Time for presents - birthdays, Christmas etc. - but no junk, please!

Hello dear Quinies,

on this occasion, I'm writing a short post today away from what's still in the pipeline from my side.

Our big boy turned 3 on Monday and grandma and grandpa traditionally give him physical precious metal $965515 (+1,13%)

$965310 (+1,64%) ... so far so good.

From grandpa's side, everything is also clear on the subject so far, there is either investment gold in small denominations or silver in whole ounces (of course always bought far too expensively in collection albums from MDM, Bayerisches Münzkontor etc.🙄). Not my money so what🤷🏼♂️.

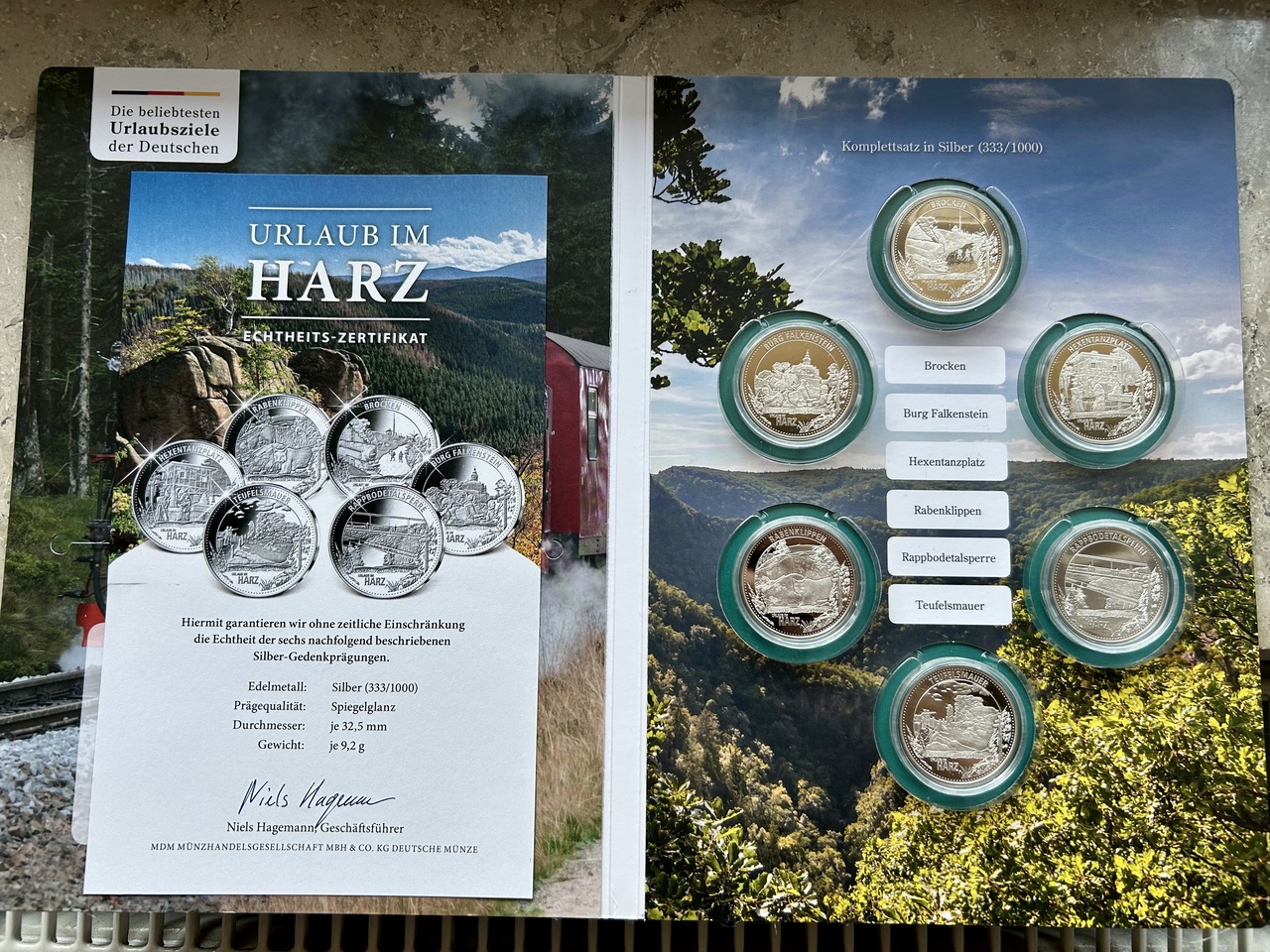

Problem: Grandma unfortunately only buys according to the look of the collections, not really with a plan for precious metals... which means we get something like this here:

The motifs are of course pretty to look at, but what are you supposed to do with 6 x 9.2g 333/1000 silver anfangen🤦🏼♂️. That's about 18.38g of fine silver... a good half ounce. To be honest, I don't even want to know the price...

So what do I do?

Whenever one of these (exclusively pretty scrapbooks) arrives, I have to take photos, post them on eBay, sell them to someone for a halfway ridiculous price (since there's almost no precious metal in them) and send them off.

Why?

Because it's no good as an investment, I don't want to have to store 30 more of these albums somewhere halfway safe and because I think that the money I get from the sale is better off in Junior's ETF savings plan.

What am I trying to tell you?

If you want to give physical precious metal (gold, silver, platinum, whatever) as a gift, please, please pay attention to investment-Qualität🙏🏻 (purity 999.9 for gold/silver or 999.5 for platinum).

It is better to buy supposedly "smaller gifts" (a 1g gold bar in 999/1000 is really tiny😅) that have a real value and retain their value. With small gift bars and small bullion coin denominations, you are effectively still paying a lot more than the pure gold value, but you are giving a sensible gift! Nevertheless, you should not buy bullion coins in denominations smaller than 1/20 ounce, after that the price premiums become more than absurd and it doesn't look great either😉.

With this in mind: Happy giving and receiving (the madness is about to start again).

Greetings, Marcus✌🏻