Hello my dears,

I wish you all a happy and successful New Year.

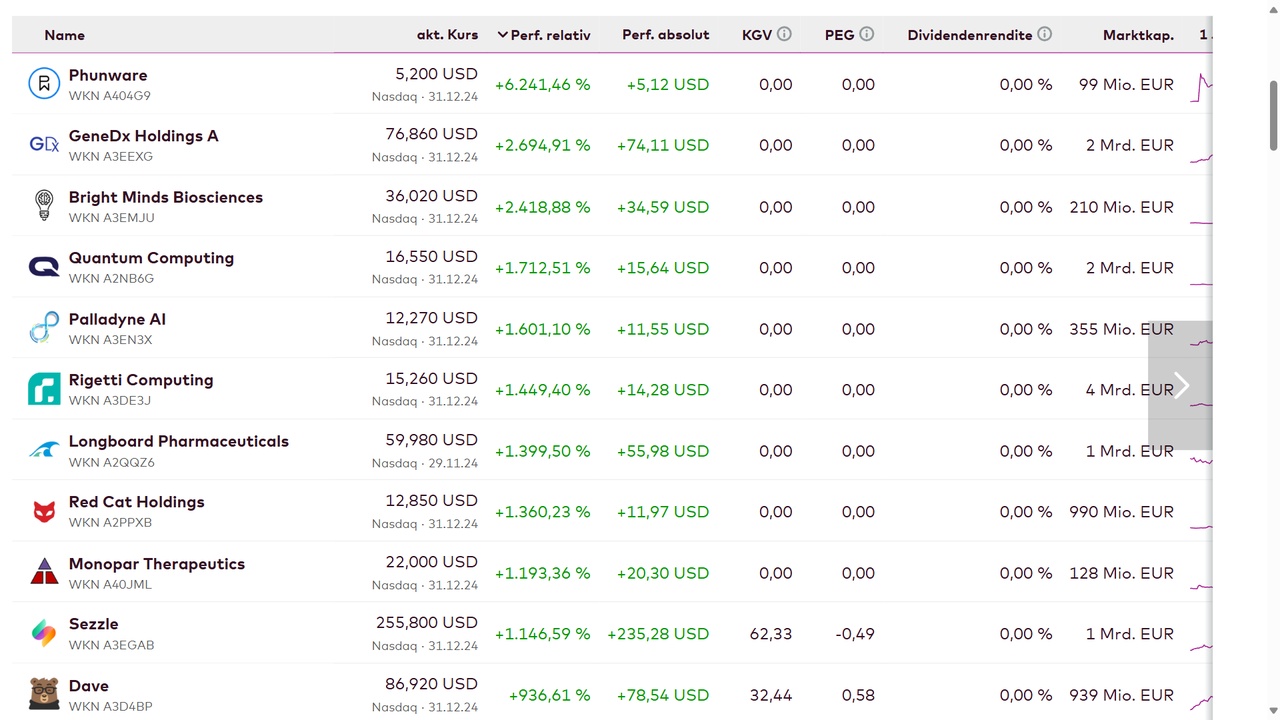

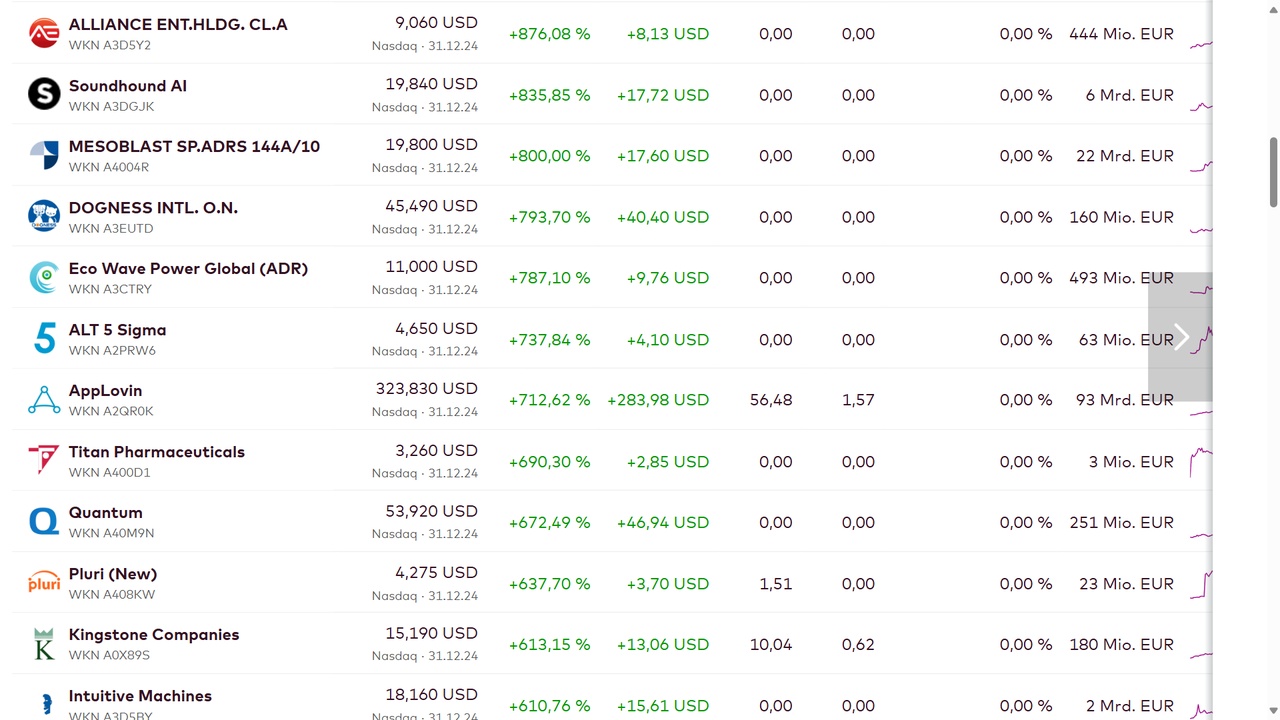

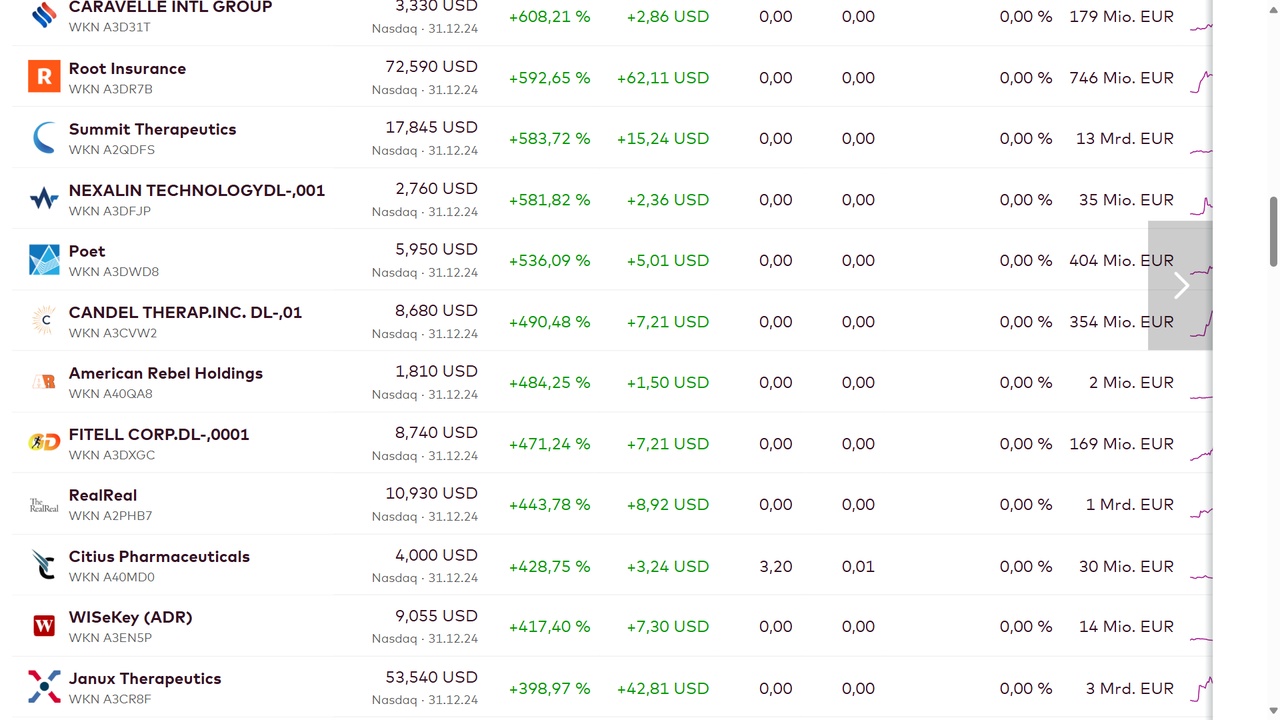

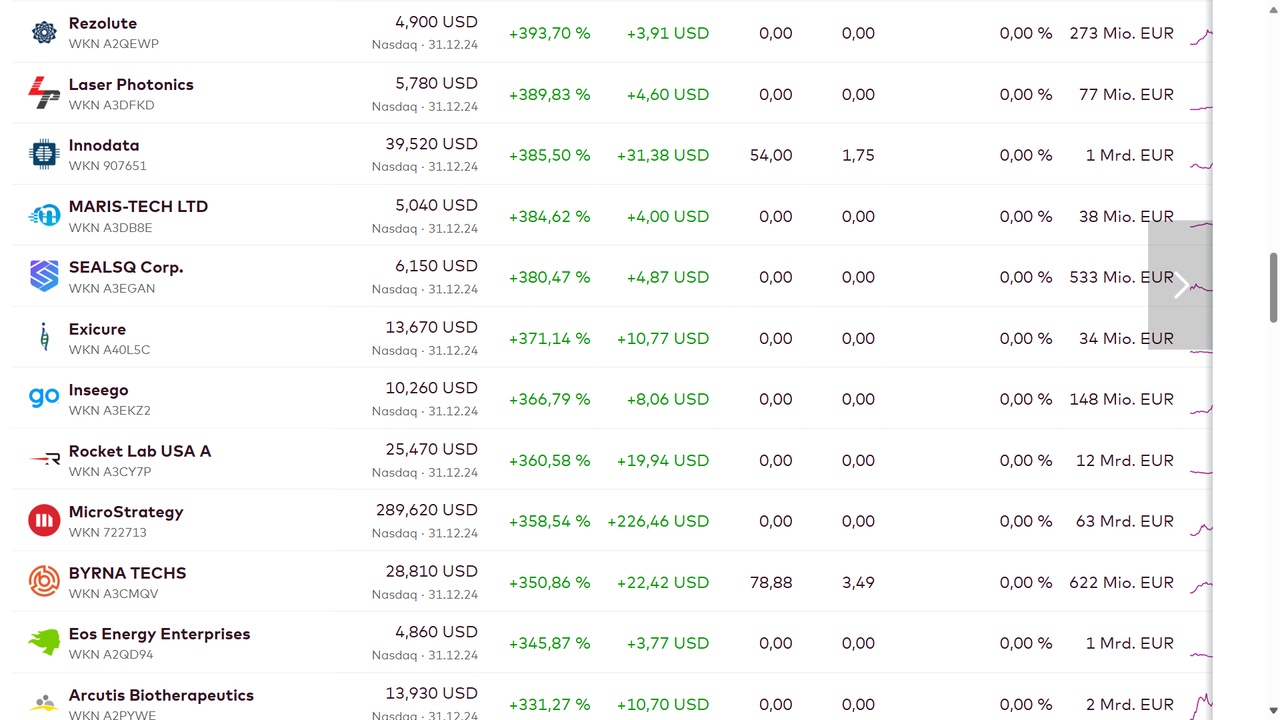

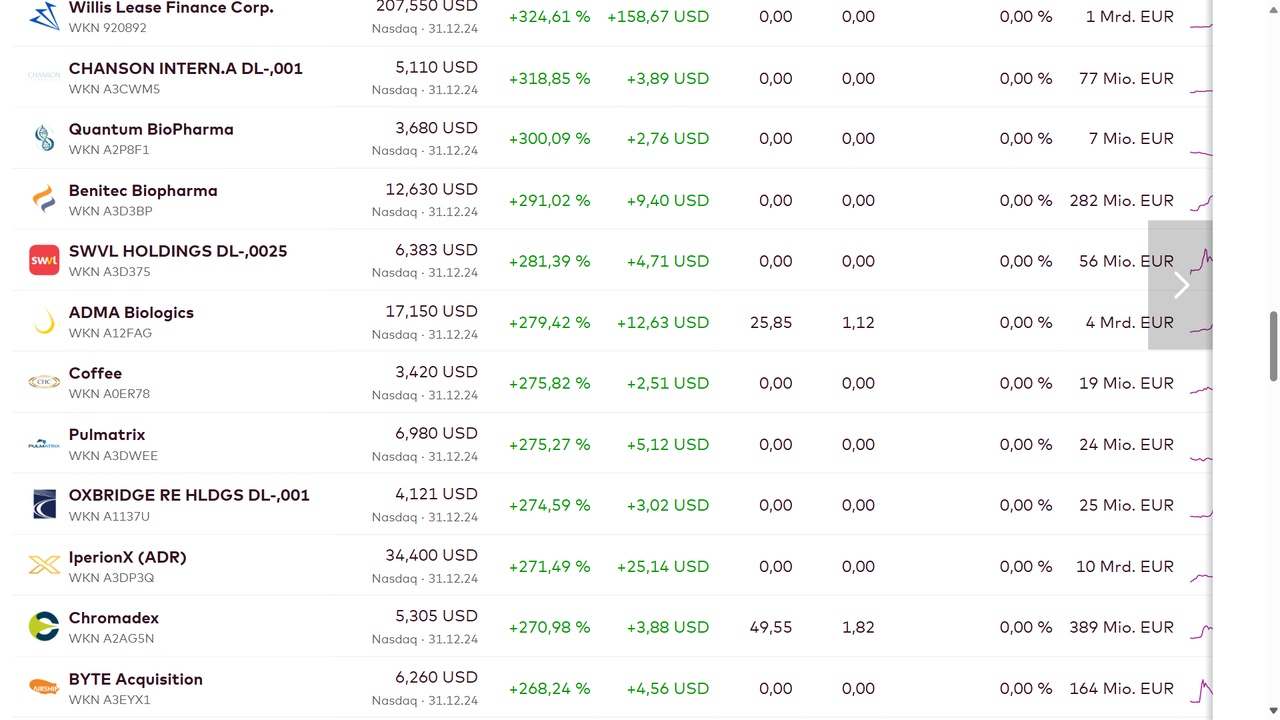

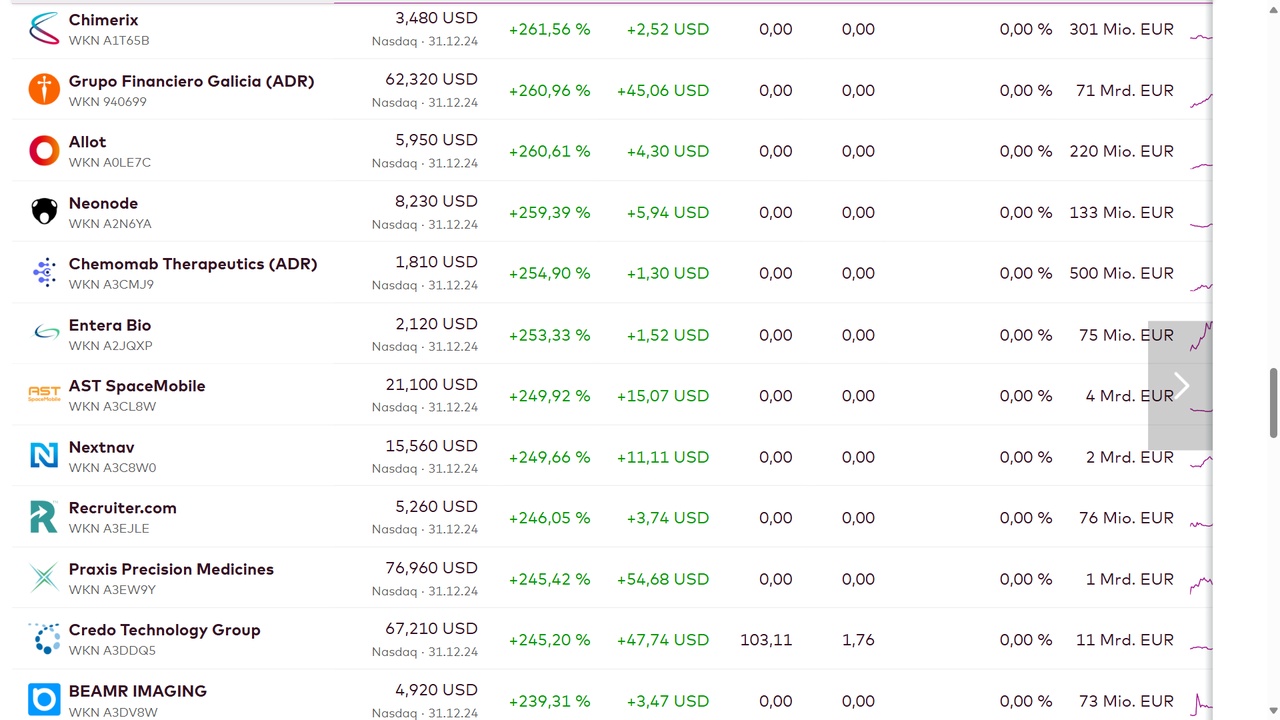

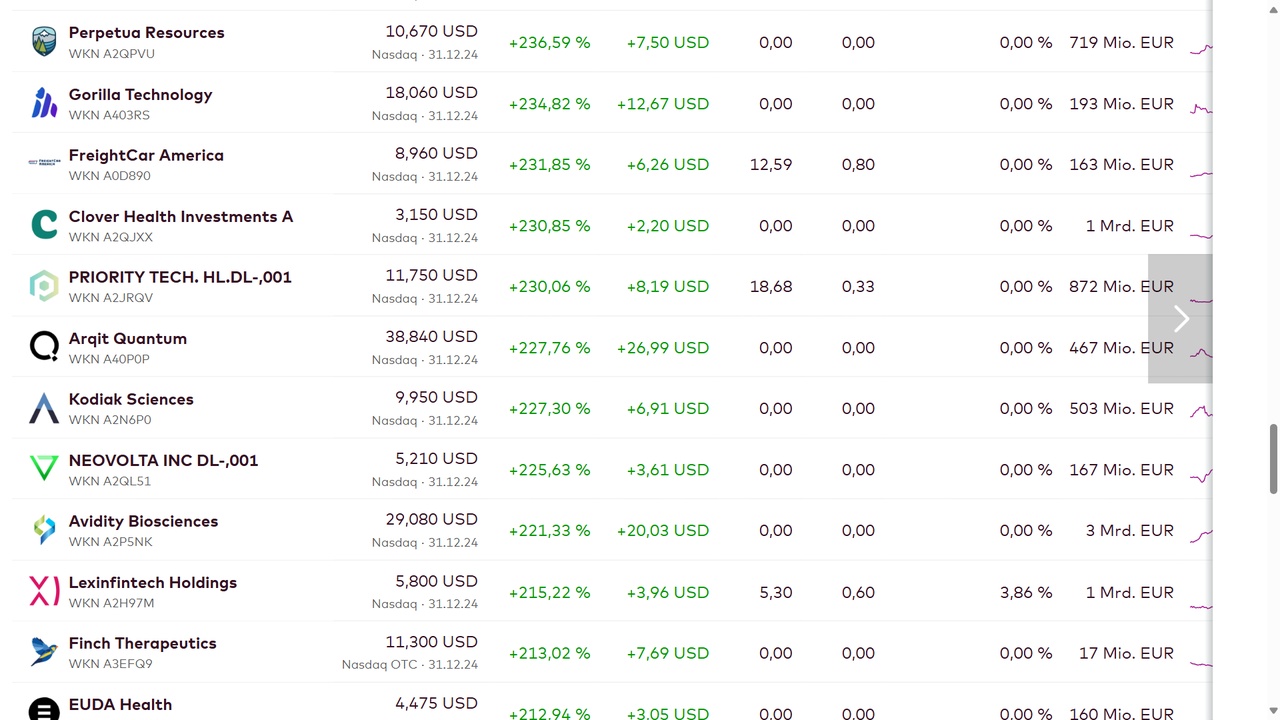

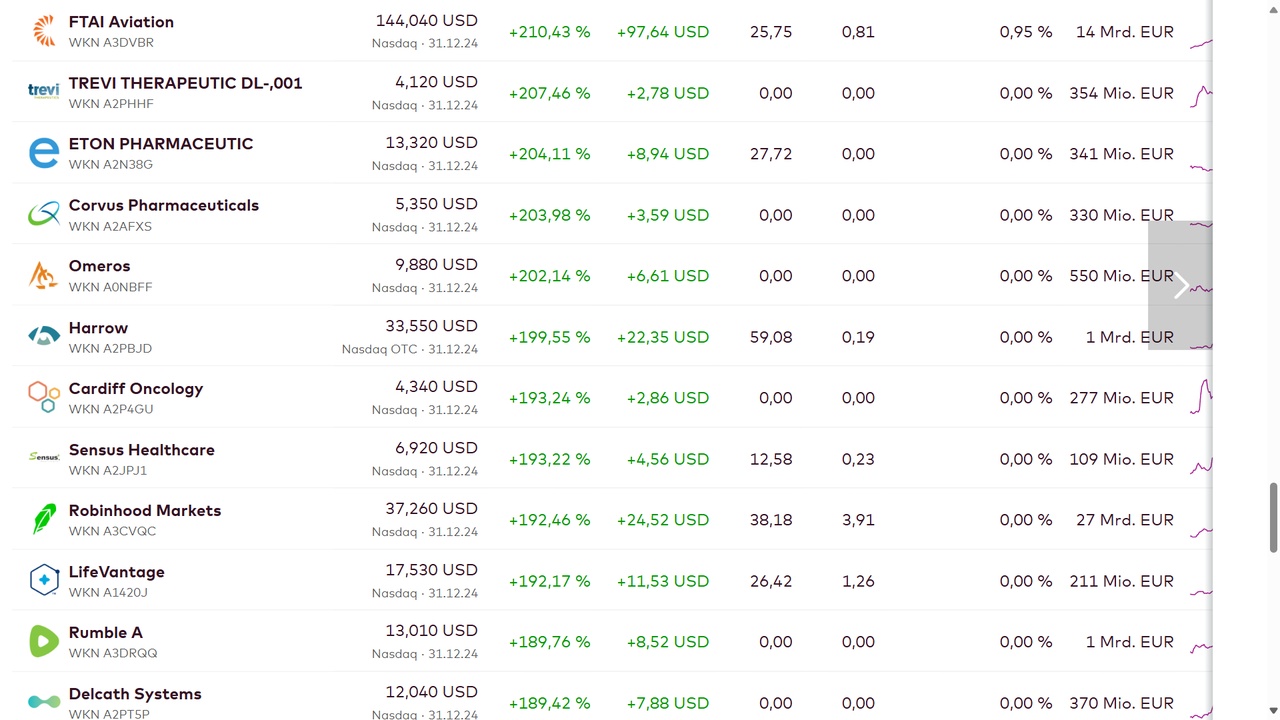

Looking back, I have picked out the TOP stocks from the NASDAQ Composite.

The question arises as to whether any of you have had these companies in your portfolio or on your radar.

I often see here that the focus is mostly on companies from the S&P. Which I also think makes sense.

Just like Buffet "Only buy what you understand" BURGGRABEN

Risk arises when you don't know what you're doing.

However, if we pursue a core-satellite strategy, we should also take a look at these companies as small satellite positions.

What strikes me immediately about the top nine is that none of these companies generates a P/E ratio.

Personally, I always find it a little difficult to invest here, unless a profit is to be expected.

We also often look at the market capitalization, which is not very high for some of these companies.

Furthermore, some companies are followed by no or only a few analysts. There are then no estimates, which often makes analysis difficult.

In the case of biotech companies, we are often not involved in the topic at all.

As small investors, we are naturally at a disadvantage here in all respects.

We should therefore concentrate on the companies that we can assess.

I have also noticed that some companies can even have a very low P/E ratio.

Such as FreightCar America $RAIL (-0,51%) with a P/E ratio of 12.59 which falls to 10.88.

A quick glance shows me that the company has become profitable again. Which is perhaps responsible for the price increase. A detailed analysis might be worthwhile here. @BamBamInvest ?

The situation is similar at Citius Pharmceuticals $CTXR is making its first profits and the P/E ratio is even falling to 0.22. According to Eulerpool, I could see that they want to generate a profit of 50mn in 2026, which will be increased to 189mn next year. The EbiT margin will then be 50% in 2026 and will continue to increase. (Maybe put it on the watch. ( ATTENTION PENNYSTOCK highly speculative)

At Kingstone Companies $KINS the chart looks like a flagpole. Nevertheless, the P/E ratio of 10.04 is not too expensive for an insurance company that has just become profitable.

Sensus Healtcare $SRTS (+0,38%) has a P/E ratio of 12.58, which falls to 8.15 due to further growth. The company has just returned to the 200-day line, perhaps a good time to enter the market.

I think this is a small selection of companies which, despite a remarkable performance in 2024, still have an acceptable P/E ratio.

It might be worth analyzing other companies from the overview in more detail.

I myself was briefly invested in Willis Lease $WLFC (-0,24%) until I was thwarted by a stop loss. Volatility is to be expected with low market capitalization.

I am still invested in $APP (-0,1%) AppLovin and $INOD (+0,78%) Inodata.

As I have seen, some are still invested in $HOOD (+0,2%) invested.

I would be interested to know if you are invested in companies from the overview and what do you think about investing in rather small, often unknown companies from the NASDAQ Composite. Do you see too much risk here, or rather potential to push the portfolio?

Please do not regard this as an investment recommendation. Rather, let's discuss it. I look forward to your comments.