$Sofi is my largest position.

Sofi is an online bank that focuses on the next generation of personal finance. The majority of its revenue comes from banking - personal loans, home loans, student loans, investments, credit cards, etc. Sofi is innovating the banking sector by offering an attractive savings account (4.6% APR) and, unlike the institutions - $BAC (-0,48%)

$WFC (+0,04%)

$CCF etc. - no longer requires physical locations.

Looking beyond the pure banking business $SOFI (-0,5%) aims to offer the best products as a one-stop-shop financial services platform for consumers and businesses - In the form of a: AWS by FinTech.

Galileo:

$SOFI (-0,5%) has been the owner of FinTech pioneer Galileo since 2020. Galileo has been manufacturing FinTech products since 2003. They offer technology for payment processing and card issuing. The company offers a platform that enables companies to create and manage different types of payment cards (debit or credit cards) and facilitate transactions with these cards. Essentially, Galileo helps businesses build and operate their own payment systems so that they can offer their customers seamless and secure ways to make purchases and transactions.

Technisys:

Since 2022 $SOFI (-0,5%) also owner of the FinTech company Technisys. Technisys develops software that helps banks and financial institutions to offer digital banking services to their customers. They develop tools and platforms that make it easier for people to check their account balance, transfer money or apply for loans simply by using their phone. Simply put, Technisys helps banks make online banking better and more convenient.

Cyberbank Konecta:

A concrete use case for $SOFI (-0,5%) as the owner of these two FinTech companies is the development of the AI-driven digital assistant Cyberbank Konecta (CK), which improves Sofi's user interface. CK has improved customer service by 7% by handling thousands of conversations around the clock without the use of customer service agents.

Vertical integration:

The acquisition of these two companies will $SOFI (-0,5%) reduce costs and expenses by excluding third-party providers (probably AWS) from the business model of $SOFI (-0,5%) business model. This will allow $SOFI (-0,5%) innovate even faster, make more decisions in real time and offer greater personalization to its 7.5 million members.

Since 2020, the number of Galileo accounts has increased from 30 million to 145 million (as of December 2023).

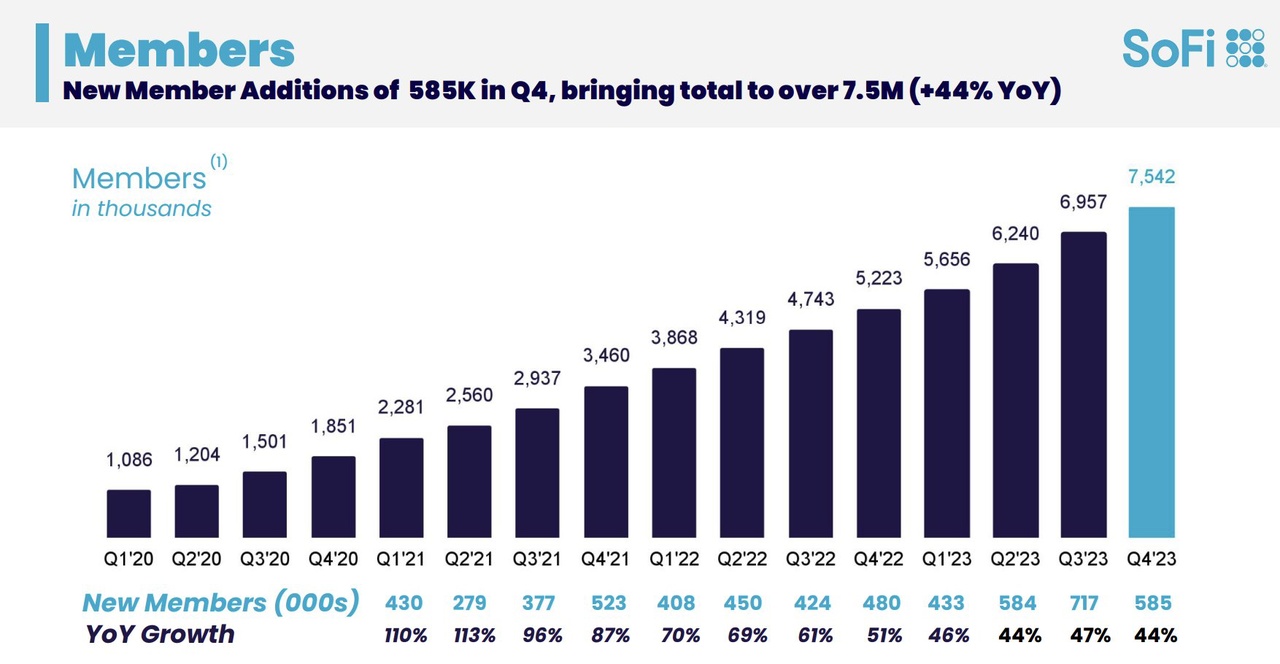

The number of Sofi members (customers with any Sofi account) has increased from 1 million in 2020 to 7.5 million now.

Official bank of the NBA:

Recently, Sofi signed an agreement with the NBA that makes Sofi the official bank of the NBA, NBA 2K (computer game series released annually) and others.

This is of great importance:

Massive amounts of Sofi advertising in arenas and NBA promotions. Some people will certainly switch to $SOFI (-0,5%) switch to do their banking.

CEO, Anthony Noto, says of the partnership:

"As the next generation of banking, we believe we can help millions of NBA fans across the country reach their financial goals and invest their money the right way."

Contest:

It's no secret that $SOFI (-0,5%) has massive amounts of threats and competition around it in the FinTech space.

Between the traditional big bank$BAC (-0,48%)

$JPM (-0,51%)

$WFC (+0,04%) etc. & all the smaller players, like $ALLY (+0,04%)

$SQ (+1,7%) & $HOOD (-0,38%) Sofi definitely has an uphill battle when it comes to market share in financial services.

$SOFI (-0,5%) offers one of the highest yields for a savings account, making it stand out from the crowd - 4.6% APY

I would $ALLY (+0,04%) as its strongest competitor.

$ALLY (+0,04%) is a competing online bank that offers a decent savings account (4.35% APY) and pretty much everything that $SOFI (-0,5%) offers (general banking), but I believe that $SOFI (-0,5%) with the support of Galileo & Technisys to help with their vertical integration, will have an advantage over time (if they don't already have it now).

$HOOD (-0,38%) Offers 5% APY on your uninvested cash, but you have to subscribe to Gold to get the benefits. Also, Sofi has many more use cases than Robinhood.

$HOOD (-0,38%) Should be perfect for investing

$SQ (+1,7%) & $PYPL (-0,17%) are more in the area of payment processing.

$SOFI (-0,5%) is for EVERYTHING to do with personal finance - that's what sets Sofi apart from the other, more niche FinTech companies.

Advantage of General Banking:

Let's say a teenage person, watches NBA games and happens to be looking for a bank to set up deposits/salary for the summer job he/she is about to get.

The person is not thinking about investing money yet or transferring money to other people/companies

the person is just trying to earn money.

He/she sees an ad as part of an NBA commercial, be it on NBA 2k or as part of the basketball game the person is watching and decides to go with the first bank that catches his/her attention.

$SOFI (-0,5%) will surely catch their attention long before their parents can convince them to go to their trusted bank. $BAC (-0,48%) , $JPM (-0,51%) or $WFC (+0,04%) to go.

What happens if, for example, 3 years later the same child wants to apply for a student loan?

$SOFI (-0,5%) will receive interest payments from this student for a decade.

What happens if this person starts looking for an apartment?

$SOFI (-0,5%) will receive interest payments on this loan for a lifetime.

What I'm saying is that a customer that $SOFI (-0,5%) once acquired is likely to stay for life. (As a rule, you don't change banks so quickly once trust has been built up, no serious mistakes have been made and you have everything in the area of finance/insurance with this bank).

Especially if CK (Cyberbank Konecta) continues to improve and the customer service removes any urge to wander.

This lifetime income stream from every member will lead to this company slowly growing into a huge banking institution.

Along with Galileo and Technisys slowly eliminating the need for third parties within the organization, this will inevitably lead to $SOFI (-0,5%) becoming one of the most cash-rich players in the FinTech space over time.

This is Sofi's competitive advantage over other smaller FinTech companies.

Continued vertical integration and greater TAM (Total Addressable Market / Total Available Market)

Sofi is the future of banking.

Key figures - Q4'23

Sofi has 7.5 million members, 44% more than last year (5.2 million). This number has been growing by more than 300,000 members quarter-on-quarter for over 2 years. In the last quarter, the number of members grew by over 500K. The number of Sofi members has been growing quarter on quarter for years.

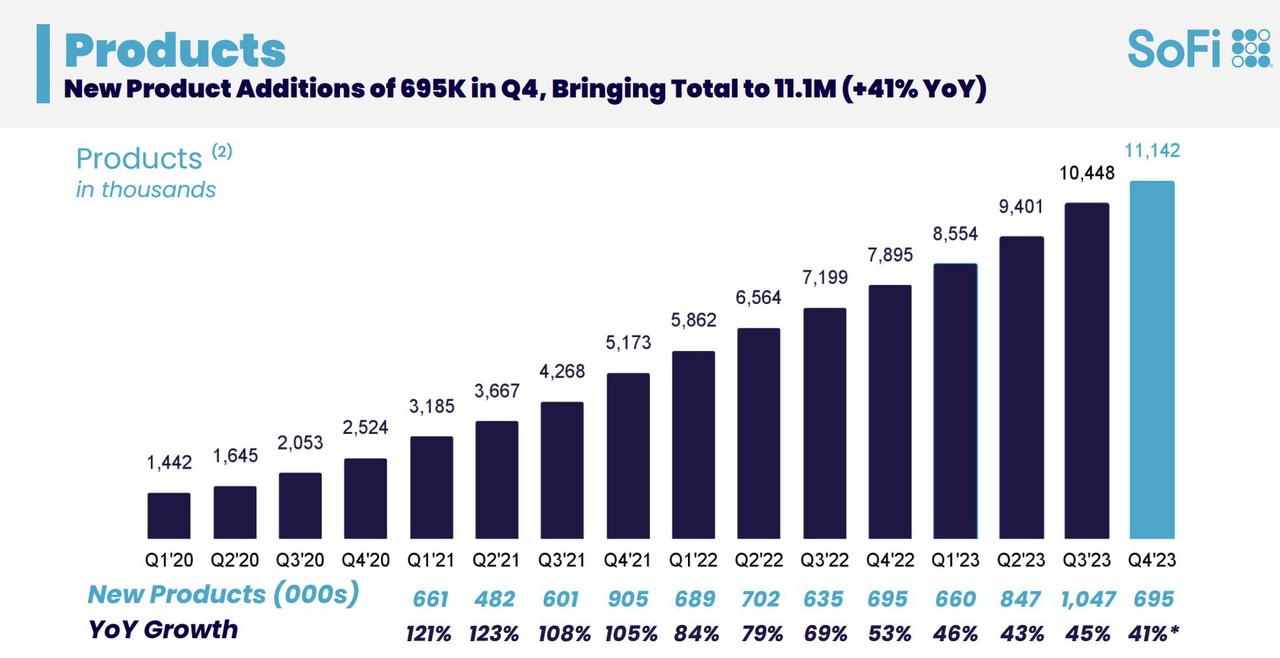

The number of products* stands at 11.1 million, an increase of 441% compared to 7.9 million in the previous year. This number has grown steadily over the years, just like the number of members. I prefer this performance to a one-off boom. This allows the company to improve its capabilities as capacity grows.

Imagine if you were randomly placed in the CEO position of a large company tomorrow. You would probably do a terrible job if you had been groomed for the position over the last 3 years. The same goes for the number of customers a company has.

*This number refers to the total number of credit and financial products used since Sofi was founded. Imagine that this figure indicates how many services have been used. Personal loans, student loans, savings accounts, investment accounts, etc. If a user has two loans of the same type - 2 personal loans - then it counts as one, but if a user has different loan types - 1 personal loan and 1 home loan - then it counts as 2.

Galileo accounts* are at 145 million, up 11% from 131 million last year. The more this account grows, the more Sofi's business diversifies. Galileo not only improves Sofi's UX, but also develops products for other companies, expanding the business model not only to B2C, but also to B2B.

*Number of users using Galileo-based products, including virtual card products, virtual wallets, peer-to-peer and bank-to-bank transfers, advanced paychecks and more. Galileo products are also the main driver of tech platform accounts, as Technisys is not yet fully ready to be included in the segment.

Credit products* are at 1.6 million, up 24% from 1.3 million last year. IMO this metric is more important than financing products. Here, transactions are concluded for life. Student loans, home loans, products that need to be paid off for life. These products are the gifts that keep on giving. Especially in the current economic environment, Sofi can charge extremely high interest rates until the Federal Reserve decides to lower rates. Imagine paying for a $400,000 Sofi loan, but paying an extra $600,000 in interest over the course of 30 years - that's tough, but great for the lender!

*Relative to the number of personal loans, student loans and home loans.

The number of financial products* is 9.4 million, up 45% from 6.5 million last year. Like every key figure, this figure has been rising steadily over several years. This is an indicator of how many accounts Sofi has to which people transfer money. In Q4 2023, Sofi stated that more than half of new users of Sofi money (current accounts and savings accounts) signed up for direct deposit within 30 days. That's great. That's how you retain members for life. It starts with a summer job, then a career, then investing with Sofi, then looking at their other products. This is the gateway that paves the way to the next generation bank - Direct Deposits.

*Relative to the number of the following accounts: Current Account & Savings, Investing, Credit Cards & more.

Finance:

Income:

Income has risen sharply in recent years.

Sofi has increased its annual revenue from USD 565 million in 2020 to USD 2.1 billion in 2023.

Much less than $ALLY (+0,04%) but at least Sofi is growing EVERY year.

Annual sales growth:

2021: +74% compared to the previous year

2022: +60% annually

2023: +33% YoY

2024: Estimated +16% YoY

2025: Estimated 17% YoY

Profitability:

In Q4 2023, Sofi finally announced a net profit for the first time, whereupon the share price rose by 20%.

We are still in the early stages of this company's profitability, with forecasts suggesting that it will be maintained in the future.

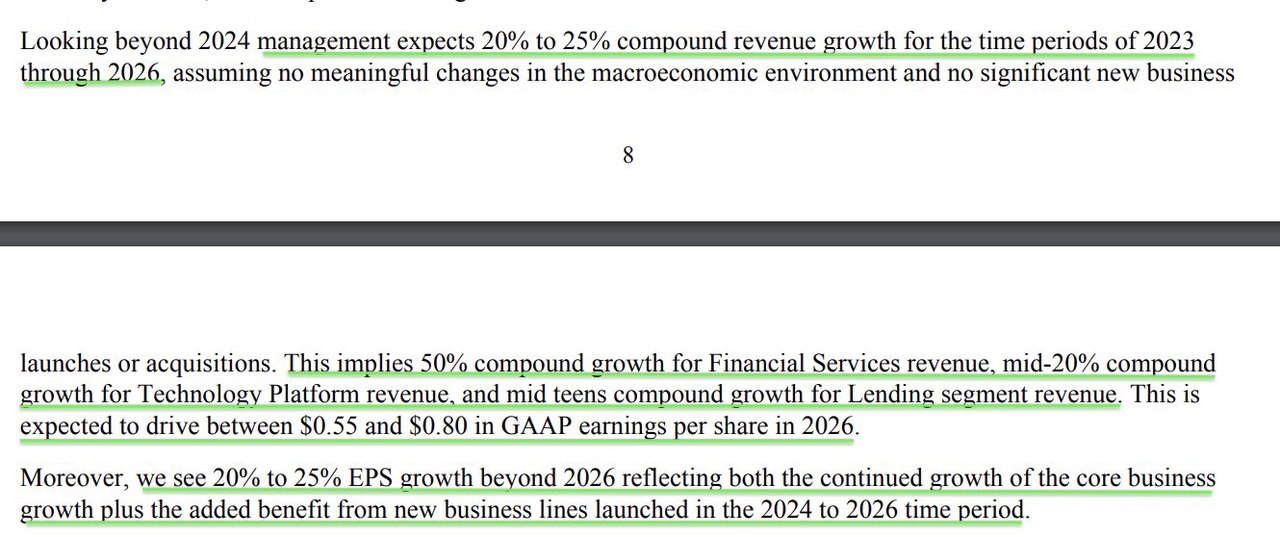

Guidance:

The company forecasts 2026 GAAP EPS of $0.55 to $0.80 and further EPS growth of 20-25% beyond 2026.

This means that Sofi's unprofitable days are over and earnings per share should increase over the next few years.

Sofi expects the following revenues for the period from 2023 to 2026:

Revenue: +20-25%

Revenue from financial services: +50%

Tech Platform Revenue: +mid -20%

Revenue from loans: +mid-teens%

Either way, this company has massive growth ahead of it, which is likely to accelerate over the next few years.

Balance sheet

Sofi has about $3B in cash and $5.2B in debt. Total liabilities: $24B

Not the strongest cash position, but not the worst either. This will improve as profitability improves.

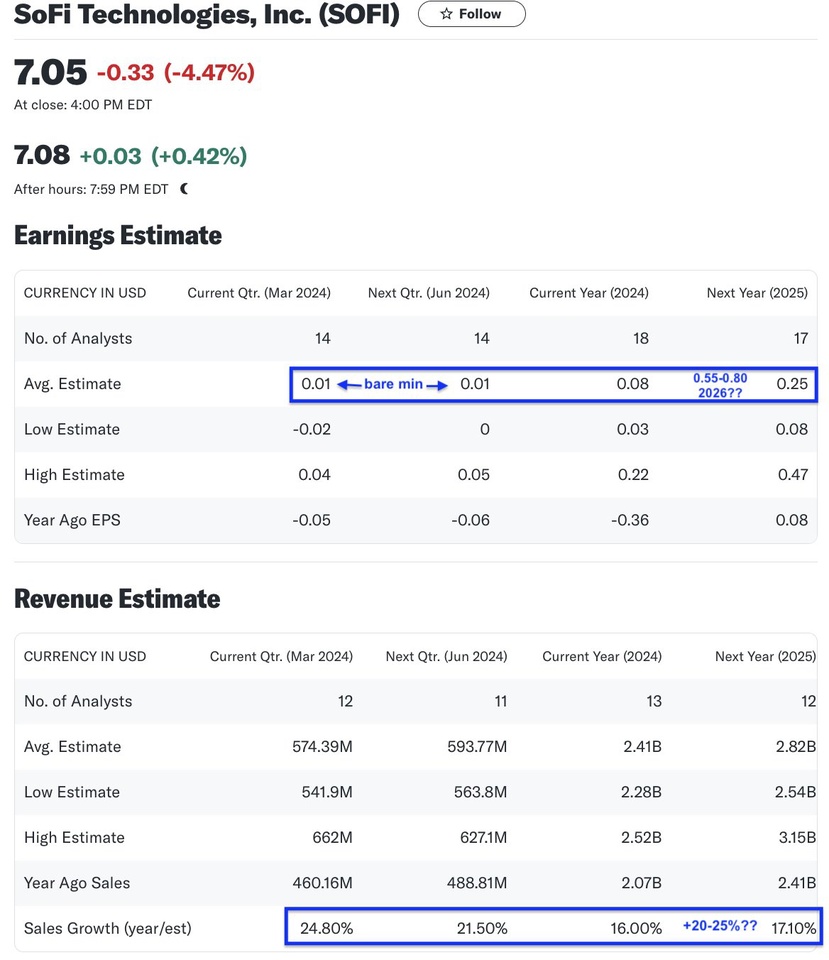

Analysts:

Turnover:

Analysts currently expect Sofi's annual turnover to grow by only 16% in 2024 and by 17% in 2025.

This is not in line with the forecast of average sales growth of +20-25% from '23 - '26

EPS:

For the next 2 quarters, analysts only expect Sofi to remain profitable with expected EPS of $0.01 for Q1 and Q2. They do not expect EPS to accelerate.

What happens if Sofi outperforms the market?

The analysts also expect Sofi to report annual EPS of only $0.08 for 2024 and $0.25 for 2025.

Either the analysts expect a boom in 2026 or their estimates for Sofi are too low for the next few years.

Overall, I expect a jump in earnings over the next few quarters.

Valuation:

Analysts expecting Sofi to report just $0.08 for 2024 equates to a Fwd PE of 100+

Assuming where the company will be in 2026, this is too low - the P/E ratio is even significantly lower.

A decent acceleration of $0.25 is expected for 2025, which equates to a P/E of 29, but I think that's still too low compared to their vision for 2026.

Sofi will report higher earnings per share in the next few years, which means that the P/E ratio is much lower than what they are currently reporting.

Closing words:

Not only do I believe that Sofi has a bright future ahead of them with their sticky business model and strategic thinking, but I also believe that Wall Street has slept through Generation Z's online bank.

Normally people have their bank for life and this is the next generation's bank.

What happens when their youthful 7.5 million members grow up and start needing student loans, home loans, credit cards, etc.?

The money they make from those 7.5 million members will accelerate/grow as their members' lifestyles become more mature and expansive and they make more money.

It starts with a savings account, then you start investing with $SOFI (-0,5%) then you set up direct deposit, then a credit card, etc.

The business model is very consistent.

Think about the last time you changed your bank .....

I sometimes find it too difficult to change brokers, even though there are brokers with lower transaction costs in Austria.

Because mine is tax-simple and I don't have to worry about it myself!

A one-stop store in Austria would be a blessing, but unfortunately I think this will take a while yet, if you look at our banking system, regulation and data protection.

For these reasons I am $SOFI (-0,5%) so convinced.

$SOFI (-0,5%) is the bank of the future.

About Galileo:

https://www.galileo-ft.com/about/

About Technisys:

About Cyberbank Konecta:

About NBA Partnership:

https://pr.nba.com/sofi-nba-partnership/