Hello people

I need your opinion tonight. I currently still have holdings with Deka. These are:

$n/a (DekaFonds TF [oriented to the DAX]) and $n/a (DEKA-MegaTrends CF (basically a MSCI World).

(It says n/a with the two funds, but they are still found).

The DekaFonds is currently up 2.34%. This will be sold soon if possible. Who wants to be in the DAX? Linde certainly doesn't.

The MegaTrends worries me more. This is currently being saved and is also doing reasonably well. Just MSCI World.

Except for a few minor shifts, it has the same (at least the first 10) companies as the $H4ZJ (+0,42%)

However, this is currently 53.51% in plus. The deposits will be stopped soon. Just didn't have that on the screen.

But what do I do with the amount? Just leave it or sell it and then buy MSCI World?

Leaving it would mean the costs shown in the attached picture (point 4 is 25% of the performance above 100% MSCI World Net Return in EUR (also taking into account the previous 5 years)).

From what I have found out so far, despite the costs, the fund has performed the same as the MSCI World with lower costs. So the final sum is approximately the same, despite higher costs. Therefore, I am unsure whether I should not just save the taxes and just leave the thing.

What is your opinion on this (apart from the usual "Sparkasse is stupid anyway").

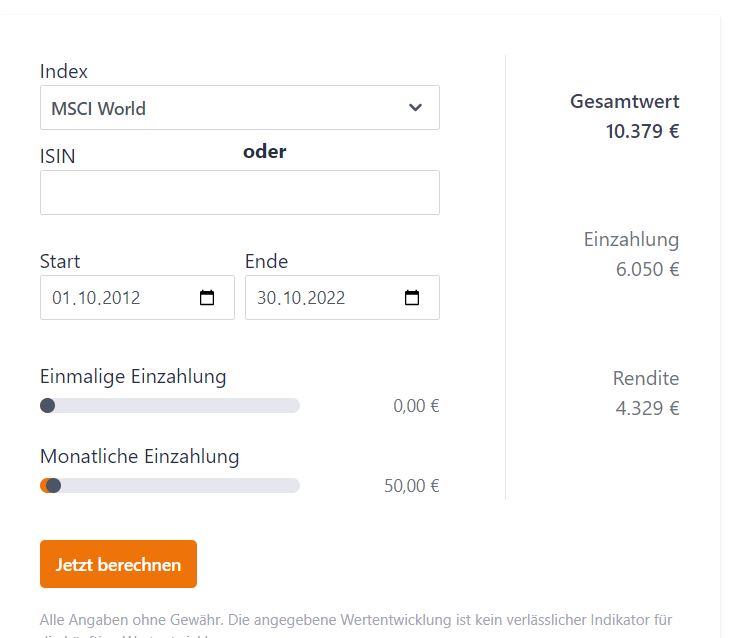

Deka has a good value calculator that also includes the costs. Unfortunately, I could not find such a thing for the MSCI World anywhere.

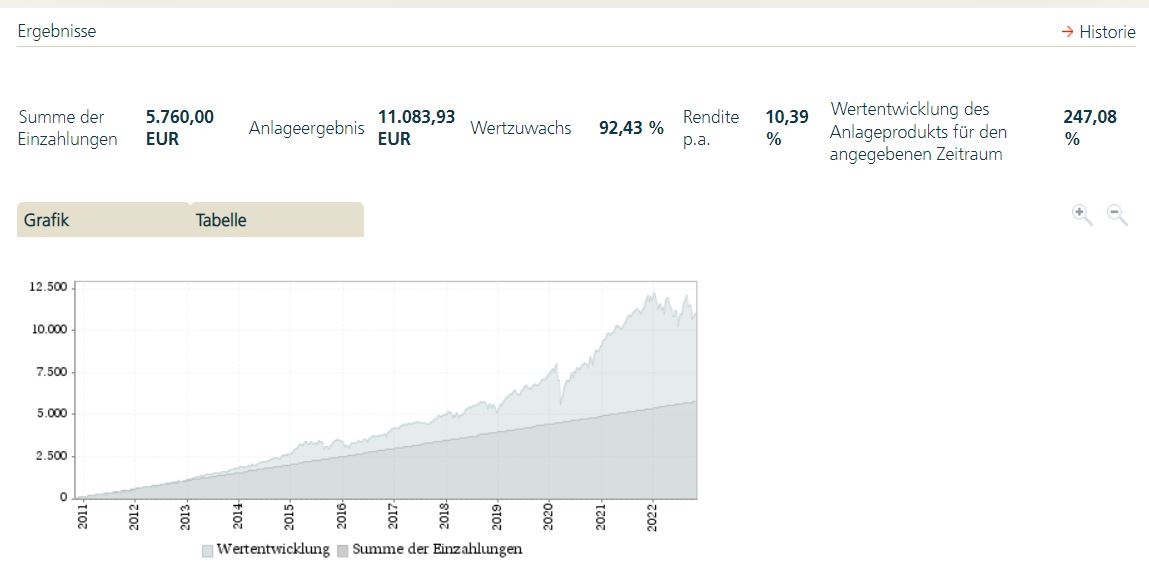

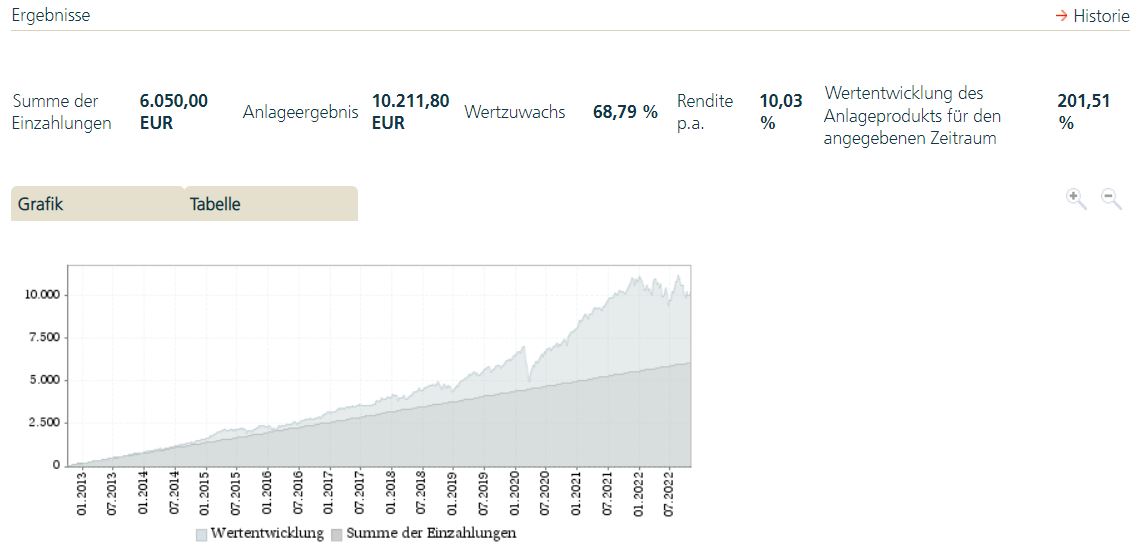

EDIT: Just added two more pictures. Even if the MegaTrends is currently equal to the MSCI World, it seems to have in the past (despite higher costs) much better performance in the past...

EDIT2: Just found something new. For the sake of completeness, I'm attaching the image as well. The other MSCI picture with the 8300€ is probably a forecast for the next 12 years, while the now attached picture shows the history.

This shows that the two are pretty much the same. I calculate in Excel...

Thank you very much.