As I have heard relatively little about this exciting share so far, I would like to introduce it to you.

Monolithic Power Systems is active in the field of electronics and offers energy-efficient electronic solutions with a total of over 4,000 products.

The main areas in which the company is active could be summarized as follows:

- AutomotiveMPS develops semiconductor solutions for applications in vehicles, such as electric vehicle technology (EVs), advanced driver assistance systems (ADAS), infotainment systems and energy management for electrical control units.

- Industrial applicationsThe company manufactures products that are used in industrial machines, automation systems and factories to maximize energy efficiency, such as in drive controls, robotics and other automation processes.

- Telecommunications and network technologyMPS offers high-performance power supply ICs for telecom equipment, servers, network devices and data centers where energy efficiency and high reliability are critical.

- Consumer electronicsIn this area, MPS provides power supply solutions for a wide range of devices such as smartphones, laptops, tablets, portable devices and household appliances that require efficient use of energy.

- Medical devicesMPS develops solutions used in medical devices for patient monitoring, portable health devices and other medical systems, with a focus on precise performance and reliability.

- Renewable energy and energy storageMPS offers products to optimize energy distribution and storage, such as in solar installations or battery management systems, to enable more efficient use of renewable energy sources.

Share price development:

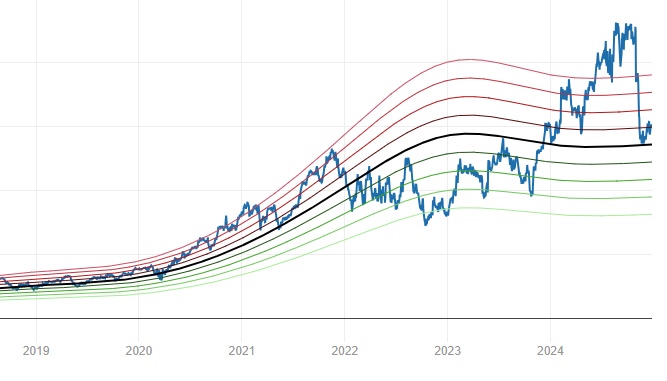

The share price has increased by approx. 275% in the last 5 years, but has lost approx. 22% in the last 6 months.

The background to this is that there is a rumor going around that Nvidia as a customer wants to part with Monolithic Power Systems due to a lack of chips. The rumor has not been confirmed by $MPWR (+1,8%) not confirmed.

Quality check:

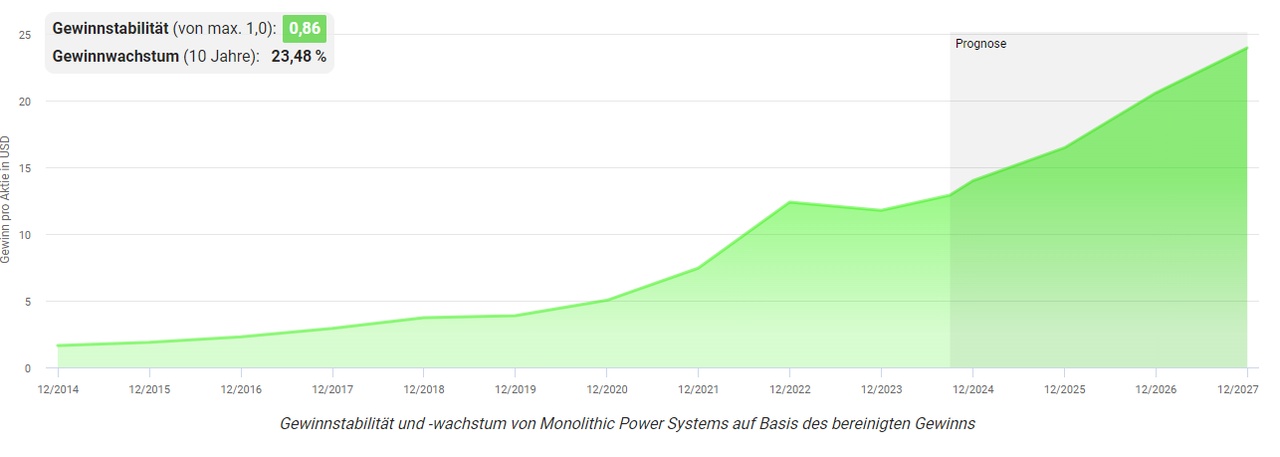

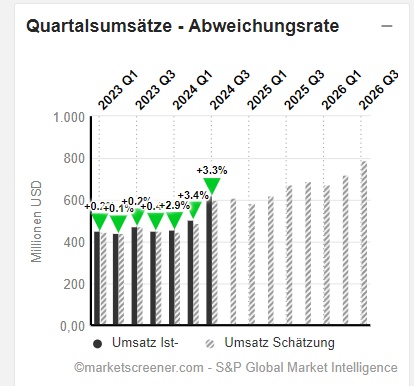

- Average sales growth over the last 5 years: approx. 25%

- Average EPS growth over the last 5 years: approx. 29%

- Net profit margin: 22.63%

- Average performance over the last 10 years: 30.90% share price growth p.a.

Fair value:

Due to the rumor about Nvidia, the share price briefly fell to the fair value according to Fair Value and is now slightly above it. The share has always been overvalued in recent years, as it is simply a quality share.

But at the moment, in my opinion, we are at a historically optimal entry point.

Forecast

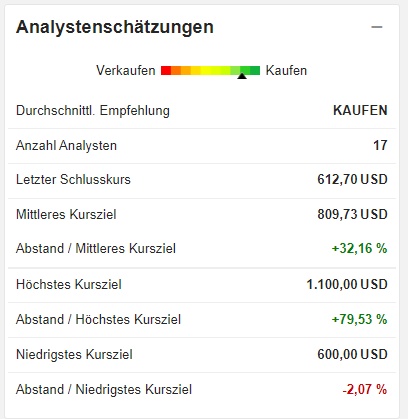

According to 17 analysts, the average recommendation is a clear buy.

Of course, everyone has to decide for themselves. In my opinion, we can buy this share at a great entry point and build up a first tranche.

The outlook for the future is promising despite the possible departure of $NVDA (-0,12%) nevertheless remains promising.

The global demand for energy-efficient solutions is growing strongly, e.g:

- Renewable energies

- Electronic vehicles and their infrastructure for charging stations

- Internet of Things (IoT)

- Industry 4.0 (automation and networking of machines)

Have you also heard of the company and what do you think of the current situation? I would be happy to receive feedback. :)