Sector performance & weekly review S&P500 | $SPY (+0,01%)

S&P 500 posts weekly rise to new record high and ends November with strongest monthly gain of the year

The Standard & Poor's 500 Index rose 1.1% in this holiday-shortened week, ending November on a strong note. The market benchmark achieved its largest monthly gain of the year.

The S&P 500 closed the shortened trading session on Friday at 6,032.38, the highest close in its history, a day after closing for the Thanksgiving holiday. Friday also saw a new daily high of 6,044.17.

Month-on-month, the S&P posted a gain of 5.7%, the biggest monthly increase since an 8.9% jump in November last year. The index is up 26% so far in 2024, with one month remaining.

Economic data this week showed that U.S. real gross domestic product (GDP) grew at an annualized rate of 2.8% in the third quarter, in line with both the previous estimate and the consensus compiled by Bloomberg. However, the measure of personal consumption expenditure was revised downwards from a previously forecast 3.7% to growth of 3.5%.

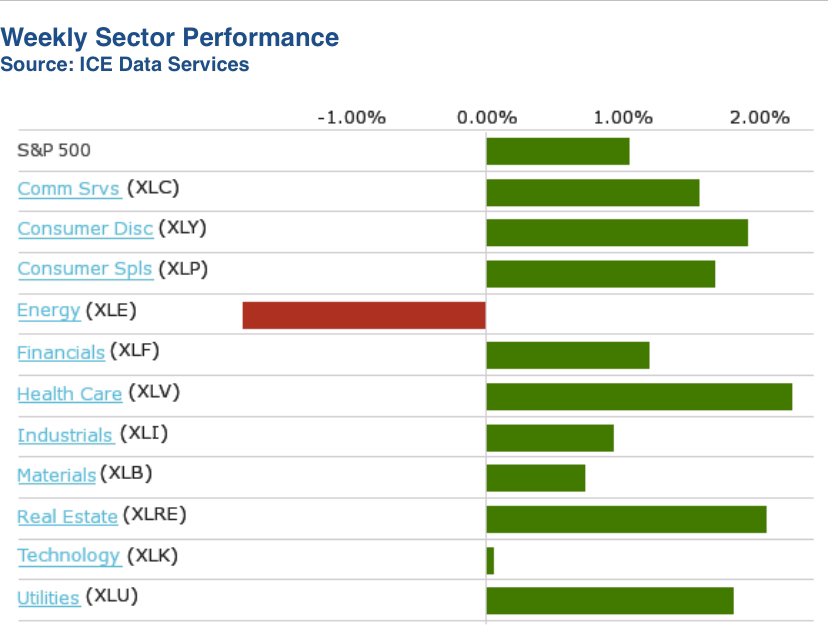

All but one sector of the S&P 500 rose this week. The consumer discretionary sector posted the largest percentage gain with a 2.3% increase, followed by a 2.1% increase in the healthcare sector and a 2% increase in the real estate sector.

Among the gainers in the consumer discretionary sector was a 14% rise in shares of Ulta Beauty (ULTA) as the cosmetics retailer prepares to release its third quarter results. Ahead of the announcement, Citigroup raised its price target on the stock from USD 345 to USD 390.

In the healthcare sector, Eli Lilly (LLY) shares rose 6.3% after its diagnostic drug flortaucipir (Tauvid) received approval from the UK's medicines regulator to test for Alzheimer's disease in adults with memory problems.

In the real estate sector, Equinix (EQIX) shares rose 4.8% after the company announced it would issue an additional 1.15 billion euros ($1.21 billion) worth of green bonds. Truist Securities raised its price target for the stock from USD 935 to USD 1,090.

The energy sector was the only loser of the week, falling by 2%. Crude oil futures also fell as the conflict between Israel and Hezbollah eased and concerns over supply disruptions eased.

Among the losers in the energy sector were shares of Diamondback Energy (FANG), which fell 4.2%, and Devon Energy (DVN), down 3.8%.

Next week, the market will kick off December with reports on construction spending in October and manufacturing data in November. However, the main focus will be on the November labor market data, which will be released later in the week.