This isn’t your typical watchlist — it’s a who’s who of the companies the U.S. needs to stay ahead in energy, defense, and AI supply chains.

Let’s break it down 👇

⚛️ Nuclear Energy & Uranium:

The U.S. wants energy independence — and that means uranium.

Names like $UUUU (-0,97%) , $LEU (-3,47%) , $CCO (-1,74%) , and $NXE (-0,9%) are at the center of the nuclear revival. Even micro-reactor plays like $OKLO are making noise as America rebuilds its atomic backbone.

🔋 Batteries & Energy Storage:

$TSLA (-1,98%) is still here, but the real upside could come from lesser-knowns like $AMPX (next-gen lithium-ion) and $MVST (-4,37%) (solid-state tech).

These are the quiet enablers of the EV and grid storage boom — and every megawatt stored is national security now.

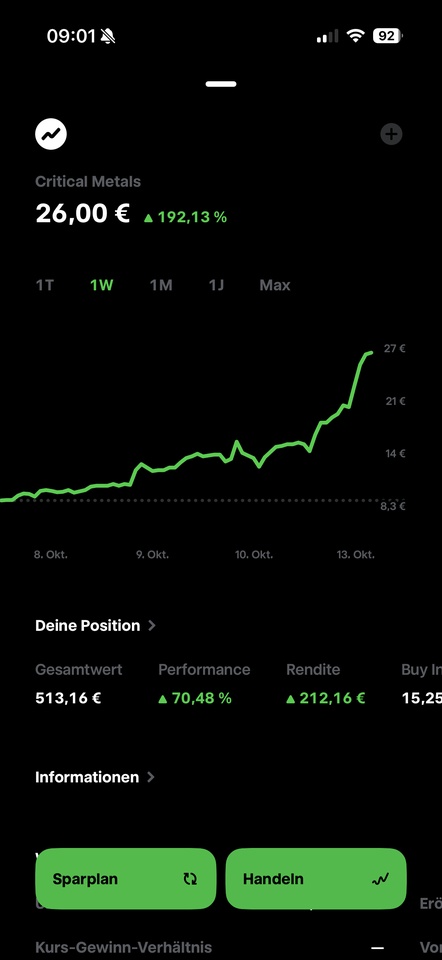

🪨 Rare Earths & Strategic Metals:

China controls 70%+ of this market — and the U.S. wants out.

Morgan Stanley highlights $MP (+0,64%) , $CRML (+5,88%) , $IVN (-0,97%) , and $WPM (+1,82%) as key players in securing rare earth supply chains critical for chips, missiles, and EVs.

⚡ Lithium:

Without lithium, there is no clean energy transition.

Watch $ALB (+2,69%) , $LAC (+0,56%) , $SGML (+0,94%) , and $SLI (+0,41%) — these are the lifelines for the world’s next battery superpowers.

💡 The takeaway:

This “National Security Index” isn’t just about defense — it’s about control of the future’s raw power: energy, data, and materials.

And the firms on this list aren’t just suppliers — they’re the gatekeepers of U.S. sovereignty in a world of rising geopolitical tension.

If you’re betting on where the big government money flows next… this might be your roadmap.