Blackrock Q3 2024 - How does it look?

In the Q3 2024 earnings call from $BLK (-0,39%) several key financial and strategic developments were highlighted.

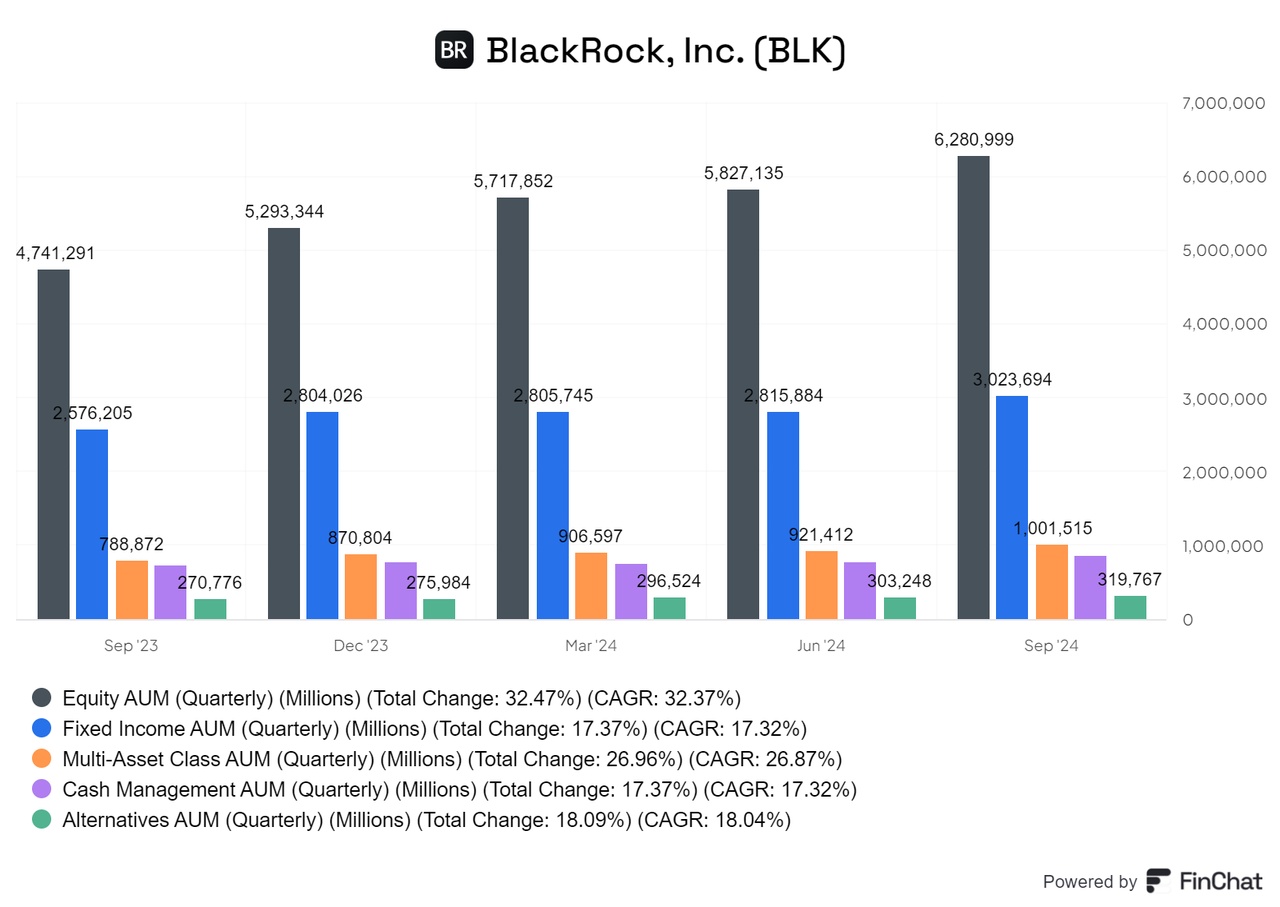

The firm recorded net inflows of USD 221 billion, the highest quarterly figure in the firm's history, and ended the quarter with USD 11.5 trillion in assets under management (AUM) - an increase of 26% year-on-year.

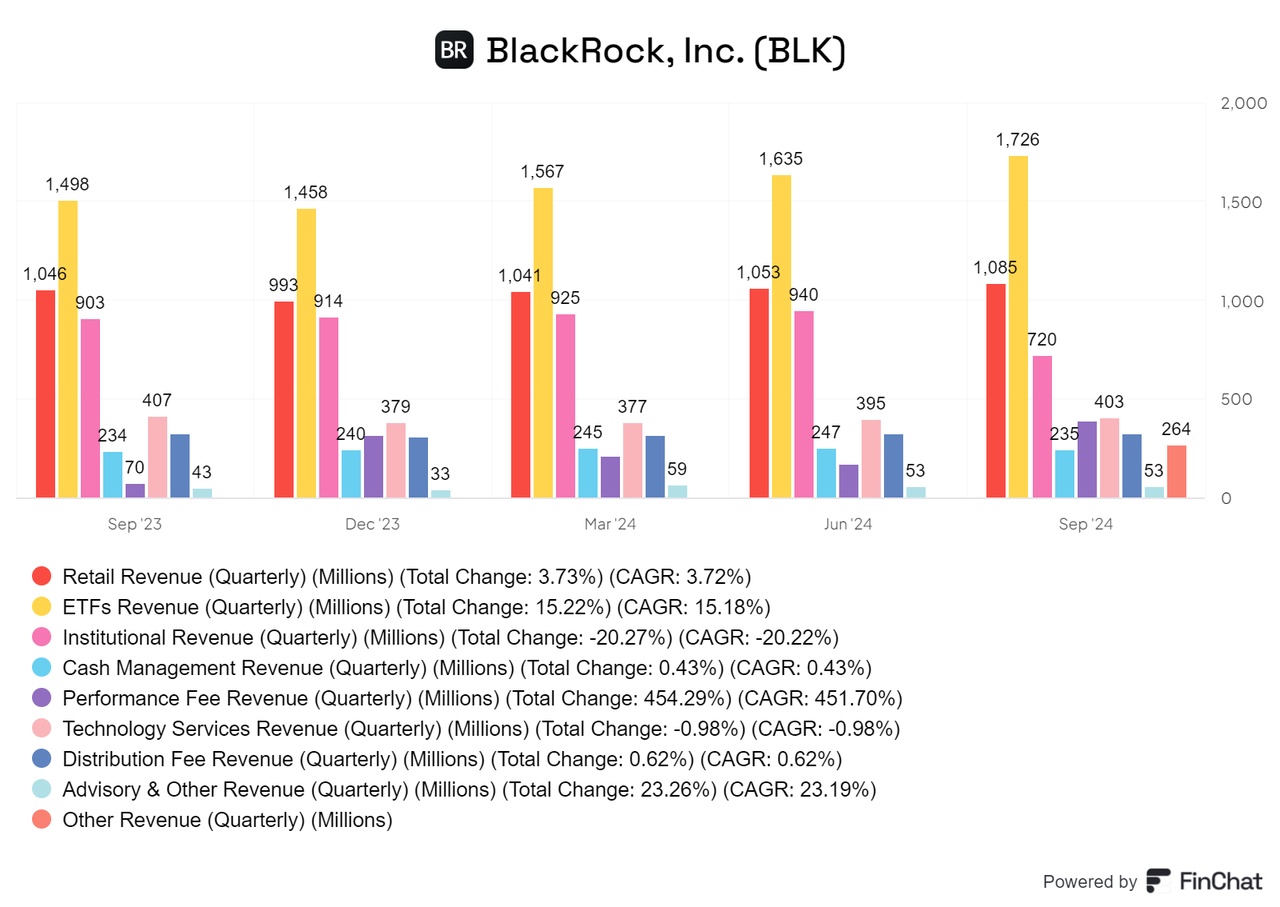

BlackRock delivered organic base fee growth of 5% annualized, the highest in three years, supported by strong results in iShares, holistic portfolio management and the Aladdin platform.

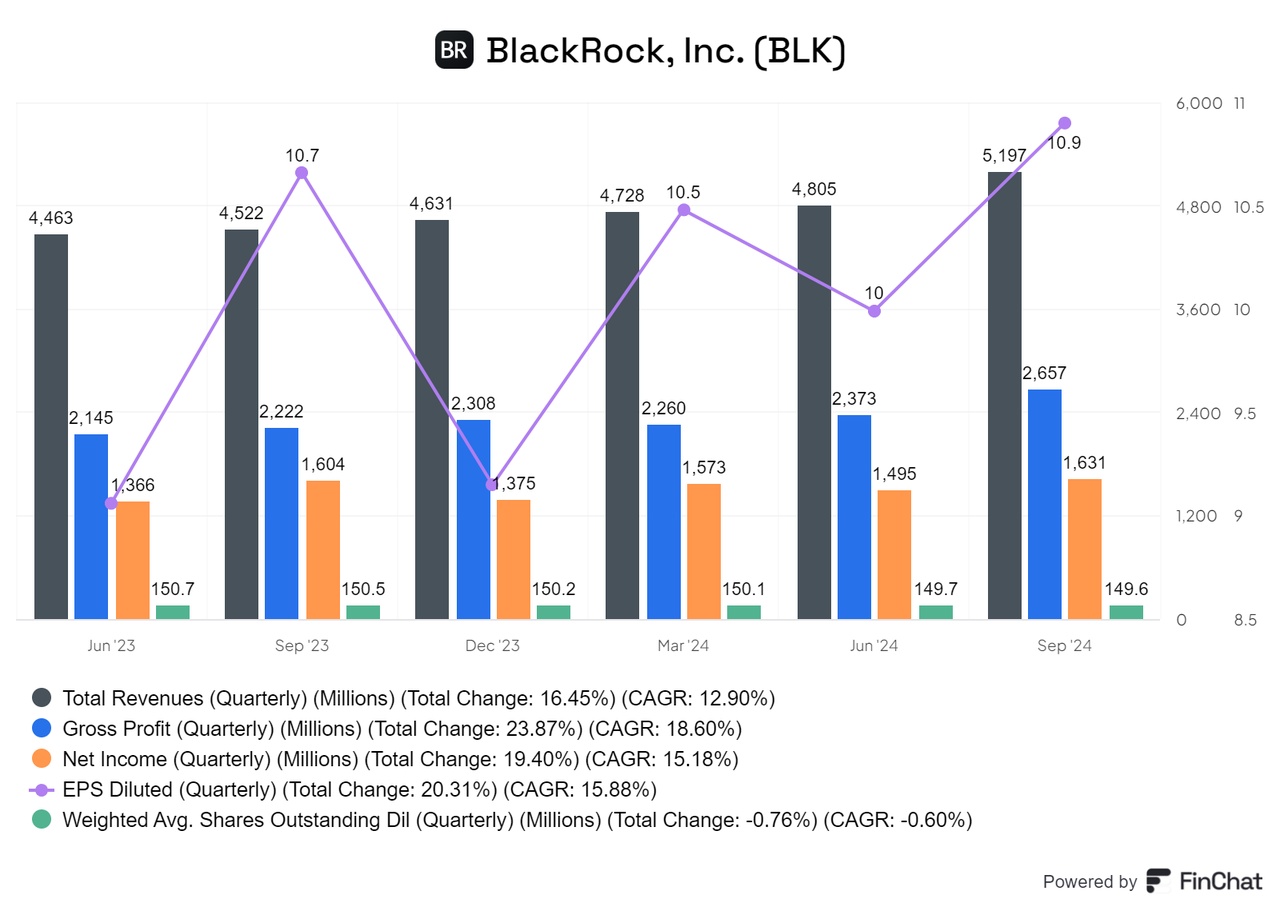

The firm's operating income increased 26% year-over-year to $2.1 billion, with an operating margin of 45.8%, up 350 basis points. Earnings per share increased by 5% to USD 11.46, despite a higher tax rate compared to the previous year.

Strategically, BlackRock emphasized expansion into private markets, particularly following the acquisition of Global Infrastructure Partners (GIP), which added $116 billion in client assets and is expected to contribute approximately $250 million in management fees in the fourth quarter of 2024. The integration of GIP is expected to double BlackRock's recurring private markets management fees.

The firm also highlighted its partnership with Microsoft and MGX, which led to the creation of a global infrastructure investment partnership for AI, with the goal of capitalizing on the growing demand for data centers and energy infrastructure. This initiative is part of BlackRock's broader strategy to explore new investment opportunities in infrastructure and artificial intelligence through scale and partnerships.

Overall, BlackRock's results reflect strong organic growth, strategic expansion into private markets and continued innovation in financial products, which positions the company well to grow further in the coming years.

A good quarter for shareholders