As February unfolds, the tanker market is heating up, driven by tightening supply, geopolitical shifts, and a surprising resurgence in VLCC rates. The US crackdown on Iran and the shadow fleet, combined with growing crude exports from the US, Guyana, and Brazil, is stretching mainstream vessel availability. Meanwhile, tanker stocks are rallying as investors anticipate a prolonged upcycle.

📈 VLCCs: Rates Surge as Supply Tightens

VLCC rates saw a surprising rebound this week despite the Lunar New Year lull. Allied reports that time-charter equivalent (TCE) earnings have jumped above last year’s levels, signaling strong demand.

The Middle East Gulf/China route has firmed to the low WS 70s* ( See explanation at end of the post ) , with sentiment pointing to further upside. Owners are in no rush to fix, as the supply of available vessels remains under pressure. Hunter Group estimates that an additional 156 VLCCs could be needed by 2026 to accommodate rising demand, yet only 28 are scheduled for delivery over the next two years.

With more cargoes set to emerge and February being a short month, some profit-taking is expected, but the fundamental tightness in the market remains

1 Year T/C - VLCC ECO / SCRUBBER

🚢 Suezmax & Aframax: Market Holding Firm

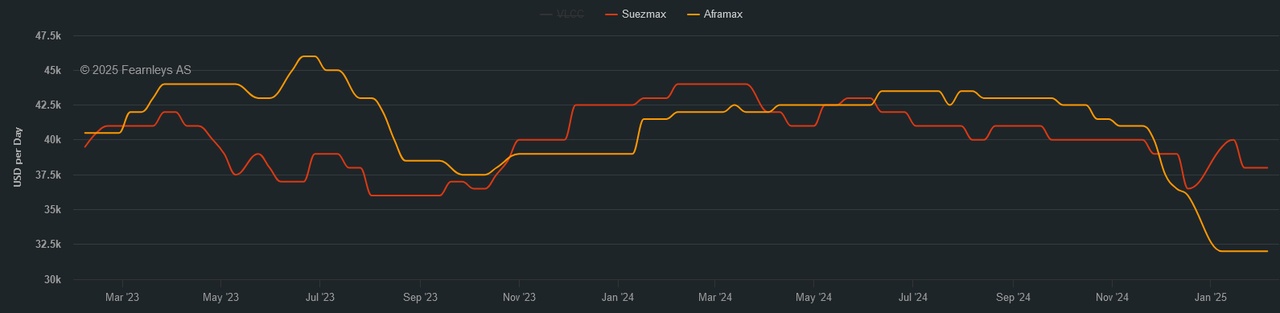

The Suezmax market is holding steady, with TD6 (Black Sea/Med) trading at a minimum of WS 92.5*, while TD20 (West Africa/UKC) is fluctuating between WS 90-92.5*. In the East, a recent fixture at WS 105* for a MEG/East run was below expectations, but owners remain optimistic given the tight vessel supply.

For Aframaxes, the North Sea market is stable, with oil company tonnage covering most stems. However, Mediterranean activity is picking up, and with tonnage thinning, rates could soon face upward pressure. The balance between Suezmax and VLCC demand in the region will dictate the next move.

1 Year T/C - SUEZMAX AFRAMAX ECO / SCRUBBER

🛢 Trump’s Maximum Pressure: The Shadow Fleet Dilemma

US President Donald Trump’s renewed maximum pressure campaign on Iran has sent ripples through the tanker market. If fully enforced, Iranian oil exports (1.7M bpd) could be replaced by mainstream Middle East Gulf barrels, requiring an additional 51 VLCCs.

Moreover, stricter sanctions enforcement is already impacting the shadow fleet. Hunter Group reports that many older, sanctioned vessels are now accepting steep discounts on scrap values, signaling potential exits from the market. However, dark fleet scrapping remains challenging, with some owners struggling to find yards willing to take sanctioned tonnage.

Visual by Grok

📊 Tanker Stocks Rally Amid Supply Constraints

Investor sentiment is turning bullish, with tanker stocks in New York and Oslo surging after Trump’s announcement. Frontline ($FRO (-0,94%) ) jumped 7.5% in New York, while DHT Holdings ($DHT (-0,61%) ) rose 3.5%. Analysts believe China will likely cooperate with the US by shifting crude purchases away from Iran, adding demand for an estimated 20-50 VLCCs.

Meanwhile, DHT Holdings posted a strong 2024, with net profits at $181.5M, up from $161.4M in 2023. The company has booked 74% of available VLCC spot days for Q1 2025 at $36,400/day, reflecting confidence in continued rate strength.

🌍 Geopolitics & Trade Flows: What’s Next?

China’s Tariffs on US Oil & LNG: ANZ reports that China’s tariffs on US energy imports are unlikely to have a major impact on oil prices in the short term.

US-Canada-Mexico Tariffs on Hold: The Trump administration has paused 25% tariffs on Canadian and Mexican imports for at least 30 days, reducing uncertainty in North American energy flows.

📈 Looking Ahead: Bullish Sentiment Grows

With VLCC supply historically tight, the orderbook at record lows, and sanctions reshaping trade flows, tanker fundamentals remain firmly in owners’ favor. As geopolitical tensions escalate and crude exports rise, the market is primed for further upside.

💬 Let’s Connect!

Will VLCC rates push past WS 80*? Will shadow fleet scrapping accelerate? Feel free to share in the comments and don't forget to like and share this post 🚢

*The Worldscale (WS) rate is a system used to calculate tanker freight rates, where WS 100 represents a standard base rate for a specific route. Rates above or below this benchmark indicate how much more or less a charterer will pay relative to the base cost. A higher WS rate means better earnings for shipowners, while a lower WS rate means lower transportation costs for charterers.