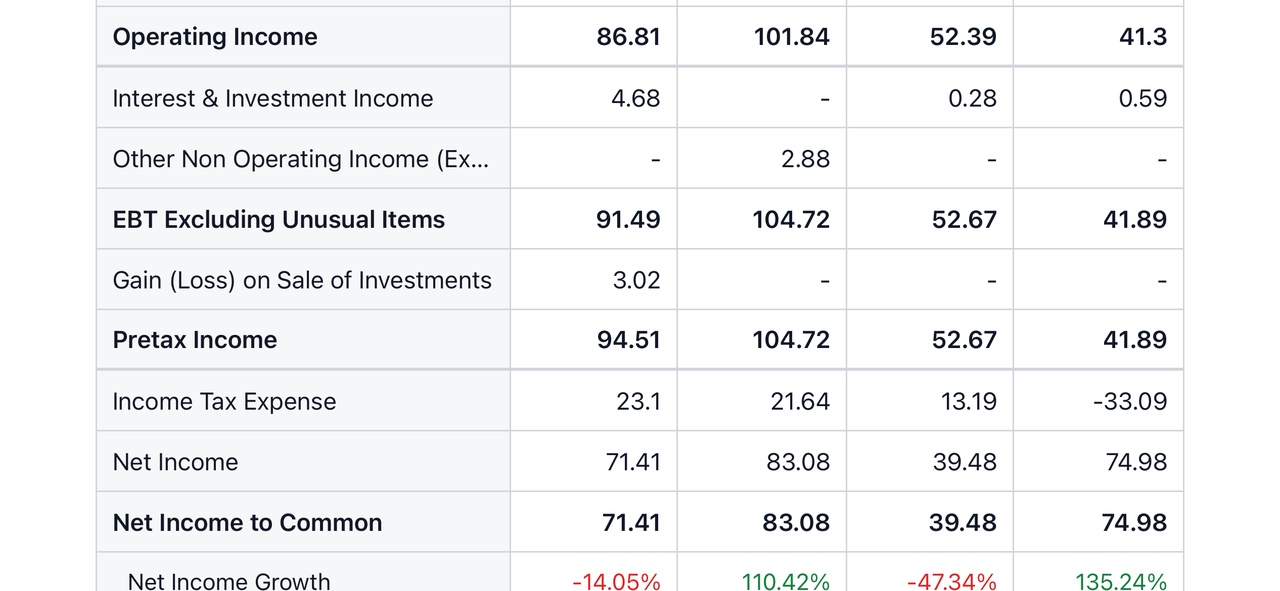

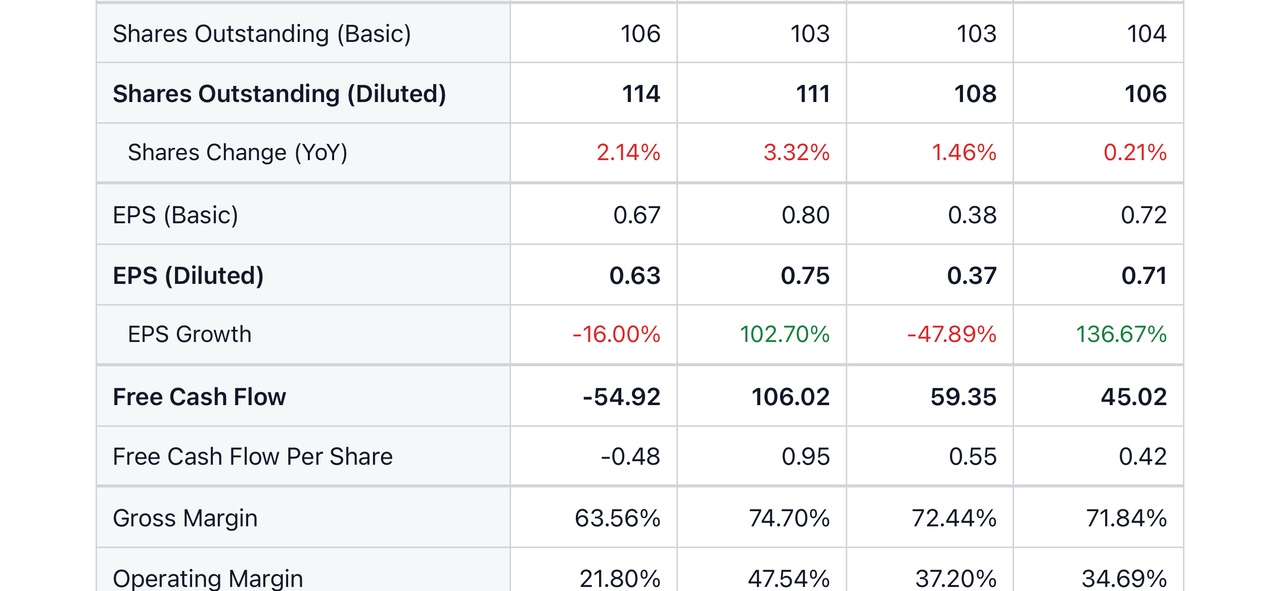

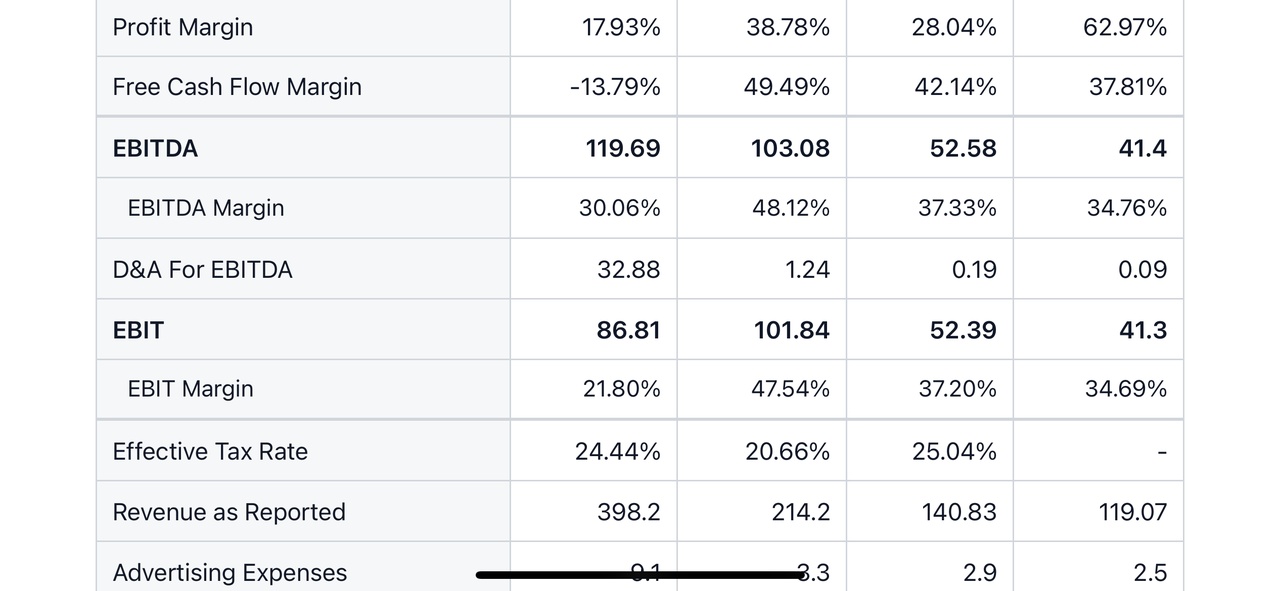

Let's switch to the figures 🔢

GROWTH AND SCALING 🚀

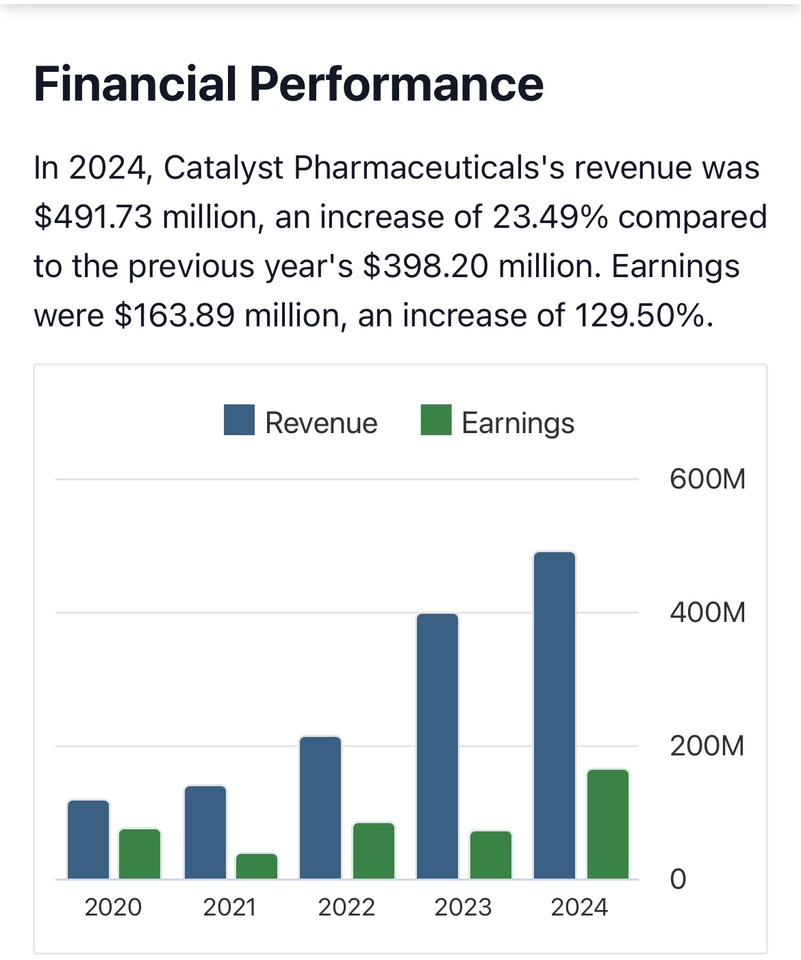

As we can see $CPRX (+1,12%) so far (since 2020) in the high double-digit growth, including the last two years 2023 & 2024🚀

What are the reasons for this strong growth? 🚀

the growth drivers 🔝

- Firdapse is by far the strongest segment in terms of sales with USD 306 million in 2024 (+18%) and a share of total sales of over 60%

followed by

- Agamree launched in March 2024 and already generated USD 46 million in net sales with a share of total sales of 9,4%

- Fycompa generated USD 137.3 million, stable compared to the previous year with a share of total sales of 27,9%

and other sales of USD 2.4 million only account for a share of 0,5% account for only 0.5%.

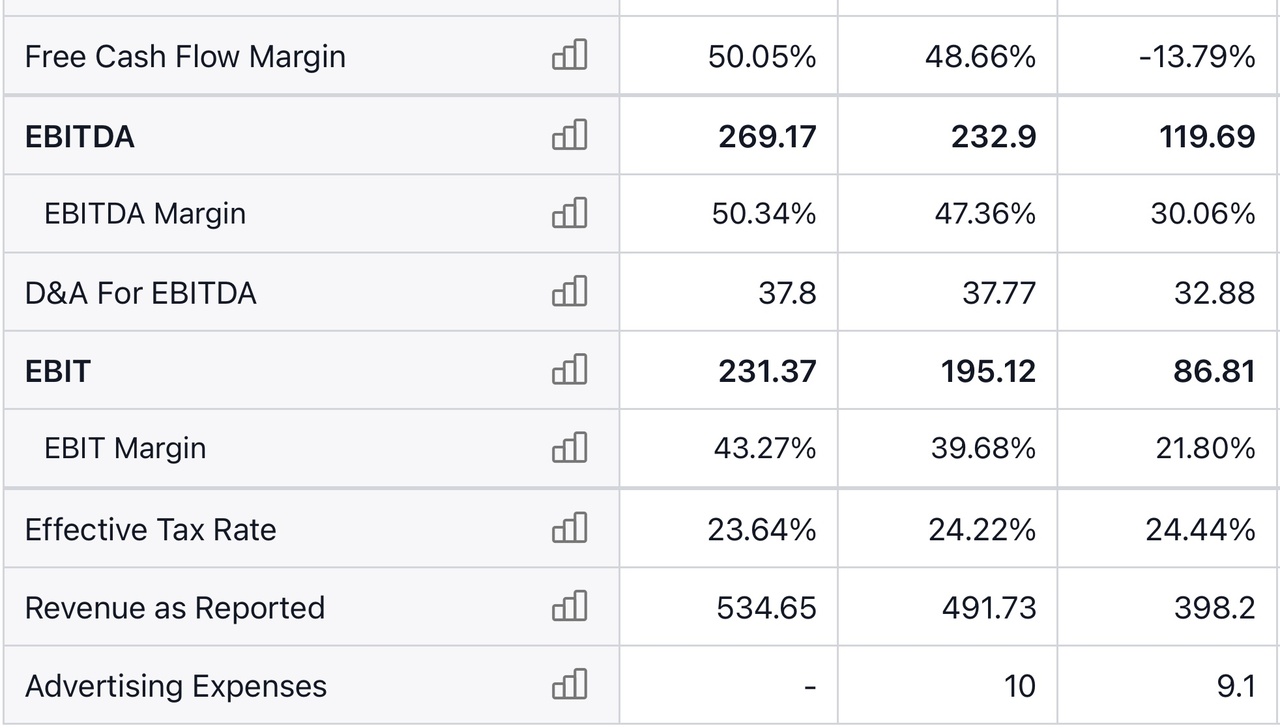

Financial strength and strategic flexibility

The financial health of Catalyst $CPRX (+1,12%) is a significant strength that underpins its growth strategy. The company ended the first quarter of 2025 with a robust cash and cash equivalents of 580.7 million US dollarsThis strong liquidity position is supported by consistent cash flow generation from operations, which totaled $60.0 million in the first quarter of 2025. The company operates without debt and offers significant financial flexibility.

GUIDANCE FOR 2025🔮

- FIRDAPSE: USD 355-360 million

- AGAMREE: USD 100-110 million

- FYCOMPA: USD 90-95 million (loss of exclusivity from May/December 2025)

- Total sales 2025: Expected USD 545-565 million

- Firdapse remains the sales pillar, is growing solidly and is expected to close at the upper end of the guidance range.

- Agamree gains market penetration - a promising start with strong growth.

- Fycompa delivers stable sales, but patent expiry threatens pressure in 2026

- Overall growth in product sales is clearly in the double-digit range - positive basis for further growth.

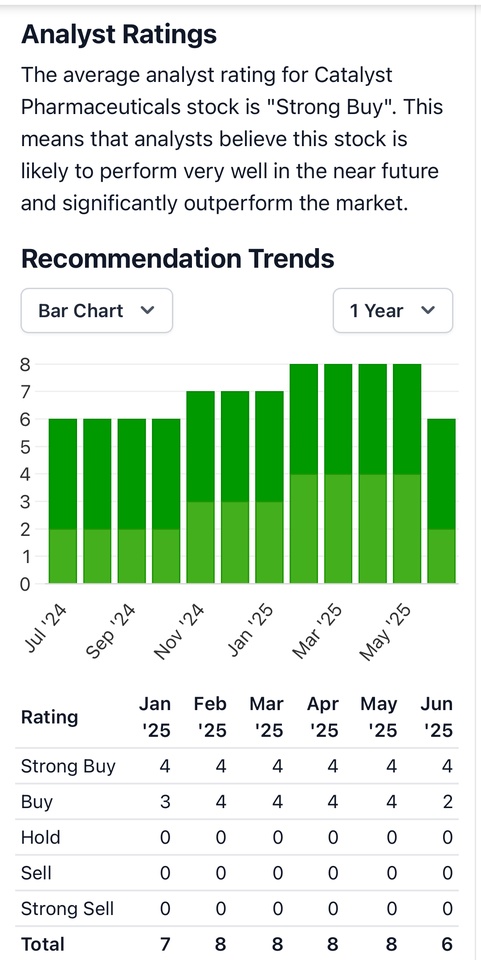

What do the analysts say? 📊

my conclusion $CPRX (+1,12%) Catalyst Pharmaceuticals ✍️

- Steady, dynamic growth since 2020 - sales quadrupled in just four years.

- 2022/23 as catalysts through market launches and expansion.

- CAGR over 5 years at around +37 %, significantly outperforms many competitors in the biotech sector .

- TTM sales continue to grow, currently over USD 530 million (Q1 2025).

$CPRX (+1,12%) Catalyst Pharmaceuticals has demonstrated strong commercial execution and strategic acumen, culminating in a record-breaking first quarter in 2025 and a reaffirmed optimistic outlook for the full year. The core investment thesis focuses on the company's ability to grow its profitable FIRDAPSE franchise and its rapidly growing AGAMREE assets supported by a robust balance sheet to drive continued growth through organic market penetration, lifecycle management initiatives and disciplined portfolio expansion through acquisitions and partnerships. While the impending loss of exclusivity for FYCOMPA represents a short-term headwind, the company's focus is positioned to maximize the value of this asset while strategically investing in its rare disease pipeline, particularly the differentiated AGAMREE and the durable FIRDAPSEfor long-term success. The strategic pivot to focus on the undiagnosed cancer-associated LEMS population and the ongoing studies to further differentiate AGAMREE underline the proactive efforts to expand market opportunities.

My first impression: What I have been able to find out in the last few days about $CPRX (+1,12%) is quite positive, which is why I opened my first position a few days ago and will add to it if it falls further.

I hope I haven't forgotten anything in this introduction 🫣 Have any of you been invested here for a while? And maybe more information for me that would be nice 😬

Would a company like $CPRX (+1,12%) something for your portfolio? @Tenbagger2024

@Max095

You are currently looking for health stocks 🧐 @BamBamInvest

THANKS FOR READING ✌️